Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- ALGO witnessed heightened promoting stress previously few days.

- Funding charges fluctuated, and improvement exercise improved after a pointy decline.

Algorand [ALGO] dropped from $0.30 to $0.18 area, plunging 40% since early February. Bulls tried to hunt entry into the market as they struggled to defend the $0.18 space.

However bulls may try a restoration if Bitcoin [BTC] defends the $20K help and surges upwards.

Learn Algorand [ALGO] Value Prediction 2023-24

In decrease timeframe charts, BTC traded sideways within the $19.76K – $20.5K vary. BTC’s worth motion may set ALGO right into a consolidation within the quick time period, however the underlying market situations will largely dictate long-term worth motion all through March.

What’s subsequent for ALGO – reversal, consolidation, or extra dump?

Supply: ALGO/USDT on TradingView

ALGO’s sturdy rally in early 2023 hit the ceiling at $0.2998, setting it for a retracement. However the worth bounced close to the 50% Fib degree ($0.2301), permitting bulls to inflict a restoration. Nonetheless, the promoting stress round $0.30 proved an excessive amount of for bulls to bypass it.

ALGO noticed elevated promoting stress after breaching beneath the important thing worth space (purple level of management line) of $0.2558, sustaining the value motion beneath the EMA ribbon.

Up to now, ALGO has dropped, oscillating between the EMA ribbon and the downtrend line (cyan line). On the time of writing, it was buying and selling within the $0.1810 – $0.1933 vary on the 12-hour chart.

Bulls may try a restoration if there’s a convincing shut above the 23.6% Fib degree ($0.1933). Continued restoration may face a barrier on the EMA ribbon ($0.2094). The following important resistance lies between the 50% Fib degree ($0.2301) and the $0.26 vary if bulls shut above the EMA ribbon.

Alternatively, bears may sink ALGO to January’s low of $0.17, particularly if BTC drops beneath $20K and continues its downtrend.

How a lot are 1,10,100 ALGOs value as we speak?

The Relative Energy Index (RSI) made decrease lows and was within the oversold zone, indicating elevated promoting stress. However there was an uptick, suggesting easing promoting stress. As well as, the OBV declined since 8 February, limiting shopping for stress in the identical interval.

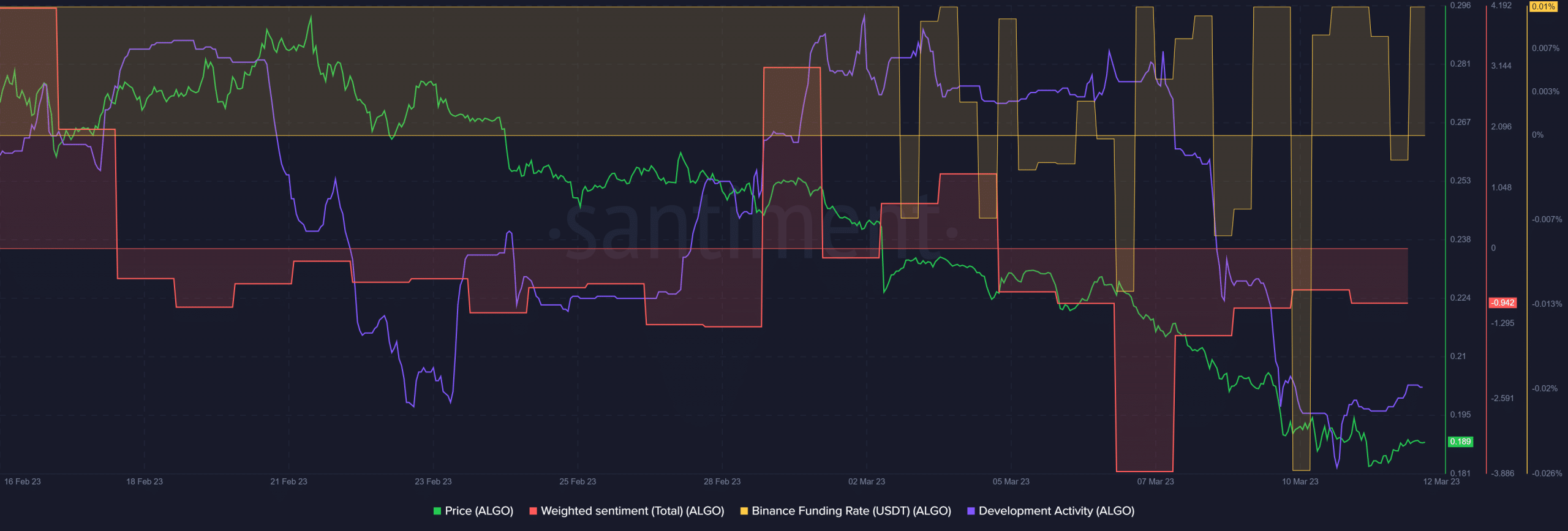

Funding charges fluctuated as improvement exercise recovered

Supply: Santiment

ALGO’s funding charges fluctuated because the starting of March, displaying unstable demand, which tipped the size in favor of bears. Additional fluctuation may give bears extra affect to devalue the token; therefore traders ought to observe it.

Nonetheless, sentiment and improvement exercise improved after sharp declines. It may provide a glimpse of hope for bulls as traders’ outlook on the token and community constructing improved.

![Algorand’s [ALGO] downtrend slows down- Is a trend change likely?](https://nourishmoney.com/wp-content/uploads/2023/03/algorand-7172953_1920-1000x600-750x375.jpg)