Bitcoin (BTC) tumbled beneath $20,000 for the primary time because the starting of the 12 months and liquidated $123.25 million lengthy positions held on the belongings within the final 24 hours, based on Coinglass information.

Throughout the broader crypto market, the entire liquidations had been $323.86 million over the past 24 hours, based on Coinglass data. The sell-off wiped off all merchants who took lengthy positions available on the market.

In the meantime, $114.14 million was liquidated on Binance alone. Different exchanges with high liquidations included OKX and Huobi, with $78.1 million and $43 million, respectively. Throughout this era, 98,955 merchants had been liquidated — probably the most important liquidation being a $9.49 million lengthy place on BTC.

Bitcoin falls beneath $20k

Within the final 24 hours, the flagship digital asset fell to $19,968 on the time of writing, based on CryptoSlate’s information.

Bitcoin had a damaging internet move of $13.7 million throughout the interval. Glassnode data confirmed that whereas $782.9 million BTC was despatched to crypto exchanges over the reporting interval, traders withdrew $796.6 million because the bears took over the market,

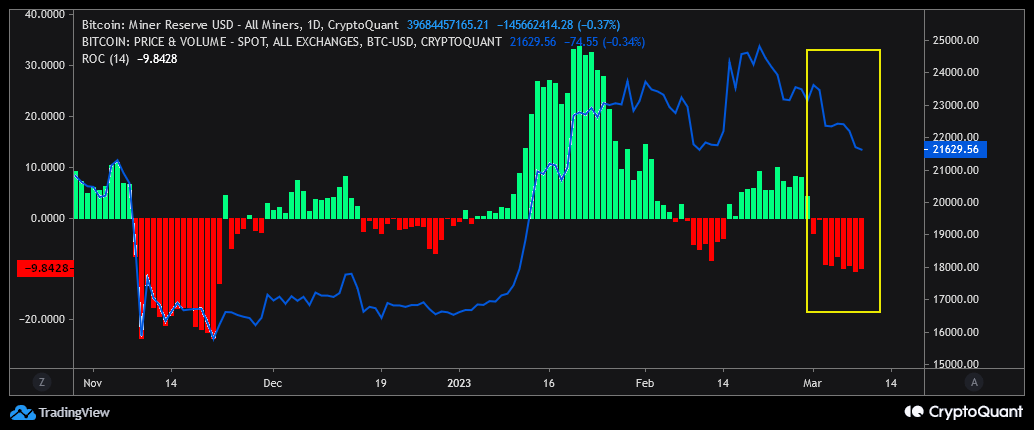

In the meantime, BTC analyst Barovirtual, citing CryptoQuant data, stated BTC miners had been placing stress on the asset. It famous that the miners had elevated the stress from March 1, which may lower the asset’s worth to both $19,500 or $16,600.

Apart from that, BTC short-term holders cashed out their earnings because the revenue ratio rose above 5%, based on CryptoQuant data.

The Silvergate, KuCoin issue

The latest market massacre has additionally coincided with the present points battling crypto-friendly financial institution Silvergate and the lawsuit filed towards the KuCoin crypto alternate by the New York authorities.

On March 8, Silvergate stated it will “voluntarily liquidate” its belongings and shut down operations. A CryptoSlate report recognized how the financial institution’s struggles had impacted crypto’s U.S. Greenback market depth over the previous month following.

In its lawsuit towards KuCoin, New York alleged that Ethereum was a safety, additional fueling fears surrounding the digital asset.

In the meantime, U.S. President Joe Biden proposed a 30% crypto-mining tax on all power prices concerned in cryptocurrency mining.