Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- The New York legal professional common filed a lawsuit in opposition to Kucoin.

- Kucoin’s worth motion broke under key help after the information of the lawsuit.

Kucoin trade’s native token, Kucoin [KCS], may face elevated promoting strain amidst the present lawsuit. New York’s legal professional common, Letitia James, has shifted focus to the trade as a part of her spirited crackdown on unregistered cryptocurrency platforms.

On 9 March, the AG filed an official lawsuit in opposition to KuCoin for failing to register as a dealer or seller apart from “incorrectly” presenting itself as an trade.

Learn Kucoin’s [KCS] Value Prediction 2023-24

At press time, KCS had breached a key $8.123 help that would entice extra aggressive promoting and supply extra shorting alternatives at sure ranges ought to bearish sentiment persists.

Can bears take pleasure in extra alternatives?

Supply: KCS/USDT on TradingView

In mid-January, KCS consolidated between the $7.519 – $8.123 vary. It flipped the construction into bullish on the finish of January earlier than going through a worth rejection at $8.894. However the $7.841 checked the drop and supply a robust restoration round mid-February, resulting in a brand new excessive of $9.192.

On the time of writing, KCS had damaged key help ranges, together with an important one at $8.123 that would induce bears to behave extra aggressively. Due to this fact, the worth motion may retest $7.841 or breach it and transfer south to different help ranges.

Bears might be offered with two potential commerce outcomes. First, shorting the token with a goal of $7.841 and a cease loss above $8.123.

The second possibility is focusing on the decrease help degree of $7.519 if bears clear the hurdles at $7.841 and $7.682. The second possibility has a better RR than the primary.

Alternatively, bulls may dent the bearish sentiment in the event that they defend $8.123 by way of a every day candlestick shut above the extent. However bulls should clear the hurdles at 200-day EMA ($8.347) and 26-day EMA ($8.511) to realize leverage.

Is your portfolio inexperienced? Try KCS Revenue Calculator

The RSI (Relative Energy Index) slid into the oversold territory whereas the OBV (On Steadiness Quantity) confirmed a downtick, indicating promoting strain elevated amidst declining buying and selling volumes.

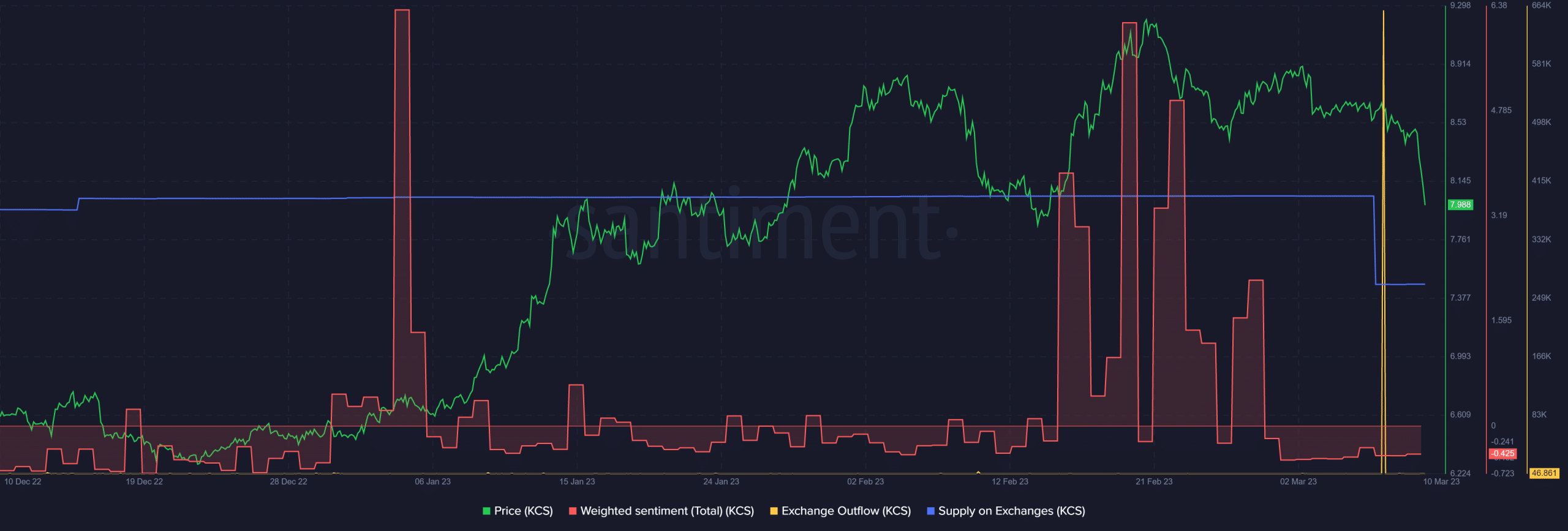

KCS noticed a latest sharp spike in trade outflow regardless of the adverse sentiment

Supply: Santiment

KCS recorded a latest spike in trade outflow, displaying short-term accumulation of the token at its earlier low worth degree. As well as, a drop in provide on exchanges on 7 March confirmed the short-term accumulation.

Nonetheless, the weighted sentiment was adverse at press time and will see a spherical of offloading after the information of the lawsuit if buyers unload at a loss.