Barely greater than half of retirees (53%) reported sturdy satisfaction with their life in retirement, based on the Worker Profit Analysis Institute’s 2022 Spending in Retirement Survey.

“I firmly imagine that one of many methods to be content material in retirement or semi-retirement is to remain energetic and engaged with the world,” says Paul Dillon, a 78-year-old grandfather in Durham, North Carolina.

Since retiring in 2006, Dillon has been an adjunct professor at Duke College’s Sanford Faculty of Public Coverage, a marketing consultant for veterans’ points, a author and a convention presenter.

Setting objectives and planning forward may help you deal with challenges and put together for brand spanking new alternatives as you age.

Listed here are 4 suggestions from consultants on getting older, retirement and monetary administration.

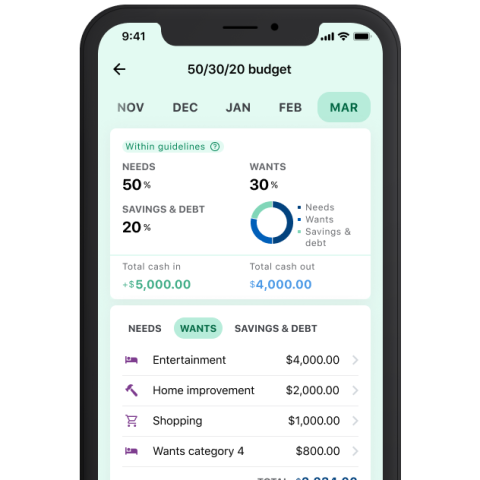

1. Check drive your retirement earnings

Will you manage to pay for when you’re retired? It’s greatest to know forward of time.

“Strive a ‘retirement check drive’ earlier than you really retire to see in case your earnings shall be sufficient,” Scott Jensen, an authorized monetary planner in Queen Creek, Arizona, stated in an e mail.

Right here’s how you can check out your retirement earnings:

-

Determine your earnings sources after retirement, similar to Social Safety, 401(okay) or IRA plans, pensions, annuities or different financial savings.

-

Dwell in your estimated retirement earnings for some time.

When you have hassle dwelling on what you’ll have in retirement, it’s an indication that you simply may not be prepared but. So you might wish to reexamine your finances and plans, doubtlessly with the assistance of a monetary advisor.

2. Plan for how you can spend your days

“Know what you might be retiring to do, not simply what you might be retiring from,” says Patti Black, a CFP in Birmingham, Alabama. Objective and connection are key, she says.

Black interviewed her purchasers about their retirement. She discovered that folks generally struggled once they targeted on once they would cease working and didn’t have a plan for what would occur subsequent. Conversely, her happiest retired purchasers have been those that took an intentional method and stayed concerned with, for instance, neighborhood organizations or taking good care of grandchildren.

“Not that they constructed out an entire week’s schedule, however they at the least had a handful of issues that they have been planning on doing,” says Black. After all, post-retirement plans don’t should be elaborate or price something, however “it actually helps to plan forward.”

3. Put together for adjustments to your well being

Almost a 3rd of adults age 65 and older have at the least one incapacity, based on 2021 American Neighborhood Survey knowledge from the U.S. Census Bureau.

These well being points solely grow to be extra frequent as we age. For instance, based on the survey knowledge, disabilities are at the least twice as frequent in folks 75 and older as these 65 to 74.

You’ll be able to put together upfront to deal with adjustments to your well being and skills.

Medicare will cowl some issues, however not every part. Further assist is out there from applications similar to Ageing and Incapacity Assets Facilities, or ADRCs, and Space Businesses on Ageing, which give native providers and help.

For instance, the ADRC of Dane County, Wisconsin, has workers and sources to assist older adults with dwelling security, imaginative and prescient and lighting, social isolation, reminiscence screenings, affording meals, medicine opinions, falls, transportation and emergency preparation. The entire ADRC’s providers are free, and there aren’t any restrictions based mostly on earnings or belongings.

You should use the Eldercare Locator, a nationwide service maintained by the U.S. Administration on Ageing, to search out applications and providers close to you.

4. Use your abilities

“Remaining engaged with the world is essential, and there are a variety of methods to try this,” Dillon says.

Retirement isn’t essentially a pointy cutoff, after which you by no means work once more. Almost 26% of adults ages 65 to 74 are both working or on the lookout for work, based on 2021 Bureau of Labor Statistics knowledge. That quantity is anticipated to develop to virtually 31% by 2031. And working a job previous age 65 is only one choice — there are many formal and casual methods to assist your neighborhood or attempt one thing new.

“It doesn’t matter what you’ve executed in your profession, whether or not it’s working in manufacturing or accounting or retail … you’ve amassed a variety of expertise. Have a look at the state of the world. Have a look at what must be executed,” Dillon says. “Go use these abilities. Go use the abilities that you simply’ve gained for the advantage of others.”