Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.

- The market construction and momentum favored the bulls.

- Given the importance of the approaching resistance, a breakthrough on the primary try may very well be unlikely.

ApeCoin has carried out effectively in latest weeks, and a breakout previous the $6 degree may very well be only a matter of time. Bitcoin additionally had a wholesome outlook after crusing previous the $22.5k resistance lately.

Is your portfolio inexperienced? Verify the ApeCoin Revenue Calculator

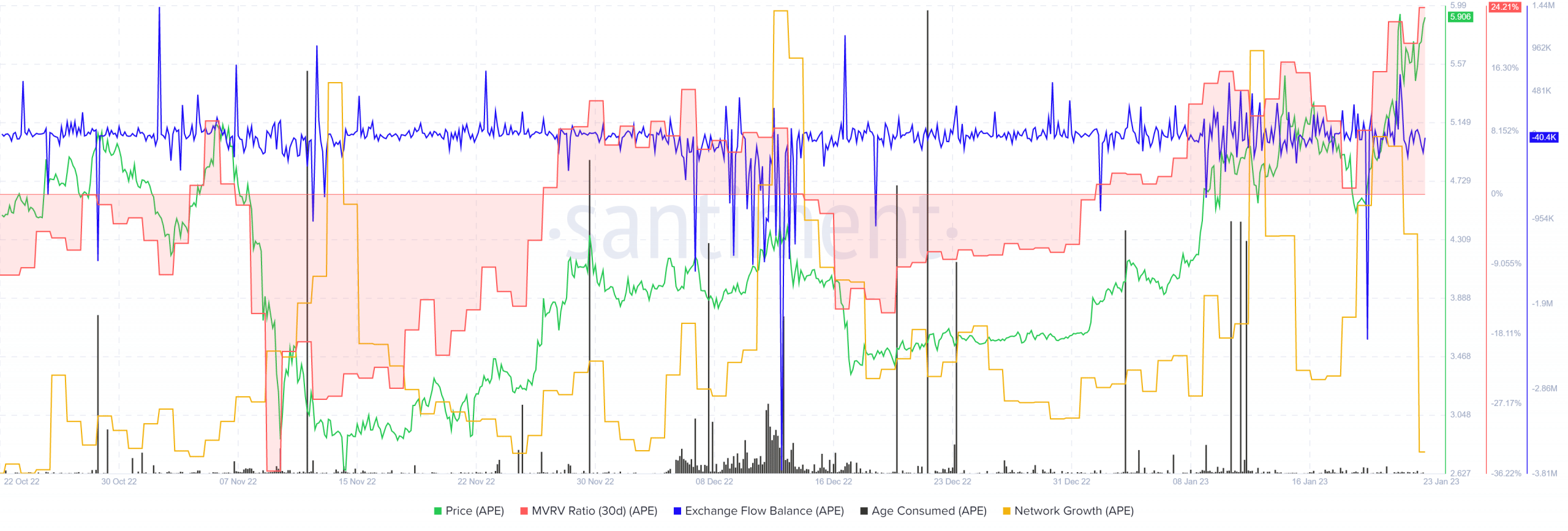

A latest report highlighted a big optimistic worth on the MVRV ratio and famous diminishing returns from staking APE. Even so, public sentiment remained optimistic. At press time, the worth reached a degree of resistance from September. What can we count on within the coming weeks?

The $5.3 resistance was crushed, subsequent up was the psychological $6 space

Supply: APE/USDT on TradingView

In early September, ApeCoin noticed giant losses and was compelled to go to the $4.18 degree as help. On September 7, the worth bounced from this degree to succeed in $6 simply two weeks later. After a couple of days of intense skirmishing, the bulls have been crushed again, and the sellers took management as soon as extra. They didn’t relinquish their vice grip until mid-November.

Reasonable or not, right here’s APE’s market cap in BTC’s phrases

Due to this fact, there was a chance of rejection at this $6 resistance. It represented a psychological spherical quantity, and the bearish response in late September paved the way in which for losses all through October and effectively into November.

Therefore it was unlikely that APE would escape above this degree on its first strive. A rejection at $6, adopted by a pullback to the $5.3-$5.5 space was extra doubtless. This might additionally pressure decrease timeframe bears right into a false sense of safety whereas giving bulls a while to lock in earnings and put together for the following march northward.

The RSI shaped a bearish divergence (orange), which steered an overextended market and supported the concept of a pullback. The earlier rejection close to $5.25 had been adopted by a pullback to $4.5, the place a hidden bullish divergence (dotted orange) was adopted by a pointy upward transfer. Due to this fact risk-averse bulls can look forward to a retest of a big help degree in addition to a hidden bullish divergence earlier than shopping for APE.

Community progress complemented the explosive worth motion and the MVRV ratio climbed increased

Supply: Santiment

Previously two weeks, the community progress metric noticed sizeable spikes alongside the growth in costs. This steered that real demand and customers backed the rally of ApeCoin. The age consumed metric didn’t see giant spikes after those on January 11 and 12. This might imply that enormous numbers of the token weren’t moved in a rush, which is typically adopted by a wave of promoting.

The rising MVRV ratio meant profit-taking might happen quickly. But, the $5.3 and $4.5 have been essential ranges of help that will must be flipped to resistance earlier than the bears can declare the sting on increased timeframes.