“Don’t put all of your eggs in a single basket.”

You’ve in all probability heard this rising up, however what does it imply, and the way can it educate you about diversification?

A farmer piles all of the eggs he collects within the morning right into a single basket. If the basket is dropped, he loses all his eggs in a single fell swoop.

The identical goes to your investments.

If you happen to put your total web value into Peloton (PTON) inventory in 2021, you may need cracked open your nest egg when it plummeted 90% in 2022.

Diversification might help you create a extra steady funding method, whereas having fun with the expansion of several types of investments.

Let’s go over the fundamentals of funding diversification, and offer you a number of tips about tips on how to create a extra diversified portfolio.

What’s funding diversification?

When speaking about investments, diversification refers back to the means of dividing your cash between totally different property with the intention to cut back danger and volatility.

This might imply splitting up your cash between shares, bonds, actual property, gold, crypto, or different property, with the aim of making the most of the expansion in every asset class, but additionally spreading your danger as properly. Diversification is a brilliant solution to make investments, as you cut back the chance of placing all of your eggs in a single basket.

For instance, in case you determined to go “all-in” on Shopify in 2020, you’d have been rewarded with a large 4x return in your funding inside a yr, solely to see it crash down by practically 80% the next yr, dropping beneath the unique worth you bought it at.

But when as an alternative, you bought a number of shares, bonds, and different property, it’s possible you’ll not have seen the short-term 4x in worth, however you additionally might not have seen the 80% loss that adopted — and will nonetheless be in revenue in your portfolio.

There are a number of methods to diversify your investments. Listed here are seven tips about tips on how to do it — in addition to what to contemplate when evaluating your funding selections.

1. Study danger

Supply: Giphy.com

Shedding cash is not any enjoyable, however investing at all times entails danger, which incorporates the chance of loss. Studying concerning the kinds of dangers concerned along with your funding selections lets you change into a better (and fewer stressed-out) investor. And spreading your danger throughout totally different property might help you stability your portfolio and decrease the general volatility of your investments.

Listed here are a number of kinds of danger to pay attention to as you construct your funding portfolio:

- Enterprise danger. When investing in particular person shares, it is very important analysis how a enterprise operates, the way it makes cash, and the dangers related to that exact enterprise. This may embrace administration modifications, upcoming payoffs, debt-to-income ratio, or different elements that may have an effect on the share worth.

- Market danger. When investing in property reminiscent of inventory or actual property, it’s necessary to know how the general market sentiment can have an effect on the worth of these property.

- Default danger. For investing in particular person companies or shares, understanding the debt obligations is necessary, particularly if the corporate has a excessive share of working prices going to service their money owed. The chance of defaulting on these money owed can have an effect on share costs.

- Inflation danger. In an inflationary surroundings, shares can drop in worth, however so can different property. It’s necessary to know how your investments will carry out if inflation rises quicker than traditional.

- Rate of interest danger. Sure investments (reminiscent of bonds) can drop in worth if there is a rise in general rates of interest by the Federal Reserve.

Learn extra: What does it imply to your pockets when the Fed raises rates of interest?

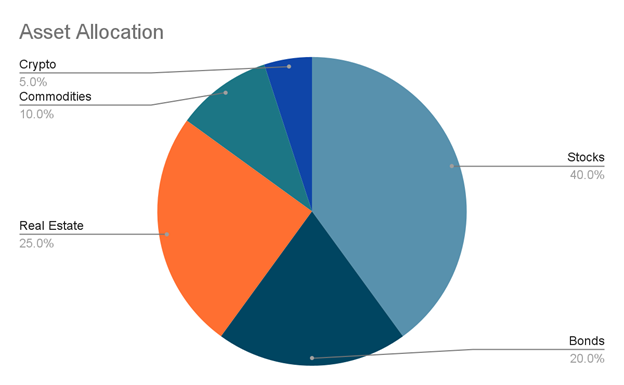

2. Create an asset allocation

If you make investments, you might be buying property that generate earnings or go up in worth over time. The way you allocate your funds towards several types of investments is known as asset allocation.

When investing in shares, the most effective methods to diversify is to separate up your investments between property which can be in numerous market sectors (reminiscent of know-how, agriculture, actual property, healthcare, and so on.). This builds diversification inside your equities portfolio.

To take it a step additional, splitting your portfolio into several types of investments might help diversify between property that aren’t correlated, reminiscent of shares, bonds, U.S. treasuries, bodily actual property, commodities (gold, and so on.), and even angel investments in companies. That approach, when one asset class drops in worth, it doesn’t essentially imply the others will.

In actual fact, there are some asset courses which can be inversely correlated, which means that if the worth drops in a single asset class, the opposite truly goes up in worth. This has sometimes been the case with shares and bonds, although rates of interest going up (as was the case in 2022) can have an effect on each.

To correctly diversify your investments with asset allocation, it’s necessary to consider your investments as a pie, and every asset class can have a slice of that pie, relying in your danger tolerance, funding targets, and investing timelines.

This pie chart of a pattern asset allocation might help you visualize how your property may very well be cut up up:

3. Spend money on index funds

Whereas choosing and selecting particular person corporations to spend money on takes a ton of analysis and understanding of enterprise fashions and financials, investing in index funds makes it simple by permitting you to personal lots of (or hundreds) of firm shares inside one single funding.

Not solely that, however index funds sometimes make investments extra in bigger, extra established corporations, whereas nonetheless holding smaller, rising corporations — providing you with the very best of each worlds with much less danger.

Index funds are a kind of mutual fund or exchange-traded fund (ETF) that maintain a wide range of particular person shares, bonds, and different property, and sometimes observe a market index, such because the S&P 500 index. These funds are sometimes market-cap weighted, holding extra investments in corporations which have the best market capitalization.

Index funds offer you automated diversification, as you may personal a whole market sector inside a single funding. A number of the hottest funds even personal each publicly traded firm inside a market, reminiscent of the overall U.S. inventory market.

You may personal a number of kinds of index funds, reminiscent of inventory market funds, bond market funds, actual property/REIT funds, or balanced funds that personal a mixture of every. And since index funds are passively managed, the charges are sometimes a lot decrease than their actively managed counterparts.

Oh, and so they outperform nearly each hedge fund and actively managed fund over a protracted time period. Even Warren Buffet agrees.

So, in case you’re trying to diversify your portfolio the simple approach, shopping for index funds based on your asset allocation is the way in which to go.

Learn extra: A newbie’s information to investing in index funds

4. Make investments exterior of the U.S.

Supply: Giphy.com

Whereas the U.S. economic system is without doubt one of the largest on this planet, and the U.S. inventory market has averaged practically 10% returns over the previous 100 years, you may additional diversify your investments by placing some cash towards corporations and property which can be exterior the U.S.

One of many best methods to do that is with a world index fund that holds among the high corporations and property in overseas markets. This consists of worldwide inventory market funds, in addition to worldwide bond market funds.

Keep in mind, there are numerous top-tier corporations which can be headquartered exterior of the U.S., reminiscent of:

- Toyota

- Samsung

- Shell

- And lots of extra

Investing exterior of the U.S. might help defend your portfolio from U.S.-specific downturns, in addition to seize the expansion of rising economies. It additionally offers you an uncorrelated asset in your portfolio, offsetting among the danger of investing solely within the U.S.

One other type of worldwide investing might be buying actual property overseas, for use as a rental property, or another income-producing exercise. Whereas rules can range from nation to nation, this is usually a solution to diversify your actual property holdings into different markets.

5. Don’t overlook actual property

Whereas many buyers will solely deal with investing within the inventory or bond markets, holding actual property is an effective way to personal well-performing property which can be sometimes uncorrelated with the inventory market.

Actual property is a strong long-term funding, and there are numerous methods to spend money on it:

REITs

Investing in actual property funding trusts (REITs) is a passive solution to personal actual property with out having to buy a property or handle it. REITs have change into widespread over the previous decade and permit buyers to personal a portion of an actual property venture, which may embrace business or residential actual property.

REITs might be purchased and offered from most on-line brokers and make it simple to personal a portion of a number of actual property properties.

Learn extra: Every part you must find out about investing in REITs

Crowdfunded actual property

Crowdfunding lets you make investments immediately into an actual property venture, pooling collectively funds from buyers. Crowdfunding affords probably excessive returns, but additionally might include a excessive minimal funding.

Crowdfunding used to solely be out there to non-public buyers however was opened to common buyers within the Jumpstart Our Business Startups Act in 2016.

Learn extra: Must you spend money on actual property crowdfunding?

Quick-term leases

Airbnb has opened up the holiday rental market to common buyers, permitting you to lease your property like a resort. You may put your property up on Airbnb, VRBO, or every other short-term rental website, and cost a better charge for trip stays. (Nonetheless, observe that in case you’re a renter, your metropolis or landlord might have guidelines about subletting for greater than you pay in lease).

From tiny properties to mansions, nearly any kind of house might be became a trip property and web you nice returns if managed correctly.

Learn extra: Is being an Airbnb host value it?

Lengthy-term leases

Lengthy-term rental properties have been a improbable asset class for lots of of years, and even Andrew Carnegie (as soon as the world’s richest man) has quipped that just about 90% of the world’s millionaires have made their fortune in actual property.

Shopping for a single-family house, duplex, or multifamily property can usher in month-to-month earnings, in addition to profit from appreciation over time. It does require a extra hands-on method, although a lot of the administration and upkeep might be employed out.

Learn extra: Are you able to make cash in actual property? Right here’s what the consultants say

6. Use a number of funding account varieties

Supply: Giphy.com

Diversification of your funding account varieties is simply as necessary because the property you maintain. It’s because there are totally different tax advantages to every account, and strategically diversifying your holdings between funding accounts might help prevent some huge cash in taxes.

Listed here are a number of funding accounts to contemplate when you find yourself constructing a diversified portfolio:

Office retirement account

The 401(okay) is a tax-advantaged retirement account that could be out there at your office. This account makes it simple to speculate immediately out of your paycheck, in addition to lets you deduct investments out of your taxable earnings for the yr.

Some jobs supply variations of this, together with the TSP, 403(b), 457(b), or different retirement plan.

Learn extra: How a lot do you have to contribute to your 401(okay)?

Particular person retirement account (IRA)

The IRA is a well-liked retirement account that isn’t hooked up to your job, permitting you to decide on your brokerage and investments throughout the plan. This may be opened by an internet brokerage without spending a dime, or by a licensed funding advisor in case you choose skilled administration of your investments.

There are tax benefits, too, with conventional IRA contributions reducing your taxable earnings now, and Roth IRA contributions might be withdrawn tax-free at retirement.

Learn extra: Find out how to open your first IRA

Well being financial savings account (HSA)

One other tax-advantaged account, the HSA is accessible to people who’re lined by an eligible high-deductible well being plan. The HSA lets you make investments cash on a tax-deferred foundation and withdraw funds (tax-free) for certified medical bills.

As a bonus, you may withdraw funds after age 65 similar to a daily IRA account.

Learn extra: Find out how to choose a well being financial savings account

Taxable brokerage account

Commonplace brokerage accounts permit you to make investments with no limits (although with out tax financial savings). These accounts might be open inside any widespread investing app, and permit extra flexibility than retirement accounts.

One tax benefit is the flexibility to make use of tax-loss harvesting, promoting dropping property to decrease your tax burden for the yr.

Learn extra: Finest on-line brokerage accounts for rookies

7. Hold some cash in fixed-income property

Diversification consists of defending your cash by placing some apart in money or in fixed-income property. This lets you make investments your cash with a a lot decrease danger of loss, whereas making the most of income-generating investments on the similar time.

The yields on these investments are sometimes decrease, but it surely retains a few of your portfolio protected from huge market downturns.

Some examples of fixed-income property embrace:

- Dividend shares. Whereas there may be nonetheless extra danger than bonds or money, dividend-paying shares can present a gradual yield and fewer volatility than progress shares and different investments.

- Bonds. Whereas not all bonds are created equal, authorities and company bonds can present month-to-month or quarterly earnings funds with much less draw back danger than different property.

- Certificates of deposit (CDs). CDs supply a hard and fast rate of interest for locking up your money for a sure period of time. The longer the time period, the upper the rate of interest (sometimes).

- Excessive-yield financial savings account (HYSA). HYSAs present higher-than-average curiosity on money financial savings, sometimes paying 10x to 20x greater than an ordinary financial savings account. This may present month-to-month curiosity with out the chance of different property, plus the funding is extremely liquid. There could also be withdrawal limits for a majority of these accounts.

Learn extra: Finest high-yield financial savings accounts

Fastened-income investments permit you to protect your capital whereas having fun with a modest return, however don’t anticipate these investments to develop your wealth as quick as different asset courses.

Why diversifying your portfolio is necessary

There’s a stage of uncertainty in each monetary market. If you happen to put all of your cash in shares, you danger dropping the whole lot if the inventory market crashes. The identical applies to the true property market, commodities markets, currencies, and every other funding. Nonetheless, all markets hardly crash on the similar time, in the identical method.

The identical applies to investments in the identical asset class. As an illustration, two shares of various corporations in numerous sectors fluctuate in another way. By diversifying, the likelihood of dropping a big amount of cash or your total funding may be very low.

The underside line

Diversification is necessary to constructing a long-term, sustainable portfolio that doesn’t have the wild swings of investing in particular person shares or crypto, however nonetheless enjoys modest progress. It additionally might help you accomplish totally different investing targets, reminiscent of extra passive earnings, funding a steady retirement, and easily the flexibility to sleep properly at evening.

Diversifying is extra than simply shopping for some shares and bonds, however can embrace totally different account varieties, totally different asset courses, and even investing in small companies. Simply be certain that to know your investing targets, timelines, and danger tolerance earlier than constructing an funding portfolio.