- ETH is on a pullback after a pointy restoration from the present market crash.

- Buyers ought to watch the 0.236 Fib assist stage.

Bitcoin (BTC) recovered from the 16.69K mark to 17K, injecting a lifeline into the trade. The king coin’s positive factors additionally boosted altcoins.

Ethereum (ETH), the altcoin king, is positively correlated to BTC. As such, it witnessed a pointy restoration from $1,182 after BTC pushed to the 17K mark.

At press time, ETH was buying and selling at $1,253 and nursing a worth pullback to a Fib stage that would provide shopping for alternatives.

Supply: TradingView

BTC’s restoration nudged ETH right into a worth inflection, marking the zero Fib stage as a assist zone. At press time, ETH was therapeutic off from a post-crash rally. We noticed a worth pullback on decrease timeframe charts. The 12-hour timeframe chart exhibited the identical pattern.

The resting zone has been established on the 0.236 Fib stage ($1216). The RSI retraced from the oversold territory, displaying a decreasing promote stress. Correspondingly, the MFI additionally retraced from the oversold entrance stage, displaying accumulation was properly underway for consumers. As such, $1,216 presents lengthy commerce entry positions with $1305 and $1307 as targets.

The bullish inclination solely holds if bulls can unleash excessive shopping for stress within the coming days or hours to maintain the upward momentum. At press time, the OBV confirmed a downtick after a latest upside, thus displaying uncertainty about incoming volumes that would dictate a robust promote or purchase stress.

A candlestick shut under $1,073 would invalidate the bullish inclination. ETH’s drop past this stage may prolong it additional downwards if bears achieve leverage; therefore, a cease loss under it’s possible.

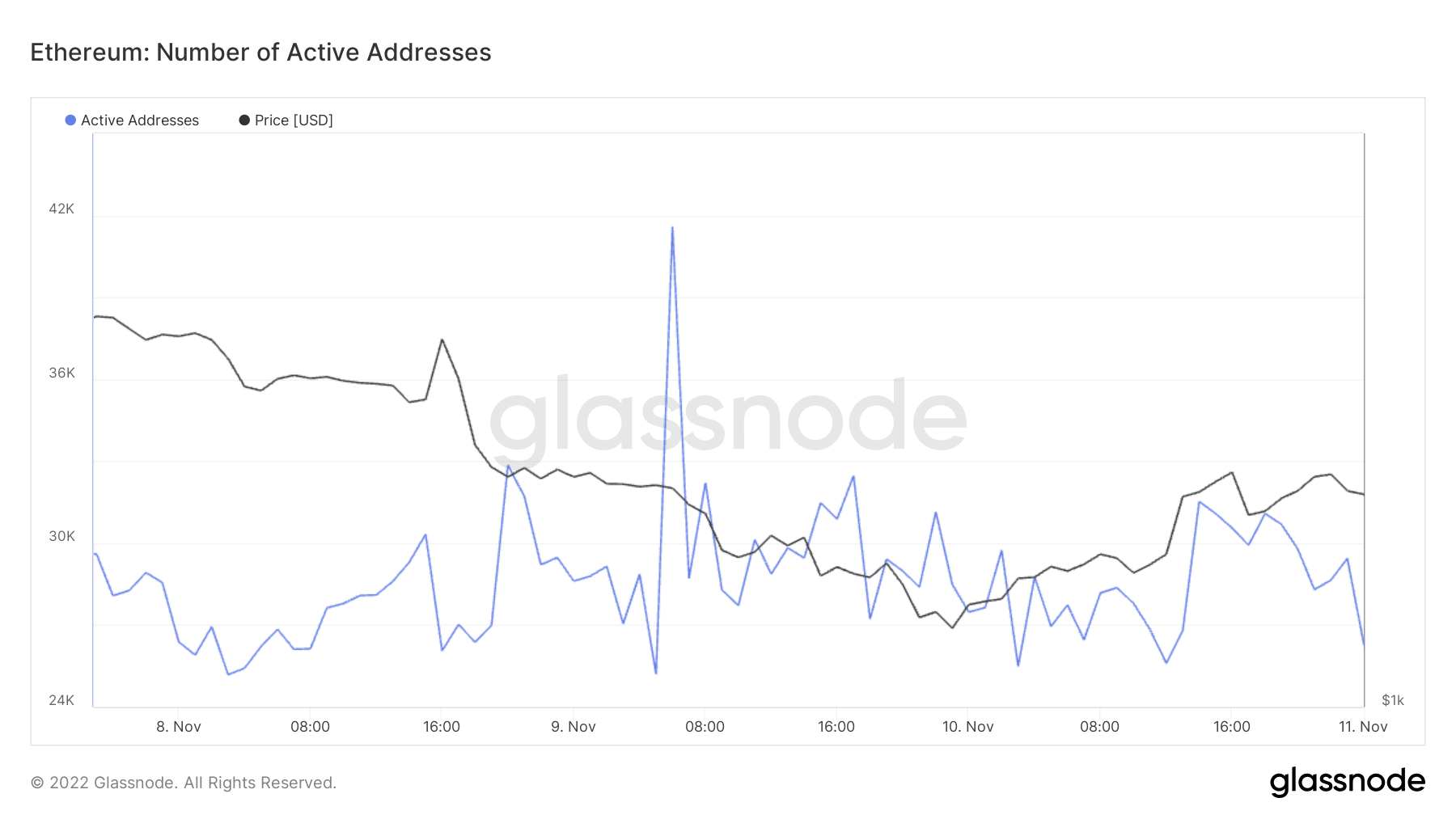

ETH lively addresses enhance after worth restoration from $1000

Supply: Glassnode

ETH’s lively deal with elevated after the sharp restoration from the $1,182 mark. This reveals that extra lively addresses have been concerned in ETH buying and selling when its worth surged. Nevertheless, at press time, ETH had dropped barely to under $1,300, and lively addresses have been additionally lowered.

The drop in lively addresses possible signifies the present uncertainty on whether or not the ETH worth will pump. ETH’s negatively weighted sentiment additional confirmed this uncertainty, on the time of writing.

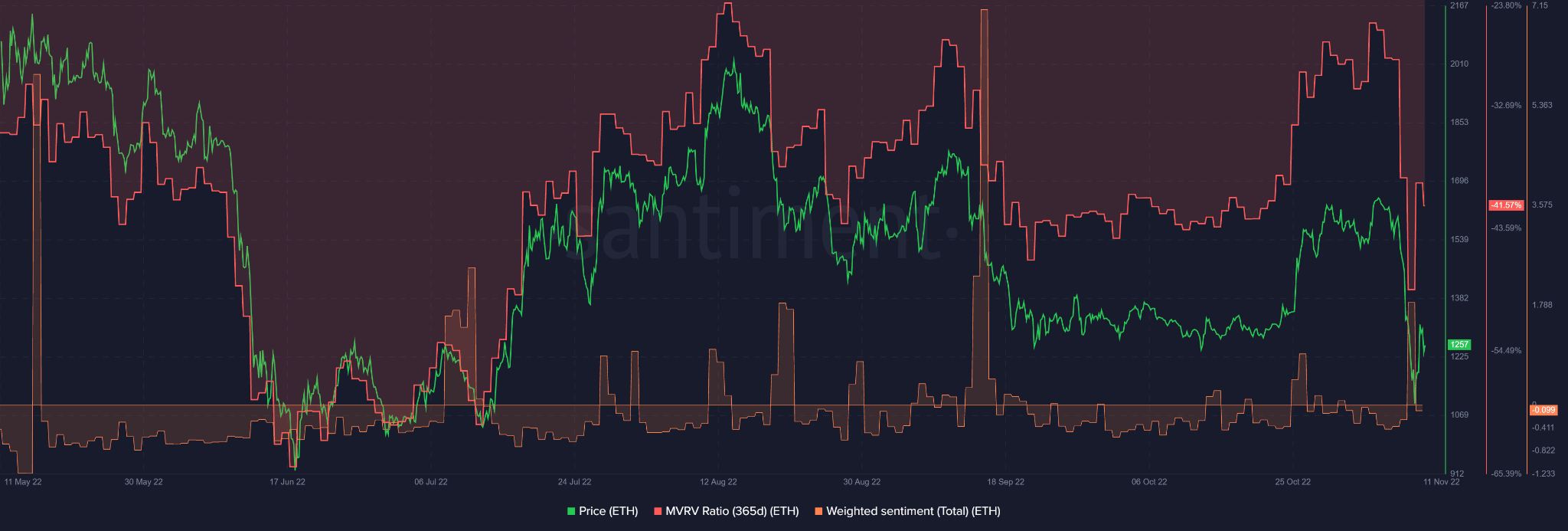

Adverse weighted sentiment exposes long-term ETH holders to extra losses

Supply: Santiment

Based on the on-chain analytics platform, Santiment, ETH’s weighted sentiment, slid into unfavourable territory after having fun with a latest constructive elevation. It means the aggregated sentiment round ETH was bearish, and a slight worth drop is a testomony to this.

Sadly, the unfavourable weighted sentiment is weighing down long-term ETH holders. The 365-day MVRV has been unfavourable for many of the yr, translating to losses.

A bearish sentiment would prolong the keep within the unfavourable territory, exposing long-term ETH HODLers to extra losses.

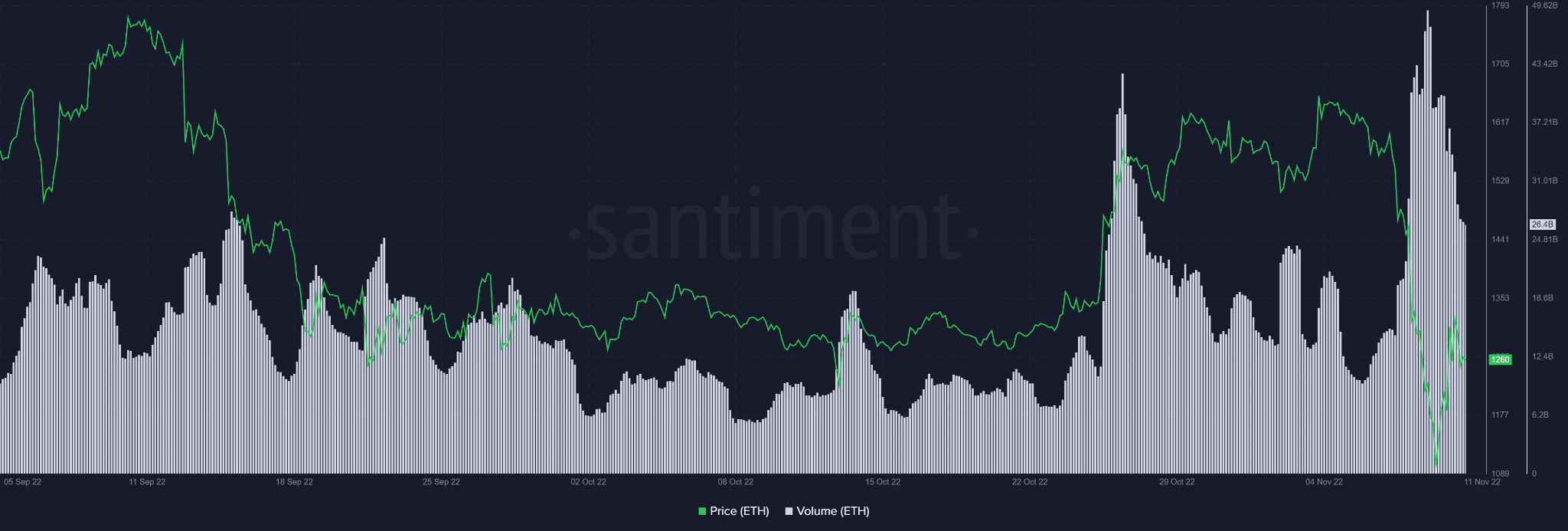

A declining quantity may deny bulls sufficient shopping for stress

Supply: Santiment

The autumn in quantity, as proven by Santiment, may additionally undermine sturdy shopping for stress to push the altcoin king upwards.

Subsequently, buyers have to be affected person and examine if shopping for stress can construct within the coming days. Additionally, monitoring BTC motion may give a transparent course on ETH’s subsequent transfer.