Earlier than 2022, I had about three folks every week ask me if they need to put money into crypto.

In 2022, it’s been zero.

As a substitute, the query has grow to be “What is crypto?”

FOMO has changed into morbid curiosity as folks watch the markets in freefall, questioning what occurred to this seemingly bulletproof funding that their outdated school roommate raved about.

MRW I watch my crypto investments in real-time | Supply: Giphy.com

So what did occur? And with greater than 60% of the crypto market worn out, what’s subsequent? The place is crypto getting in 2023 and past?

Will it skyrocket once more? Stabilize? Or lastly die off like many are saying?

What occurred to Bitcoin in 2022?

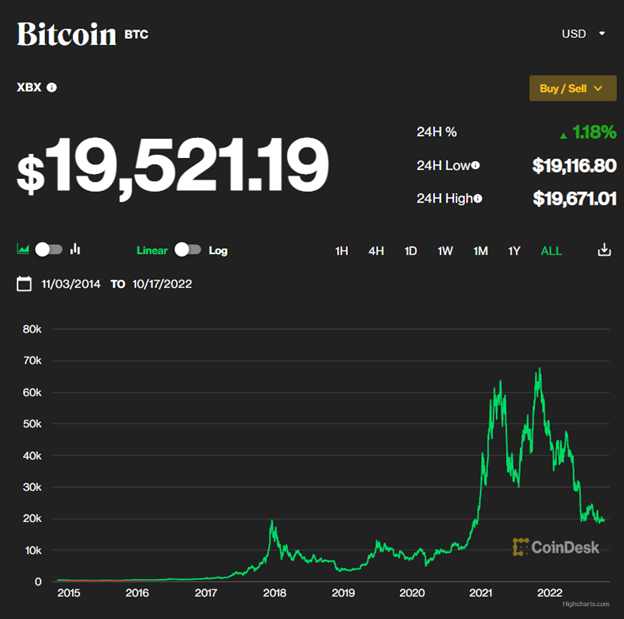

After a really insane run in 2021, with Bitcoin costs up 1,200% and Ethereum costs up 4,500% from their pre-pandemic ranges, the crypto market crashed onerous.

And never like slipped-on-a-banana onerous, however like the-snowboarder-didn’t-land-the-jump onerous (belief me, I’ve been there).

Supply: CoinDesk

At its lowest level in 2022, Bitcoin was down an eye-watering 79% from its pandemic-era peak. Ethereum values are tremendous suppressed, too, as are DOGE and Cardano.

All instructed, over 60% — or $2 trillion — was wiped off the crypto market in a matter of weeks.

So what the (bleep) occurred?

Usually when a market crashes this tough, it’s as a result of numerous traders bought spooked and bought. Then, when costs dipped sharply, extra traders bought spooked and bought. Rinse, repeat.

So what despatched the primary wave of traders working for the exit?

My idea is that some large-cap traders noticed the writing on the wall and bought out whereas costs have been above $60,000. Institutional traders are inclined to abandon dangerous, speculative property anyhow when rates of interest rise and the financial system slows down. They’d reasonably stuff their cash in bonds and anticipate issues to blow over earlier than taking massive dangers.

However along with a number of massive traders heading for the exits, many different elements accelerated the bleeding, together with:

- Russia’s conflict on Ukraine

- Rumors of Russia banning Bitcoin

- El Salvador’s catastrophic Bitcoin rollout

- The devastating failure of Terra Luna, a “stablecoin” that misplaced 99.97% of its worth in a single day

- Rising consciousness of crypto’s devastating local weather influence

Ultimately, crypto costs fell about as exponentially as they rose throughout the pandemic. Some traders stay unperturbed, even optimistic. They are saying that is the proper time to “purchase the dip” and make investments whereas it’s low-cost.

The way forward for crypto: 3 potential eventualities

Ultimately, there are solely 3 ways crypto can go: up, down, or simply chill proper the place it’s.

1. To the moon: Why crypto may get well

First up is the “to the moon” state of affairs. What are some causes to assume the crypto market may get well from the continued Crypto Winter — and maybe even thrive?

The U.S.’s “blessing” may enhance world acceptance

On March 9, 2022, U.S. President Biden issued a prolonged govt order known as “Government Order on Making certain Accountable Growth of Digital Property.”

To spare you from studying all 6,000 phrases, right here’s a abstract: Biden desires each department of the federal authorities to analysis and perceive crypto to allow them to begin regulating it ASAP. He desires to mitigate crypto-related crime, help crypto growth, and general make the digital asset house extra secure, pleasant, and welcoming to the American investor.

Many crypto people seethe on the considered regulation, however should you ask me, taming the Wild West isn’t such a nasty factor. Like taming the actual Wild West, it may convey security, prosperity, and new traders — all of which might drive costs upwards.

Biden additionally desires the U.S. to be seen as a “thought chief” within the digital asset house. In different phrases, he desires the U.S. to indicate the remainder of the world how coexisting with crypto could be finished proper, and that outright bans a la China and India are a missed alternative.

If Biden’s cupboard can pull it off, it may imply that world acceptance may skyrocket — and that international locations in search of a ban may reverse course and comply with the U.S.’s playbook.

Blockchain tech has demonstrated its resilience and maturity

{Dollars} wouldn’t exist with out banks, and Bitcoin wouldn’t exist with out the blockchain.

Blockchain was designed to exchange third events like banks or PayPal that presently must lord over each single on-line transaction. Give it some thought: you can not alternate worth with one other individual on-line with no financial institution or different monetary establishment concerned. And even when that third celebration doesn’t cost a payment, they will inject exterior affect and/or sluggish the entire course of down. Worst of all, having hundreds of on-line banks every with its personal ledger means cost tracing is almost unattainable.

Learn extra: What’s the future of money?

The blockchain was meant to resolve all these issues — a safer and sooner system freed from corruption. Nakamoto even inbuilt anti-theft measures; should you can muster sufficient computing energy to steal Bitcoin, why not mine it (which additionally controls inflation)?

Up to now, Nakamoto’s genius design has paid off. Bitcoin works. Blockchain works. Certain, the pair could suck up a ton of energy, however the system works. Primarily based on Nakamoto’s authentic tech, cryptos are scaling — other than energy consumption, there’s no main tech holding them again. Exchanges have been hacked, however many level to the failings in their very own safety software program — not a failure of the blockchain.

Briefly, the truth that blockchain has proof-of-concept could also be sufficient to shoot bitcoins to the moon, and a few altcoins with it.

Rising markets are getting in on the motion

In relation to crypto exchanges, Coinbase tends to suck up many of the press and a focus. I’m not saying they don’t deserve it; in spite of everything, Coinbase was instrumental in getting Fortune 500s to simply accept crypto and was additionally the primary crypto platform to be “knighted” with an IPO.

However Luno deserves some love, too.

That’s as a result of Luno introduced crypto to rising markets. From Africa to South America, the crypto commerce in growing areas of the world is prospering, and analysts say it’s for 2 major causes.

The primary is clear: crypto presents a option to multiply cash the place others don’t exist. Merchants in Guatemala or Mozambique could lack entry, training, or just the alternatives to put money into shares or actual property. Crypto presents a option to shield their financial savings from inflation and corruption, requiring little investing information.

Second, crypto presents a means for migrant employees to switch a refund residence whereas saving on remittance charges. In response to a report by the World Financial institution, expats despatched $48 billion again to sub-Saharan Africa in 2019 alone, paying a median 9% in remittance charges every time.

That’s over $4.3 billion in charges squeezed out of a inhabitants already residing away from their households on a good funds.

Against this, if everybody had transferred funds again to their households through Luno, they might’ve paid as little as 1.5%, saving $3.6 billion within the course of.

Granted, transferring funds internationally through crypto nonetheless comes with dangers:

- It might be stolen

- The crypto may lose worth whereas in transit

- The vacation spot nation may ban, regulate, or tax it

However for now, crypto appears to be serving a precious goal for the worldwide group — which may result in a worldwide resurgence as expats choose their remittance-killing cash of alternative.

2. Cruise management: Why crypto may stabilize

Some say that crypto will get well, others that it’s lifeless within the water. Is it extra prone to fall someplace in between and easily sit back for some time?

Listed below are some causes to assume that crypto may lastly stabilize at +/- 10% of present values.

Elevated tax accountability may drastically decelerate buying and selling

Folks underestimate the IRS.

They have been the primary federal company to arrest Al Capone, and in 2014, additionally they grew to become the primary company to step in and regulate the crypto business.

Yep, a full eight years earlier than Biden’s govt order calling for extra oversight — and a yr earlier than Ethereum even existed — the IRS checked out crypto in its larval stage and went, “We gotta regulate this s***.”

Hassle is, regardless that the IRS made crypto good points taxable in 2014, no one listened. It took the IRS six extra years to develop a system for monitoring down crypto tax dodgers, however now they’ve it. And since the blockchain is clear by design, illicit crypto merchants have nowhere to cover.

And it’s not simply the truth that crypto good points are taxed on the common capital good points tax fee that can decelerate buying and selling; it’s the truth that correctly reporting your crypto exercise to the IRS could be a large, large ache within the rear

Learn extra: Utilizing Bitcoin or different cryptocurrency? You’ll nonetheless owe taxes

Now that each single commerce is each reportable and taxable by as much as 37%, crypto merchants could ease onto the brakes and HODL for longer, serving to to stabilize costs and maybe even flip crypto right into a bona fide, center time period funding (versus a short-term feeding frenzy).

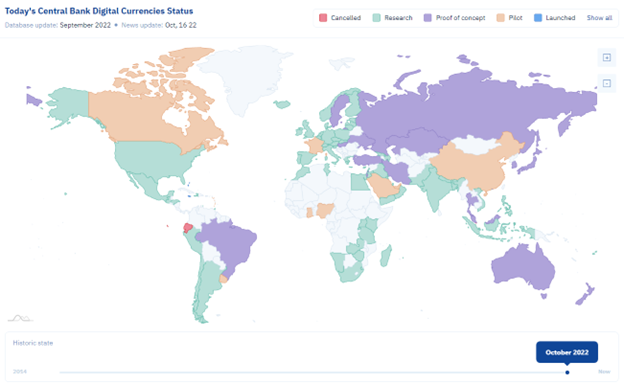

The Central Financial institution Digital Currencies (CBDCs) may dilute the market

A Central Financial institution Digital Forex (CBDC) is what occurs when a nation’s central financial institution appears to be like at crypto and goes hmm… let’s make our personal.

China led by instance after they banned Bitcoin in 2013 and began rolling out the digital yuan only one yr later

Since then, international locations like Canada, France, The Bahamas, and extra have adopted swimsuit with their very own state-sponsored cryptos — and dozens extra are within the testing stage.

Supply: CBDC Tracker

The publicly acknowledged objective of CBDCs is to make transactions safer, cheaper, and simpler for residents. The proliferation of CBDCs may scale back crime, enhance cross-border commerce, and general enhance the well being of the host nation’s financial system.

But it surely’s not a stretch to think about that among the international locations on that map are utilizing CBDCs to snuff out — or, on the very least, dilute — the utilization of conventional cryptos like Bitcoin and Ethereum.

Moreover, CBDC growth may very nicely be a precursor to an outright crypto ban. The U.S., Canada, and The Bahamas are about the one international locations making an attempt to construct a system the place crypto and CBDCs can fortunately coexist. For China, India, Bangladesh, and sure Iran, their CBDC was extra like a nail within the coffin.

All that being stated, I don’t assume CBDCs will kill crypto. In crypto-friendly international locations they might truly elevate cryptocurrency values by inviting a recent wave of traders to the digital asset class.

Ultimately, I feel CBDCs can be like a cop standing on the porch of a home celebration. They gained’t finish issues instantly, however they’ll definitely sluggish issues down.

3. Crash and burn: Why crypto may die off

To borrow a quote from Elrond, crypto’s record of allies grows skinny. Particularly Bitcoin’s, and historic knowledge reveals that the remainder of the crypto market tends to comply with the place Bitcoin goes.

Right here’s why Bitcoin may crash and burn — and convey a complete lot of the crypto market down with it.

Crypto crime remains to be working rampant

Your shares could also be down this yr, however at the very least they haven’t been stolen.

Sadly for crypto traders, having their property stolen is a really actual risk. A report by Chainalysis discovered that in 2021 alone, $3.2 billion price of crypto was stolen from traders — a 516% rise in crime from the yr earlier than.

In the meantime, the U.S. nonetheless hasn’t determined which company will step in and regulate the business — the Commodity Futures Buying and selling Fee (CFTC) or the Securities and Change Fee (SEC). Which means true fraud safety, like now we have with shares and actual property, might be years and years away.

In the meantime, the foremost exchanges at the moment are getting hacked on a monthly basis for sums nicely into the tens, generally lots of of thousands and thousands. And positive, a few of these exchanges are insured — however refunding crypto is notoriously tough. Heck, Mt. Gox was hacked in 2014 and the numerous majority of traders have but to see a single Bitcoin returned.

All it may take is yet one more large-scale hack for traders to throw their arms up and say, “I’m finished, give me some Treasury-backed bonds.”

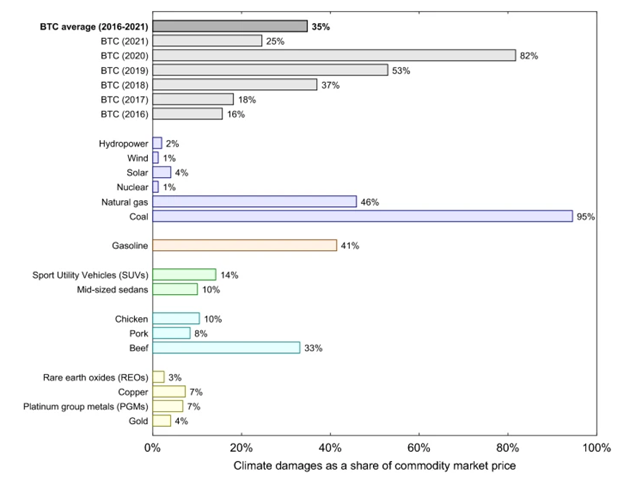

Bitcoin is worse for the surroundings than beef manufacturing

From Tesla to Wikipedia, increasingly more organizations have damaged up with Bitcoin because of the devastating influence that Bitcoin mining has on the environment.

As a result of immense energy calls for of the pc farms powering Bitcoin, the OG crypto now creates extra local weather harm than all of the SUVs and mid-sized sedans on the earth combined. It’s additionally worse for the surroundings than world beef manufacturing — mainly the benchmark for ozone-burning industries.

Supply: Scientific Reports

And when you think about that 194 international locations signed the Paris Settlement vowing to shrink greenhouse fuel emissions, it’s onerous to see a future the place Bitcoin mines can proceed working with impunity — even in international locations the place crypto stays authorized.

Along with rising crime and environmental issues, crypto faces threats from regulators, the tech giants making an attempt to manage and exchange it, and traders themselves shedding religion and inflicting costs to fall additional.

So can it survive all this?

To seek out out, let’s check out the pillars holding up Bitcoin and the remainder of the crypto cabal. Is Bitcoin resting on bedrock? Or rotting wooden?

Greatest altcoins to think about going into 2023

Ethereum 2.0, aka “the merge”

If Bitcoin was a pickup truck — easy and unrefined — Ethereum was like an Audi. It was sooner, fancier, and loaded with extra know-how.

However ultimately, each the truck and the Audi have been fuel guzzlers.

So on September 15, 2022, the group behind Ethereum efficiently transformed the crypto from proof-of-work to proof-of-stake — an occasion they known as “the merge.” Ethereum now makes use of 99.95% much less power and has purchased itself a ticket to the following era of crypto.

Cardano

Cardano touts itself as a third-generation cryptocurrency (Bitcoin > Ethereum > Cardano) and to its credit score, it does have some fairly slick options inbuilt.

Naturally, transaction speeds are lightning quick and it helps all the very best blockchain goodies — dApps, good contracts, NFTs, and extra. It’s additionally four million times as power environment friendly as Bitcoin and was peer-reviewed by a group of worldwide consultants earlier than launch.

However maybe its coolest characteristic is the treasury. Cardano transactions have a tiny “tax” inbuilt that goes in direction of system upkeep. This fashion, the group can guarantee Cardano retains evolving with group enter, each when it comes to suggestions and financing.

Tether

Tether is the closest factor now we have to a digital greenback. It’s pegged to the U.S. greenback so it’s all the time price exactly $1.00, and whereas which will sound boring to traders, it’s truly mega useful.

As an illustration, changing your crypto to Tether as a substitute of withdrawing it might prevent large on taxes. And Tether can be simpler to ship to household in different international locations with out triggering remittance charges.

It’ll be fascinating to see how central financial institution digital currencies (CBDCs) react to Tether given they mainly serve the identical goal. However within the meantime, Tether’s an excellent useful gizmo for any crypto dealer to have of their toolbelt.

Learn extra: 8 alternate options to Bitcoin

A fast historical past of cryptocurrencies

1983 – 2008: Exploration begins

Cryptographers and programmers have been exploring the concept of digital forex since Star Wars: Return of the Jedi was in theaters.

In 1983, American cryptographer David Chuam conceived of an untraceable digital forex known as “ecash,” later known as “Digicash.”

In 1998, 10 years earlier than Satoshi Nakamoto revealed his white paper on Bitcoin, a Chinese language pc scientist known as Wei Dai revealed “b-money, an anonymous, distributed electronic cash system.” In it, he outlined the fundamental ideas that almost all cryptocurrencies use at present — his early affect on crypto was so profound that the creators of Ethereum based mostly their unit of measurement after him: the “wei.”

As early pioneers like Chaum and Wei set the groundwork for a digital forex, Satoshi Nakamoto gave the idea wings in 2008.

2009: Satoshi Nakamoto launches Bitcoin

Bitcoin’s official birthday was January 3, 2009. That’s when the mysterious Satoshi Nakamoto used Bitcoin software program v0.1 to generate the primary “block” (aka the genesis block) and mine the primary “coin.”

To commemorate the second and to make a dig at conventional banks, Nakamoto included the day’s headline in his compiled code file:

The Occasions 03/Jan/2009 Chancellor on brink of second bailout for banks

Nakamoto continued growing each Bitcoin and the blockchain with a group of expert builders till mid-2010 when he handed off the challenge to Gavin Andresen and easily vanished. However even by then, Bitcoin and the blockchain have been absolutely purposeful. Nakamoto’s proof-of-concept was stay and working, and different devs began to take discover.

2011-2015: The altcoins arrive

Bitcoin served as a proof-of-concept for cryptocurrencies, so alternate options shortly adopted swimsuit. Any various crypto to Bitcoin was given the moniker “altcoin.”

In 2011 Charlie Lee based Litecoin, which used various cryptography algorithms to speed up coin manufacturing and transaction speeds over Bitcoin. Namecoin arrived the identical yr, created by Vincent Durham as a means to assist customers encrypt their identities, thus defending on-line free speech.

In 2013, Billy Markus and Jackson Palmer launched the primary satirical crypto, Dogecoin. DOGE largely existed as a joke, however the memes it spurred helped to ease new traders into crypto. Quickly, so many traders have been in on the joke that DOGE mockingly grew to become a bona fide funding — rising from a launch worth of $0.00026 to an all-time excessive of $0.722 by late 2021.

Lastly, the final altcoin price mentioning is Ethereum, which launched in 2015 and has grow to be the second hottest crypto (and second-largest by market cap) behind Bitcoin. The chief distinction is that Ethereum permits customers to alternate worth and data like pc code, whereas BTC is primarily used for worth exchanges solely.

In whole, over 20,000 cryptocurrencies have flooded the market since 2011. However regardless of the overwhelming amount of opponents, no one has topped Bitcoin for market cap or recognition.

In consequence…

2016-2020: Bitcoin’s first bubble bursts

Within the span of 5 years, Bitcoin’s worth rose from $1,000 to $60,000 a pop. For example simply how loopy that’s, think about should you purchased a condominium in early 2016 for $200,000. Then, in late 2020, you discover out it’s price $12 million.

Bitcoin’s worth exploded means sooner than shares or actual property and it’s not onerous to see why. All it takes is eighth-grade economics:

Surging demand + restricted provide = skyrocketing costs

Plus, not like homes or PlayStation 5s, no one was ever “priced out” of Bitcoin. Irrespective of the place you have been on the earth or how a lot cash you had, you could possibly all the time purchase a tiny little bit of Bitcoin.

So folks did, and costs stored surging upwards.

That stated, it wasn’t a clean journey from $1,000 to $60,000. From 2017 to 2020 the worth of a bitcoin regarded just like the EKG of a scared chihuahua, with huge peaks and valleys fluctuating between $7,000 and $12,000.

Oftentimes, the worth would plummet in a single day, inflicting panic.

The shopping for frenzy throughout the 2017 vacation season led to Bitcoin’s first bubble burst, with costs that wouldn’t get well to pre-2018 ranges till late 2020. I’m simply speculating right here, however the root trigger appears to be that too many new traders purchased in directly, all believing their funding to be bulletproof. Then, when Bitcoin plunged 20%, they bought spooked and bought.

However those that held on for pricey life (or HODL, because the group likes to say), have been quickly vindicated throughout the COVID-19 pandemic.

2020-2022: Crypto’s pandemic growth

COVID-19 created the proper storm for crypto. Retail merchants and recent traders alike have been feeling jaded, anti-establishment, and, in some instances, determined for an funding alternative that might refill their depleted financial savings.

Some turned to GameStop inventory, however numerous extra turned to crypto.

As costs started rising, crypto quickly gained a repute as a hedge in opposition to COVID-related chaos. Folks began pouring cash into crypto in early 2020, and within the quick time period, their bets paid off greater than tenfold; Bitcoin alone rose from $4,861 in March 2020 to an all-time excessive of $67,789.63 in November 2021.

Ethereum carried out even higher, rising from simply $110 a pop to an all-time excessive of $4,891.70

Sadly for anybody who purchased close to the height, costs haven’t returned since. Not even shut. However hey, at the very least we bought dank memes out of it:

2022: The continued “Crypto Winter”

That brings us to 2022. As talked about earlier, numerous elements have been dragging costs down, together with however not restricted to:

- Rising rates of interest inflicting institutional traders to desert high-risk property

- Retail merchants and new traders getting spooked and promoting

- Russia’s conflict on Ukraine

- El Salvador’s catastrophic Bitcoin rollout

- An elevated variety of nationwide bans

- The rise of CBDCs

- Rising consciousness of crypto’s devastating local weather influence

When will it finish? Nicely, should you ask me, crypto has far more working in opposition to it than for it. However even while you put apart elements like impending laws, skyrocketing crypto crime, and extra, the straightforward truth is the large crypto secret is out:

You may make some huge cash on crypto, positive.

However you too can lose a ton, too.

The cat’s out of the bag and it’s too late to place him again in. Now that everybody’s seen simply how devastating a crypto funding could be to your backside line, demand could by no means rise excessive sufficient to convey Bitcoin again to $60,000 and even $30,000.

However Bitcoin’s retirement is probably not a nasty factor. Given its environmental harm, it is likely to be time for Bitcoin to throw within the towel and let its proof-of-stake successors take over. And maybe the loss of life of Bitcoin may result in the altcoins thriving as ex-Bitcoin fanatics pour into newer property.

Who is aware of. The one fixed with crypto, actually, is change.

Abstract

So, do you have to put money into crypto now?

Nicely, I wrote a complete characteristic to reply that loaded query. Take a look at Do you have to purchase crypto now?

However the quick reply is, perhaps just a little (5% of your portfolio) should you actually wish to. However you don’t want crypto to get wealthy, and even financially unbiased. There are means simpler, safer strategies.