Perhaps you’ve heard that ETFs are a very good funding.

Or bonds.

Or index funds.

By why, although? How a lot can you actually earn from these investments?

Effectively, you’re in the appropriate place to search out out!

Welcome to the Cash Below 30 Funding Calculator, the place you possibly can plug and chug numbers to see how varied sorts of funding may repay over time.

Along with fast recaps on what ETFs, bonds, and such truly are, I’ll present you learn how to discover the anticipated annual development price for every so you possibly can precisely predict your income over a sure time period.

So with out additional ado, let’s crunch some numbers.

What Kinds of Investments Will this Calculator Work For?

The funding calculator works effectively for:

- Excessive-yield financial savings accounts (HYSAs)

- Certificates of Deposits (CDs)

- Cash market accounts

- Retirement accounts

It additionally works fairly effectively for:

- Shares

- ETFs

- Index funds

- Bonds

- REITs

Offered you plug within the right anticipated annual development price, which I will help you discover for every.

Lastly, the calculator does not work for:

(For causes that I’ll clarify later.)

Funding Calculator

Find out how to Use the Funding Calculator

To make use of the funding calculator, merely enter 4 numbers:

- Your preliminary funding quantity

- How a lot you’ll proceed investing every month, if something

- The anticipated annual development price of the funding

- The variety of years you anticipate to be invested

Right here’s a breakdown of every one, and learn how to enter the appropriate quantities.

Preliminary Funding

Your preliminary funding is just how a lot you place in on day one.

Let’s say you open a Roth IRA with $250 of your commencement cash. You intend to maintain including to it, after all, however for now, your preliminary funding is $250.

Equally, in the event you have been to purchase $100 value of a sure inventory, your preliminary funding can be $100.

So your preliminary funding is simply the primary chunk of cash that you just put in.

How A lot You’ll Make investments Every Month

Once more, this one is simply so simple as it sounds. How a lot are you going to maintain contributing to this particular funding over time?

Let’s say you earn $4,000 a month pre-tax and wish to contribute $500 of it to your Roth IRA. Then $500 is the quantity you’ll put on this subject.

It’s value noting, too, that you may additionally put $0 on this subject. You don’t have to make month-to-month contributions to each funding you make. For instance, it’s not unusual for buyers to purchase, say, 10 shares of a sure inventory and simply let it sit of their portfolio and mature for some time.

That’s very true for dangerous investments. It’s possible you’ll wish to wait and see how your funding performs earlier than committing extra money to it.

(Anticipated) Annual Progress Fee

Your anticipated annual development price is the quantity your funding is projected to develop, expressed as a share.

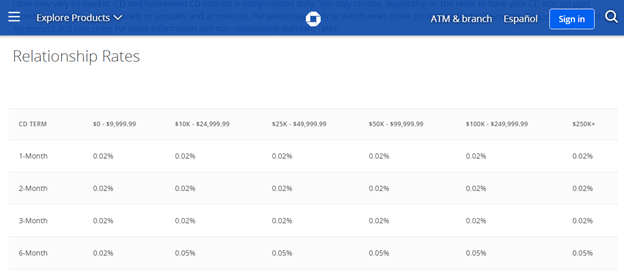

Generally, an anticipated annual development price is tremendous simple. CDs, for instance, have mounted rates of interest which are assured upfront so that you’ll know precisely what your anticipated annual development price can be. Chase Financial institution’s CD assured price for a nine-month CD is 0.02%, in order that’s what you’d put on this subject.

Supply: Chase

Different occasions, the anticipated annual development price of an funding might require a bit of extra analysis.

That’s why I’ve devoted a complete part beneath to serving to you discover the anticipated annual development price of varied funding sorts (e.g., financial savings accounts, shares, crypto, and so forth.).

However first, let’s cowl the ultimate three fields of the funding calculator, together with the final subject you’ll must enter:

Variety of Years

Lastly, the variety of years is just the period of time you’ll wait to money out your funding.

For instance, in the event you’re 25 and also you’re attempting to find out how a lot your Roth IRA will earn earlier than retirement at age 65, you’d put 40 on this subject.

In the event you’re investing in index funds so you should buy a home in 10 years, you’d put 10 on this subject.

The variety of years you’re prepared to maintain your cash invested is also called your funding horizon. Since compound curiosity builds on itself, the longer your horizon, the extra money you’ll earn.

Now let’s speak concerning the outputs.

Output No. 1: Ultimate Worth

The ultimate worth is the whole worth of your funding on the finish of your funding horizon. Hopefully, this quantity is greater than you anticipated!

That’s as a result of compound curiosity is the key to wealth. In the event you make investments sufficient cash for an extended sufficient time, it’ll construct on itself and make it easier to obtain monetary independence a lot sooner.

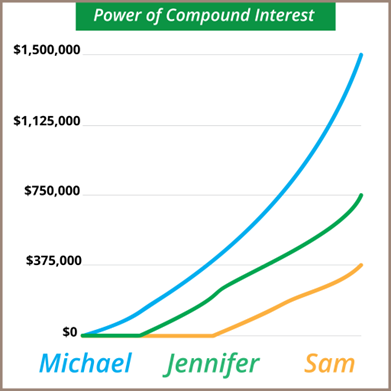

For instance the facility of compound curiosity over time, listed below are three people who invested the identical amount of money — simply beginning at totally different occasions. Michael began at 25, Jennifer at 35, and Sam at 45.

Supply: Cash Below 30

To be taught extra concerning the wealth-building superpower that’s compound curiosity, try If You Nonetheless Don’t Consider within the Energy of Compound Curiosity, You Should See This.

Output No. 2: Curiosity Earned

Lastly, curiosity earned simply reveals you the way a lot of your ultimate worth got here from curiosity alone.

Ultimate Worth = Preliminary Funding + Month-to-month Contributions + Curiosity Earned

Subsequently, curiosity earned could be a useful metric for parsing out how a lot you contributed versus how a lot cash your funding truly generated for you.

Now that you understand how the Funding Calculator works, let’s speak about learn how to ID the anticipated annual development price of varied sorts of investments (as a result of it’s not at all times so simple).

The place Can I Discover the Anticipated Annual Progress Fee for Varied Kinds of Investments?

Excessive-Yield Financial savings Accounts (HYSAs)

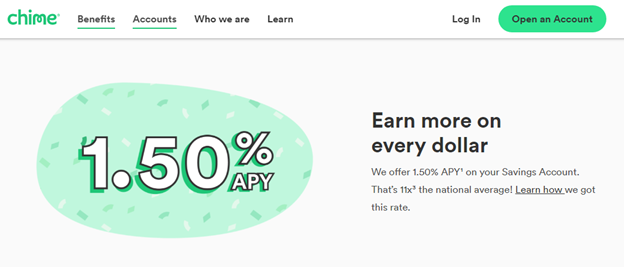

Excessive-yield financial savings accounts are simply common financial savings accounts that pay out 10 to twenty occasions the nationwide common for financial savings account rates of interest — in today’s rates, that’s round 1.50% to 2.00%. Not a complete lot, however they’re zero threat and a few even have sign-up bonuses of $150+.

Learn extra: Greatest Excessive-Yield Financial savings Accounts In contrast

To seek out the anticipated annual development price of a financial savings account, simply search for the APY (annual share yield, aka that 1.50% to 2.00% quantity we mentioned above).

Do notice, nonetheless, that HYSA financial savings charges are variable — not mounted. So your ultimate worth isn’t assured.

Supply: Chime

Certificates of Deposit (CDs)

Not like with financial savings accounts, CD rates of interest are mounted — which means you’ll know your actual anticipated annual development price upfront.

The tradeoff is that with CDs, your cash is locked in — you possibly can’t withdraw it till the CD reaches its maturity date (i.e., expiration date).

CD charges are additionally tremendous low today, averaging simply 0.46% for six months according to the Fed. So your cash might be higher off sitting in an HYSA, if nothing else.

Nonetheless, it’s good to pay attention to CDs as an possibility in case charges return up.

Learn extra: Greatest CD Charges, Up to date Each day

To seek out the anticipated annual development price of a CD, simply search for the share “charges” within the chart:

Supply: Chase

Cash Market Accounts

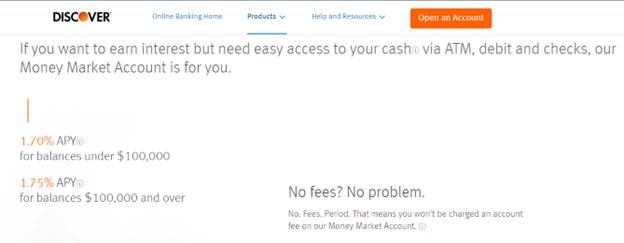

Cash market accounts are like hybrid checking and financial savings accounts. They generate curiosity like a financial savings account, however you may also write checks from them like a checking account and arrange computerized invoice pay.

Some cash market accounts even have tiered rates of interest, like 1.50% for balances of $10,000 or greater, 2.00% for $50,000 and better, and so forth.

Learn extra: Greatest Cash Market Accounts

To seek out the anticipated annual development price on a cash market account, search for the APY:

Supply: Discover

Retirement Accounts (401ks, Roth IRAs, and so forth.)

In the event you’re new to retirement planning, right here’s the thin: retirement accounts are particular financial savings accounts that generate greater quantities of curiosity (suppose 7% in comparison with 2%) and have varied tax benefits, however can’t be accessed with out penalty earlier than age 59 and a half.

Anyhow, the anticipated annual development price of a retirement account can differ based mostly on the combination of shares, bonds, and index funds inside it. However the median anticipated annual development price of a retirement account tends to be round 7%.

Do remember the fact that in the event you set your variety of years for earlier than you flip 59 and a half, you’ll incur penalties for early withdrawal.

Learn extra: Newbie’s Information to Saving for Retirement

Shares, ETFs, and Index Funds

Shares are little tiny shares of firms that rise and fall in worth based mostly on the corporate’s efficiency, sector efficiency, the well being of the general financial system, and numerous smaller elements.

ETFs are like baskets of shares that you may put money into suddenly, united by a standard theme. For instance, as a substitute of investing in 50 totally different solar energy shares, you possibly can put money into a single photo voltaic ETF that incorporates 50 shares and see related efficiency (and save time and costs).

Lastly, index funds are ETFs that signify a complete index just like the S&P 500. Subsequently, investing in an index fund is tantamount to investing within the inventory market as a complete.

I grouped shares, ETFs, and index funds collectively as a result of yow will discover the anticipated annual development price for all three the identical manner: Google the CAGR, or “compound annual development price.”

The CAGR averages previous efficiency and is commonly used to evaluate a potential trajectory of future efficiency. Microsoft, for instance, has a CAGR of 15.5% — which is why it’s extensively thought of a “blue chip” inventory that’s dependable and constant.

Learn extra: Getting Began with Shares: The Newbie’s Information to the Markets

Bonds

A bond is like an IOU. You’re lending cash to an organization, your native municipality, and even the U.S. authorities, and so they pay you again with curiosity.

Kinda empowering, no?

Anyhow, bonds are extensively thought of to be protected investments and may even present a stream of passive revenue through dividends.

Learn extra: How Does a Bond Work? A Easy (and Informative) Information

You’ll find the anticipated annual development price for a bond by on the lookout for the “Yield.” For instance, Treasury I Financial savings Bonds, or I Bonds, change their yield each six months to match the speed of inflation. So the yields on I Bonds are 9.62% in September 2022.

Actual Property and Actual Property Funding Trusts (REITs)

Calculating the anticipated annual development price of a single piece of actual property could be fairly tough. There are simply too many variables like unexpected bills and troublesome renters that may render moot any anticipated development.

That’s to not say you shouldn’t put money into actual property — simply that the returns on a particular piece of property could be laborious to estimate with a easy funding calculator.

Learn extra: Can You Make Cash in Actual Property? Right here’s What the Specialists Say

REITs, alternatively, are firms that personal a number of items of actual property, from properties to workplace buildings to warehouses. They’re required to pay out 90% of their earnings as dividends, so you should utilize dividend yield as a tough substitute for the anticipated annual development price.

Learn extra: Investing in REITs: The whole lot You Have to Know

Crypto

Lastly, there’s crypto.

Adore it or hate it, crypto is each too new — and too unpredictable — to have an anticipated annual development price. Even LUNA, which was touted as an interest-bearing stablecoin that turned the sixth hottest crypto on Earth — misplaced 99.9999% of its worth in a single day.

Subsequently, I’d strongly advise not placing any crypto within the funding calculator since you possibly can’t financial institution on any of the numbers it offers you.

Learn extra: Find out how to Spend money on Cryptocurrency: A Newbie’s Information

The place Ought to You Make investments Your Cash?

The three keys to efficient investing are:

- Consistency

- Analysis

- Variety

There’s nobody miracle asset that you need to make investments all your cash in, and anybody who tells you in any other case most likely doesn’t have your greatest pursuits at coronary heart.

Somewhat, it’s greatest to take a position as a lot cash as you possibly can in a wholesome number of locations. To get began heading in the right direction, try Find out how to Make investments: Important Recommendation to Assist You Begin Investing.

The Backside Line

Now that you understand how a lot you possibly can presumably earn from various kinds of investments, I’d advocate taking our quick quiz to find out your threat tolerance. As a result of whereas incomes excessive returns feels nice, investing inside your consolation stage feels even higher.

And for extra on accelerating your path to monetary independence, stick to Cash Below 30.