- Bribes paid out to vlCVX holders have began to go down.

- Furthermore, the Curve protocol is reportedly struggling because the variety of customers on the protocol has been declining.

In accordance with knowledge offered by Delphi Digital, a big sum of bribes, totaling $250 million was paid out to vlCVX holders.

A complete of $250M of bribes have been paid out to $vlCVX holders. pic.twitter.com/QYNOw9tIvW

— Delphi Digital (@Delphi_Digital) March 5, 2023

Learn CRV’s Value Prediction 2023-2024

Bribes function an incentive for voting on gauge weights and might result in the injection of extra liquidity into swimming pools as a secondary impact.

This could happen each on the base layer of the Curve or by way of Votium on the Convex, which is a layer above.

The people providing the bribes are taking a big gamble that the additional liquidity that their providing generates, as a result of further CRV rewards, might be extra precious to them than the bribe itself.

The people can earn bribes by holding onto the vlCVX token, which is an instrument of Convex Finance.

A majority of the bribes have been accrued in This fall of 2022. As Q1 of 2023 approaches an finish, the general bribes despatched declined massively. One of many causes for a similar could be the lowering APR generated by way of vlCVX’s bribe income.

Primarily based on Dune Analytics’ knowledge, it was noticed that over the previous few months, the APR offered by the vlCVX token fell from 30.72% to 23.17%.

Supply: Dune Analytics

This decline in vlCVX’s APR and the next charges paid out may sign the actual fact the Curve protocol could also be struggling.

Curves and forks within the highway

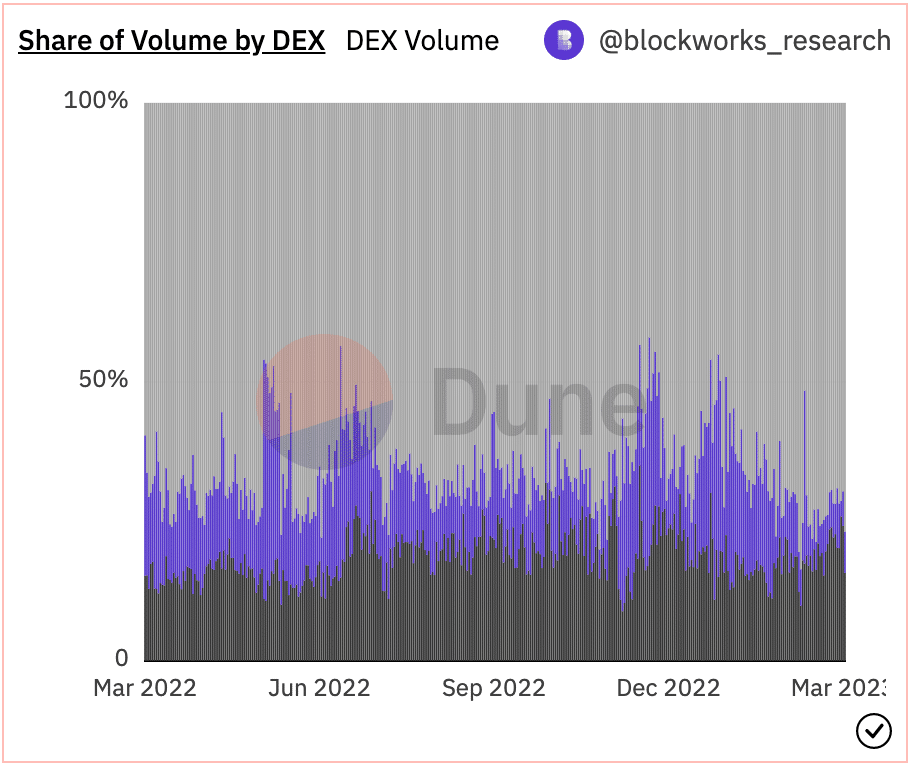

One other indicator of the Curve protocol going through challenges could be the autumn of its share within the DEX house. Because the starting of the 12 months, Curve Finance’s dominance within the DEX markets by way of quantity fell from 15.2% to six.2%.

Uniswap and different profitable DEXs managed to take up a big a part of the market share throughout this era.

Supply: Dune Analytics

Curve’s struggles within the DEX market could also be attributed, partly, to a lower in its consumer base. Primarily based on Messari’s knowledge, it was discovered that there was a 0.21% lower within the variety of distinctive customers on the Curve Finance platform within the final month.

This decline additionally had an affect on the buying and selling quantity of the protocol, which decreased by 0.39% throughout the identical interval

The issues weren’t restricted to the protocol alone, because the token related to it additionally encountered difficulties.

Is your portfolio inexperienced? Take a look at the Curve Revenue Calculator

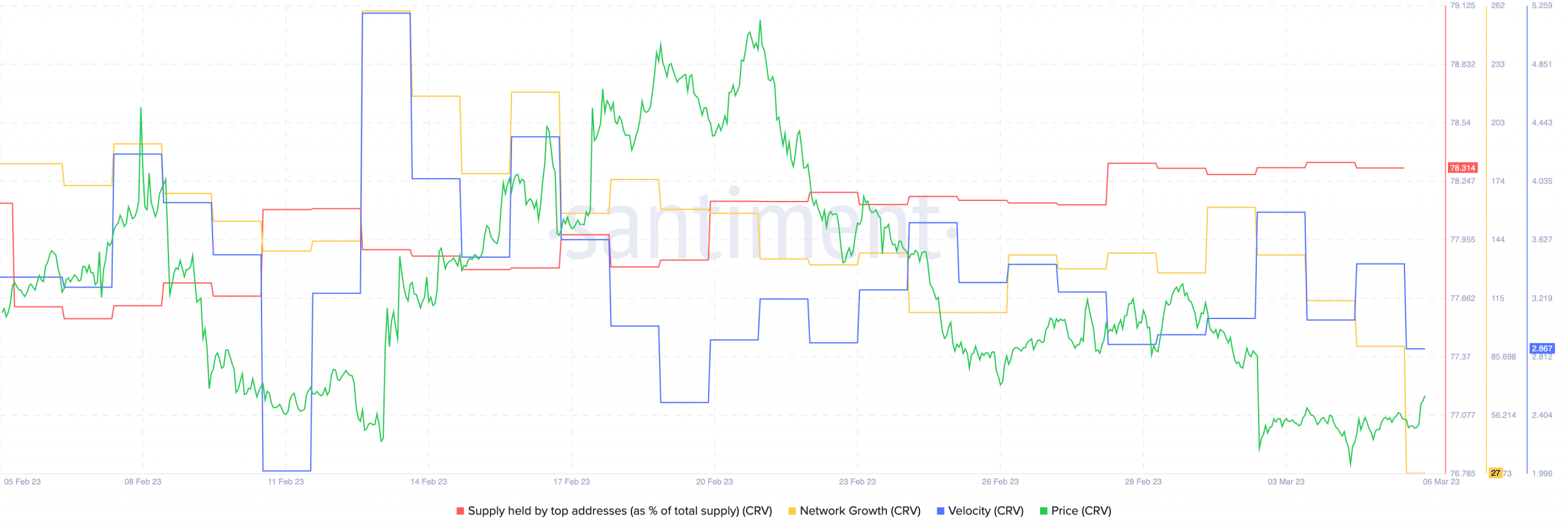

Santiment’s knowledge indicated that there was a lower in each community development and velocity for CRV. Thus, suggesting a drop in total exercise and curiosity from new addresses.

Supply: Santiment