- Whales added 400,000 ETH regardless of a latest value increment

- Extra ETH is being circulated though the present vault might be overpriced

Like a ton of property within the crypto-market, Ethereum’s [ETH] value jumped over the weekend. Even at press time, the second-largest cryptocurrency in market worth maintained a 5.11% hike within the final 24 hours. For sure, this has introduced some calm to the market. Particularly since a lot of it was flashing pink over the weekend.

Learn Ethereum’s [ETH] Value Prediction 2023-2024

Nonetheless, regardless of the good points registered on the charts, whales didn’t appear to be content material. As identified by Ali_charts, a crypto-analyst on Twitter, addresses holding 1000 to 10000 ETH added $600 million to their holdings.

The data, derived from Glassnode, revealed that the whales took the motion when ETH was nonetheless hovering above $1,680 on the charts.

#Ethereum whales with 1,000 to 10,000 $ETH added round 400,000 #ETH to their holdings within the latest #crypto market dip, price round $600,000,000. pic.twitter.com/OMfebJoPVh

— Ali (@ali_charts) March 14, 2023

On the alternative aspect of ETH

So, does the buildup imply ETH nonetheless tends to climb additional? Properly, in accordance with Glassnode, the Community Worth to Transaction (NVT) sign had a studying of 98.45, at press time. The metric typically displays the 90-day shifting common development of the day by day transaction quantity, somewhat than a day-to-day valuation.

In comparison with its worth in latest occasions, the aforementioned NVT signal is a excessive one. And, the final time it was as excessive was again in February 2020. Therefore, it appeared to substantiate that traders have been pricing ETH at a premium whereas the market cap’s progress outpaced its on-chain transaction quantity.

Supply: Glassnode

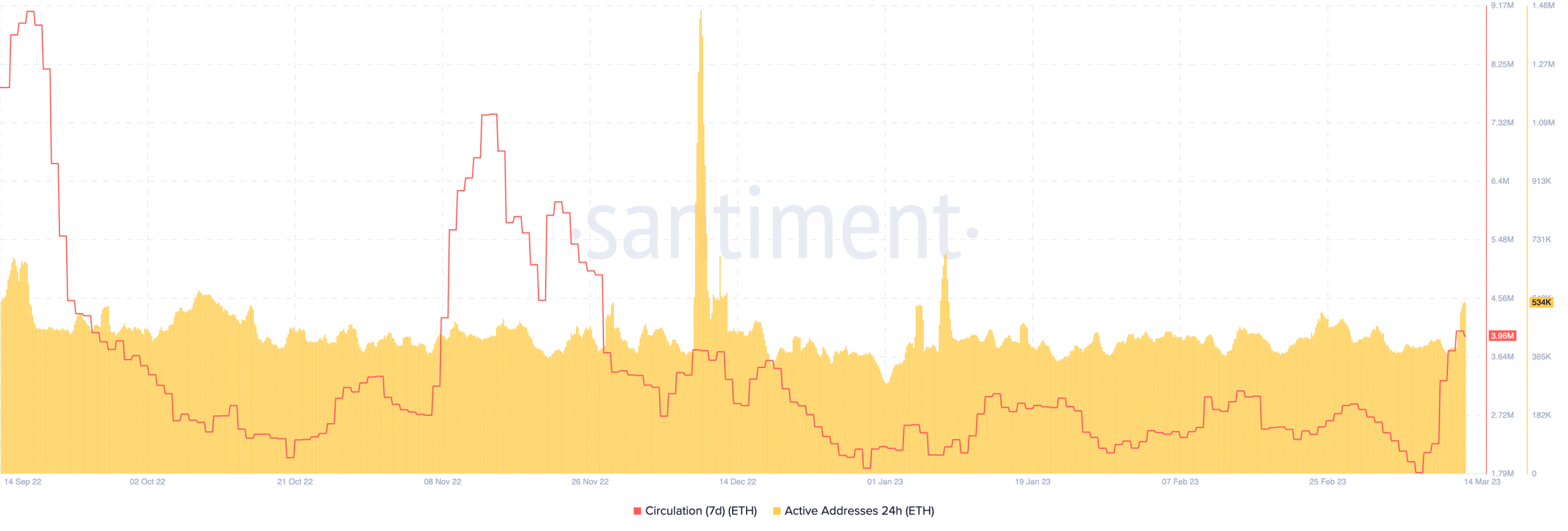

Whereas the aforementioned metric thought of ETH as being at present overpriced, extra of the altcoin has been in circulation during the last seven days. The circulation exhibits the variety of distinctive cash which were used for transactions inside a particular interval.

At press time, the seven-day circulation was 3.96 million. This implied that many items of ETH have been swirling across the market, regardless of their numbers falling when in comparison with the day before today.

That being stated, one metric that has consistently moved north is Lively Addresses. This metric measures the variety of distinctive addresses energetic on a community. With 24-hour energetic deal with rely of 534,000, the studying implied that many wallets had both acquired or despatched ETH during the last 24 hours.

Supply: Santiment

Is your portfolio inexperienced? Verify the Ethereum Revenue Calculator

Virtually equal trade stream reactions

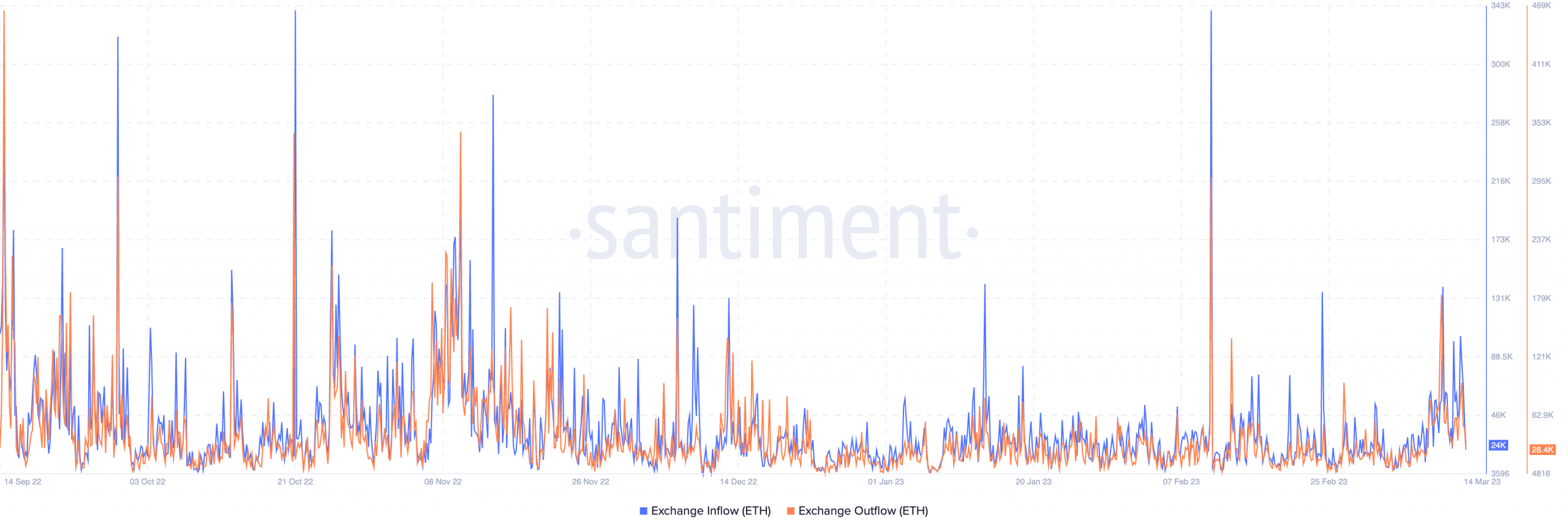

Whereas ETH stays on whales’ radar, activities on exchanges revealed that it has been an in depth contest for outflows and inflows.

In actual fact, in accordance with Santiment, trade outflows have been as excessive as 28,400. This appeared to underline merchants’ non permanent market scarcity and contribution to an asset’s appreciation.

Supply: Santiment

Then again, the trade inflows have been 24,000. With the distinction in favor of the outflows, it signifies that ETH has a slight likelihood of foregoing depreciation within the brief time period.

Nonetheless, merchants may nonetheless must be cautious of projection. This, due to a number of unfavorable developments and contrasting market reactions.