Affirm is a “purchase now, pay later service” that provides customers the choice of paying for his or her buy in installments as a substitute of requiring the entire cost upfront. It may be used for a variety of merchandise, from clothes to electronics, furnishings, and even journey. Many journey corporations, together with Expedia, Priceline, Orbitz and American Airways, use Affirm.

Should you’re contemplating utilizing Affirm to pay in your journey, learn on to study extra in regards to the service, the way it works and whether or not utilizing it’s a sensible cash transfer.

What’s Affirm?

Whilst you might not have heard of Affirm, the purchase now, pay later or BNPL service has develop into fairly widespread, with over 12.7 million prospects as of June 2022. From January to March of the identical 12 months, it prolonged roughly $3.9 billion of loans. BNPL providers like Affirm are particularly widespread amongst youthful generations — an estimated 75% of all BNPL customers are both Gen Zers or millennials.

Affirm provides two forms of cost plans:

-

Affirm Pay in 4. This feature lets you pay in 4 equal installments each two weeks with no curiosity or influence in your credit score rating.

-

Month-to-month funds. This feature is a mortgage that lets you pay in both three-month, six-month or 12-month installments at various rates of interest primarily based in your credit score rating.

Affirm additionally provides a financial savings account and a digital card, which can be utilized like a bank card (even at areas that do not settle for Affirm).

Who can use Affirm?

-

Be no less than 18 years outdated (or 19 years outdated for Alabama residents and a few Nebraska residents).

-

Have a Social Safety quantity.

-

Personal a telephone quantity that’s registered within the U.S. and may obtain SMS textual content messages.

Along with the above standards, Affirm will even contemplate the next when deciding if you happen to qualify for a mortgage with them:

-

Your cost historical past with Affirm.

-

How lengthy you have had an Affirm account.

-

The variety of loans you’ve with Affirm.

-

Verification of your revenue and money owed.

As a result of approval relies on a number of elements, if you happen to’re buying at an internet site that makes use of Affirm, we advocate having a backup plan in case you don’t qualify for a mortgage.

The place can you employ Affirm to pay for journey?

Affirm has partnered with a number of widespread journey corporations. Examples of people who can help you pay with Affirm embody:

Should you select to get an Affirm digital card, you should use it to e book on different journey websites, together with Accommodations.com and Reserving.com.

The way to use Affirm to pay for journey

There are two methods to make use of Affirm to pay in your journey:

-

E-book on an internet site that features Affirm as a cost choice.

-

Use an Affirm digital card.

This is a more in-depth take a look at each choices.

Use Affirm as a cost choice

To present you an instance of reserving journey on an internet site with Affirm as a cost choice, we checked out reserving the Hyatt Ziva Puerto Vallarta for 3 nights in August on Expedia.

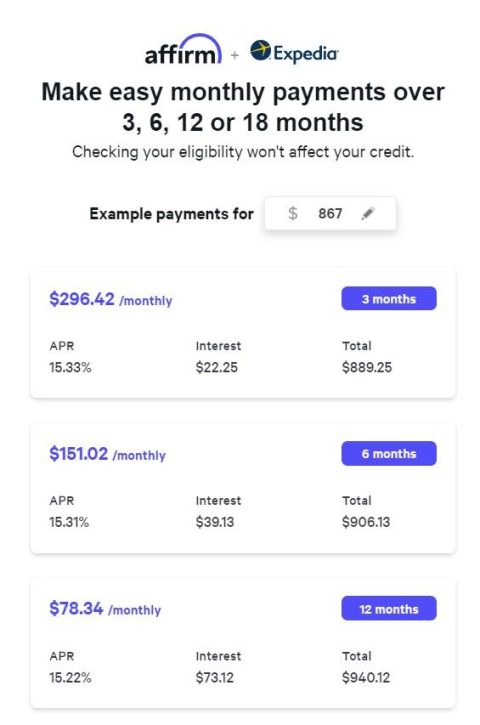

This keep would value $867 whole if you happen to determined to pay for it with both a credit score or debit card or PayPal, however you can too click on “Month-to-month Funds” and you may see an choice to pay with Affirm.

Once you click on “Be taught extra,” Affirm provides you examples of what your month-to-month funds would appear to be primarily based on whether or not you pay in three-month, six-month or 12-month increments, in addition to your whole cost quantity and the way a lot you will pay in curiosity.

The month-to-month cost for the 12-month plan is just $78.34, versus $296.42 on the three-month plan. Nevertheless, remember that if you happen to select this feature, you will pay $940 in your lodge keep as a substitute of the $867 you’d have paid with a card or PayPal — an extra $73.

The cost choices above are solely examples — you will want to use to seek out out if you happen to qualify for Affirm. You may additionally be requested for a down cost or be given totally different rates of interest primarily based in your monetary scenario.

Should you resolve you need to pay with Affirm, you will want to supply your cellphone quantity and create an account with some fundamental private data.

After doing so, you will obtain a real-time resolution on whether or not your request was authorised. You will then be capable to use Affirm to pay in your journey primarily based on the cost schedule you choose.

Use an Affirm digital card

If you would like to make use of Affirm, however you are not supplied the choice to take action when reserving, you could possibly use a digital bank card.

To get began, you will have to obtain the Affirm app and select the “Digital Card” choice. You will then choose “Pay with a one-time-use digital card” and enter the approximate quantity your buy will value.

You will obtain an instantaneous resolution, and if you happen to’re authorised, you will get a digital card you may add to your telephone’s pockets. Then, while you’re able to pay, enter the cardboard particulars as you’ll with some other bank card. Take into account, nevertheless, that you’re going to want to finish your transaction inside 24 hours of being authorised for the digital card.

When ought to I take advantage of Affirm to pay for journey?

There are a few situations the place it might make sense so that you can pay in your journey with Affirm:

You are in a position to make use of Affirm Pay in 4

Since Affirm Pay in 4 lets you pay in 4 installments with zero curiosity and no influence in your credit score rating, this could be a nice choice if you do not have the money to pay upfront and may’t wait to make your buy.

For example, if a flight prices $800, you’d pay 4 installments of $200 – the primary installment due at time of buy. Simply bear in mind to funds for these extra funds over six weeks.

You are reserving important journey however lack the funds to pay in full

As a lot as we like to journey, we usually do not advocate reserving a visit until you’ve the funds to pay for it or can repay the cost instantly earlier than any curiosity accrues.

But when there’s important journey that you should e book — for example, a household or medical emergency — and you may’t pay in full, Affirm could be a helpful choice if you do not have a bank card or if it provides a greater rate of interest than your bank card.

Nevertheless, suppose you are contemplating utilizing Affirm as a result of the rate of interest is decrease than your bank card. In that case, we advocate calling your bank card firm to see if they’ll offer you a decrease promotional charge.

Except for the restricted examples above, you are seemingly higher off paying for journey in your credit score or debit card or with one other cost choice.

Should you’re considering of utilizing Affirm on journey

Whilst you could also be tempted to make use of Affirm so that you simply needn’t pay in your journey in whole upfront, purchase now, pay later providers could be detrimental to your funds if not used correctly.

Except you should use Affirm Pay in 4 to rapidly repay your mortgage with no curiosity, Affirm expenses a excessive rate of interest that you simply’re higher off avoiding the place potential. It is higher used to assist in a pinch, akin to while you’re touring for a last-minute emergency.

The way to maximize your rewards

You need a journey bank card that prioritizes what’s essential to you. Listed below are our picks for the greatest journey bank cards of 2022, together with these greatest for: