- Chainlink opened up early entry to Chainlink Staking, whereby its customers can commit as much as 7000 LINK tokens

- LINK’s value continues to go down plunging holders into additional losses.

Extensively used oracle community Chainlink [LINK] on 15 November opened up early entry to the preliminary beta model of Chainlink Staking (v0.1) in preparation for the launch on the Ethereum mainnet in December 2022.

Learn Chainlink’s [LINK] value prediction 2023-2024

In October, Chainlink announced “Chainlink Staking,” which is described as a “cryptoeconomic safety mechanism” by means of which individuals can commit their LINK tokens in sensible contracts to “again sure efficiency ensures round oracle providers.”

In line with the main oracle community, making LINK staking attainable would allow,

“Chainlink decentralized oracle networks (DONs) to scale to service a broader vary of functions and better worth use instances throughout Web3 and conventional Web2 industries.”

These granted early entry to the beta model of the Chainlink Staking (v0.1) could be allowed to commit as much as 7,000 LINK tokens “in a first-come, first-serve method” till the pool cap is reached.

LINK did what it might

Following the primary announcement of Chainlink Staking, LINK tried a value rally and grew by 24% previous to the collapse of FTX. Per knowledge from CoinMarketCap, the #21 largest cryptocurrency by market capitalization traded for as excessive as $8.9 as of 8 November.

Nonetheless, as the remainder of the market started capitulating when FTX collapsed, the worth of the oracle community plummeted as effectively. Its value has since fallen by 27% up to now eight days, knowledge from CoinMarketCap confirmed. As of this writing, LINK traded at $6.52.

At $6.52, LINK traded at its August 2020 stage. On a year-to-date foundation, the worth per LINK has declined by 67%.

With persistent fall within the asset’s value and extenuating market circumstances which have made any important value rally nearly inconceivable, LINK holders within the final 12 months have all held at a loss, knowledge from Santiment revealed.

On-chain knowledge from Santiment confirmed that LINK’s MVRV ratio has been destructive within the final 12 months. Furthermore, it has lingered constantly under the mid-0 line since November 2021.

At press time, LINK’s MVRV was -69.53%. This meant that if all holders offered their holdings on the present value, they’d all incur losses on their investments.

Supply: Santiment

Down unhealthy

As the remainder of the market tried restoration following the FTX incidence, lack of conviction continued to path LINK. Its value was up by 3% within the final 24 hours at press time.

Nonetheless, buying and selling quantity declined by 15% inside the identical interval. This confirmed that buyers harbored low conviction of any continued value rally within the quick time period.

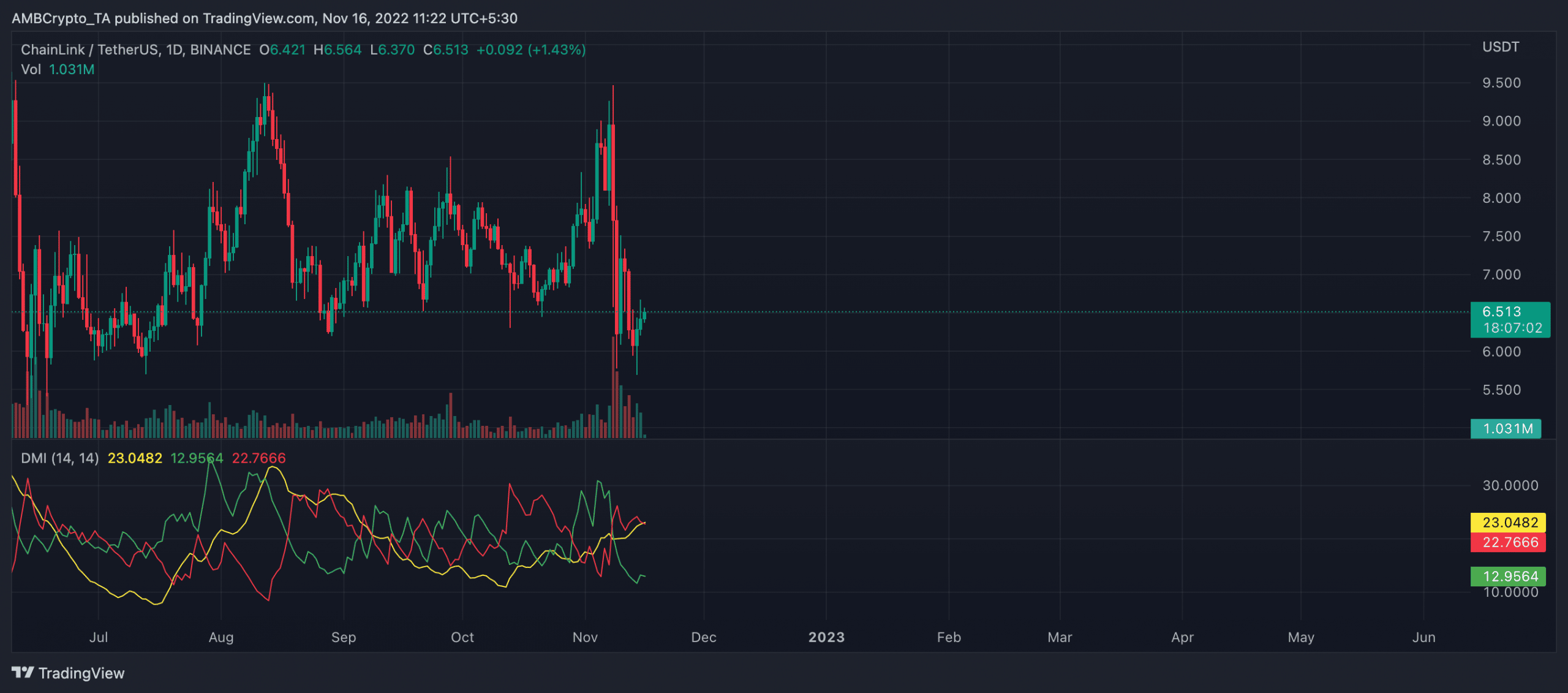

On a every day chart, sellers had management of the LINK market. This was confirmed by the asset’s Directional Motion Index (DMI) place. At press time, the sellers’ power (crimson) at 22.76 was solidly above the patrons’ (inexperienced) at 12.95.

Supply: TradingView