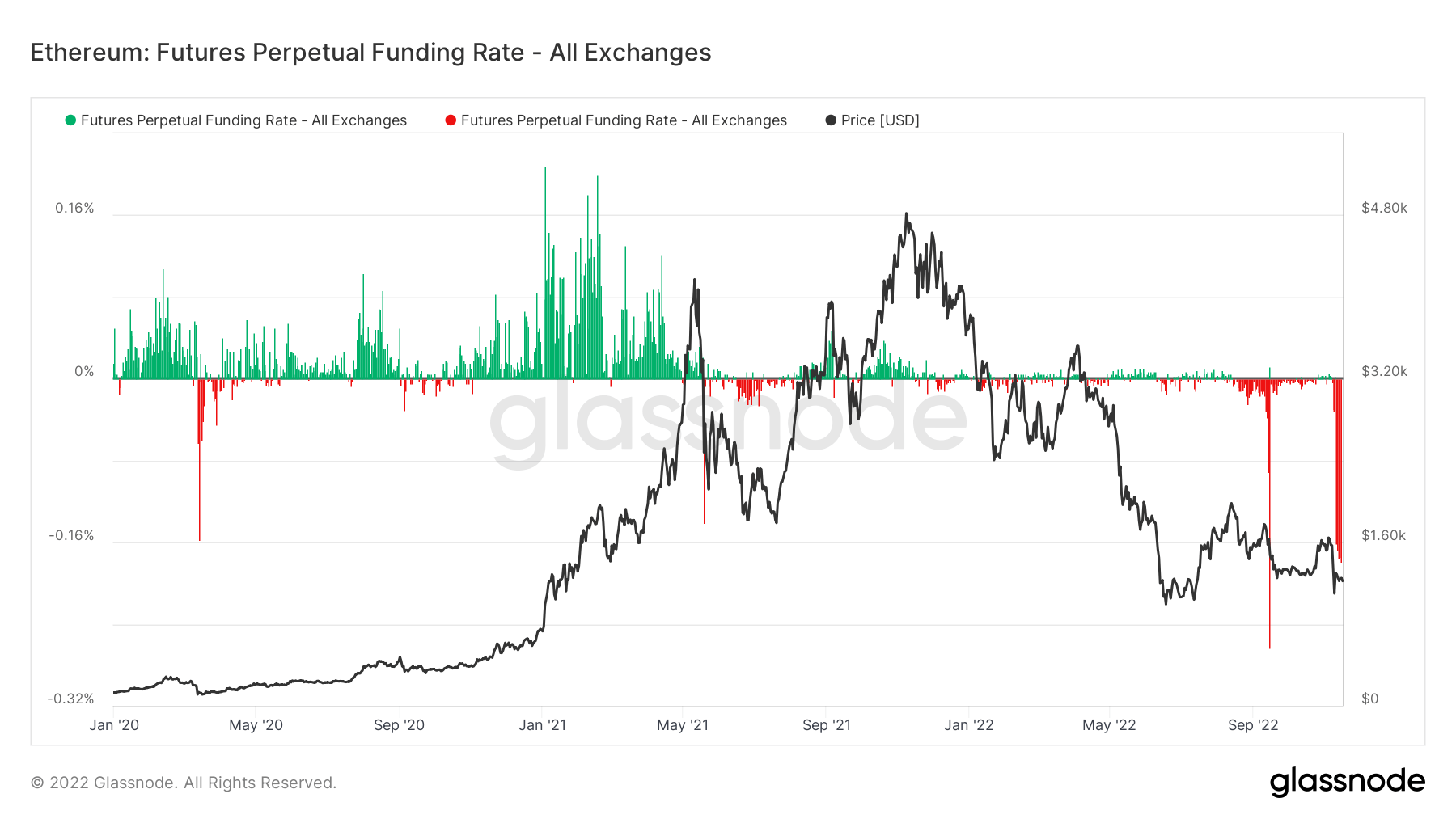

On-chain information reveals that Bitcoin(BTC) is presently the third-most shorted cryptocurrency ever, whereas Ethereum(ETH) stands because the second-most shorted.

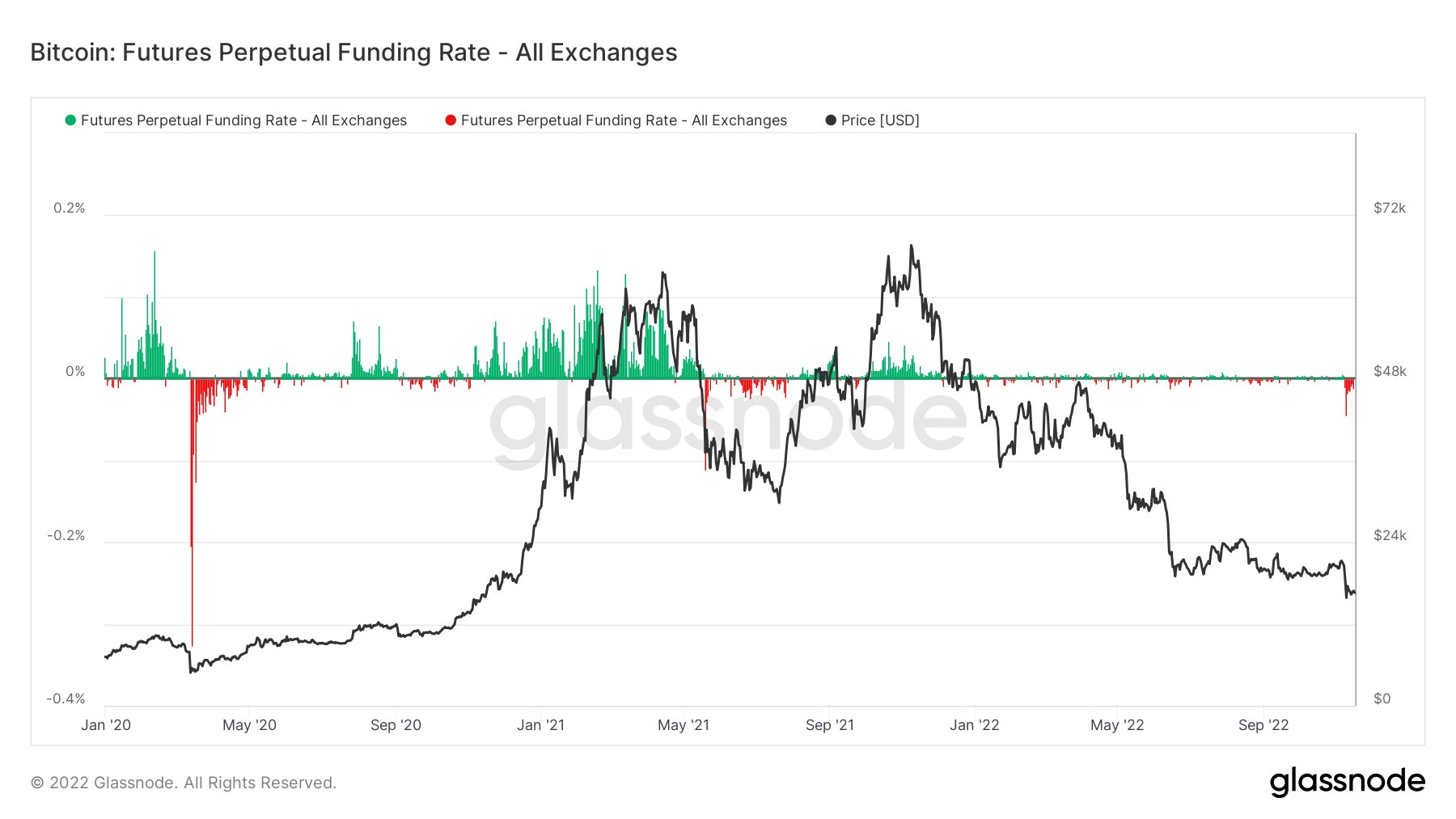

Analyzing the common funding fee (in %) set by exchanges for perpetual futures contracts, it may be noticed above that lengthy positions periodically pay quick positions each time the speed proportion turns into constructive. However, when the speed dips in the direction of the adverse finish of the chart, quick positions will be seen to pay lengthy positions periodically.

Occasions marked a low within the BTC cycle will be noticed above in March 2020, Summer time 2021, June 2022, and November 2022.

In second place concerning shorting, ETH was probably solely shorted extra in the course of the Merge occasion because of the ‘purchase the rumor, promote the information’ contagious mentality on the time.

We now have seen the steepest dip towards adverse funding charges in current historical past by September. Regardless of the decline, the idea that shorting will drag a value to zero typically snaps again – forcing patrons so as to add gasoline to the rally.

To verify this reversal for the occasions forward, it’s anticipated that additional weeks of deep adverse funding will probably be required earlier than a snap-back occasion happens.