When the economic system begins to say no and the media begins to counsel that there’s an impending recession on the horizon, what can buyers do to guard their cash and doubtlessly capitalize on the state of affairs? One of many locations that many individuals have turned to occurs to be one of many oldest and most recognizable property that’s nonetheless used in the present day: gold.

Investing in gold throughout a recession may be advantageous as a result of its worth tends to rise because the inventory market falls and buyers search for a secure place to protect their capital. That is due primarily to its shortage in addition to gold being universally acknowledged as a medium of trade.

In fact, gold isn’t the one funding to think about throughout a recession since there can be alternatives in different asset sectors too. On this publish, take a more in-depth take a look at gold and see the way it’s classically carried out throughout earlier recessions.

We’ll additionally spotlight a couple of different essential investments to bear in mind as you’re employed in the direction of shielding your cash and leveraging this recession to your benefit.

| Platform | Promotions | Hyperlink |

|---|---|---|

|

0.4% Price | Presents Safe Storage With Further Price | Signal Up |

|

0.8% Charges | Presents Safe Storage For Further Charges | Signal Up |

Is Gold A Good Funding Throughout A Recession?

At any time when the economic system begins to indicate indicators of hassle, one thing buyers will discover is that the value of gold sometimes begins to rise. To totally recognize why that is taking place, it’s useful to grasp what makes gold invaluable within the first place.

Why Gold Is Precious For Traders

Gold has been thought to be a medium of trade and retailer of wealth for hundreds of years. It was utilized by kings and civilizations lengthy earlier than individuals began utilizing fiat foreign money, the government-issued “paper cash” that you just and I take advantage of in the present day.

As a matter of reality, U.S. {dollars} had been redeemable for a hard and fast quantity of gold up until 1971 when then president Nixon took the country off of the Gold Standard.

Gold derives its worth from three essential traits:

- It’s broadly fascinating – You possibly can go anyplace on this planet and gold can be acknowledged as having worth

- It has relative shortage – Gold shouldn’t be simply mined relative to different valuable metals. Subsequently, its provide is considerably restricted

- It has a variety of makes use of – Other than having it as wealth, gold has a variety of sensible makes use of as a commodity for issues like jewellery, electronics, computer systems, dentistry, and many others.

When the inventory market falls or the shopping for energy of the greenback begins to erode due to inflation, buyers lose confidence in these fashionable types of property. As an alternative, they may flip to what has traditionally completed a very good job of defending their principal.

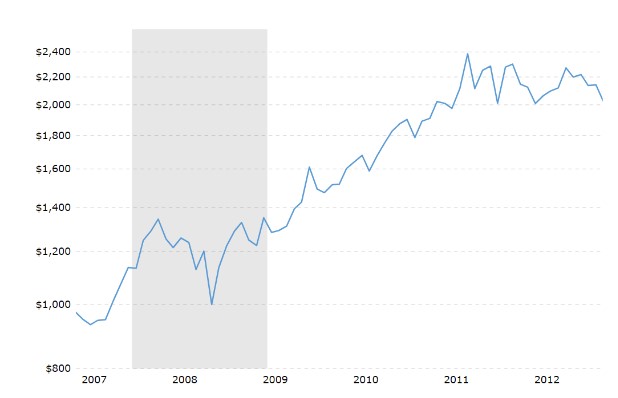

To offer you some thought of how gold has carried out up to now, let’s skip over the mini-recession that passed off in 2020 in the course of the begin of the COVID pandemic and return to the 2008 Nice Recession.

That is when main monetary establishments started to fail as a result of sub-prime mortgage disaster, and it induced the inventory market to lose almost 50 % of its worth.

But, between 2008 and 2012, the price of gold increased by a dramatic 101 percent. This was primarily as a result of buyers flocked to the commodity as they waited for presidency intervention and the economic system as an entire to get again on observe.

Methods You Can Make investments In Gold Throughout A Recession

If you wish to make gold part of your portfolio, there are a couple of methods you may go about doing this.