- Bitcoin exchanges outflows witness a surge in the previous couple of days

- BTC whales didn’t present a lot of an curiosity in buying the king coin at discounted costs

Should you have been hoping for crypto winter to finish quickly, then the newest market crash could have simply dampened your temper. Fortuitously, the newest Bitcoin [BTC] observations may very well be the silver lining to a darkish cloud that’s presently hovering over the crypto market.

Learn Bitcoin’s [BTC] worth prediction 2023-2024

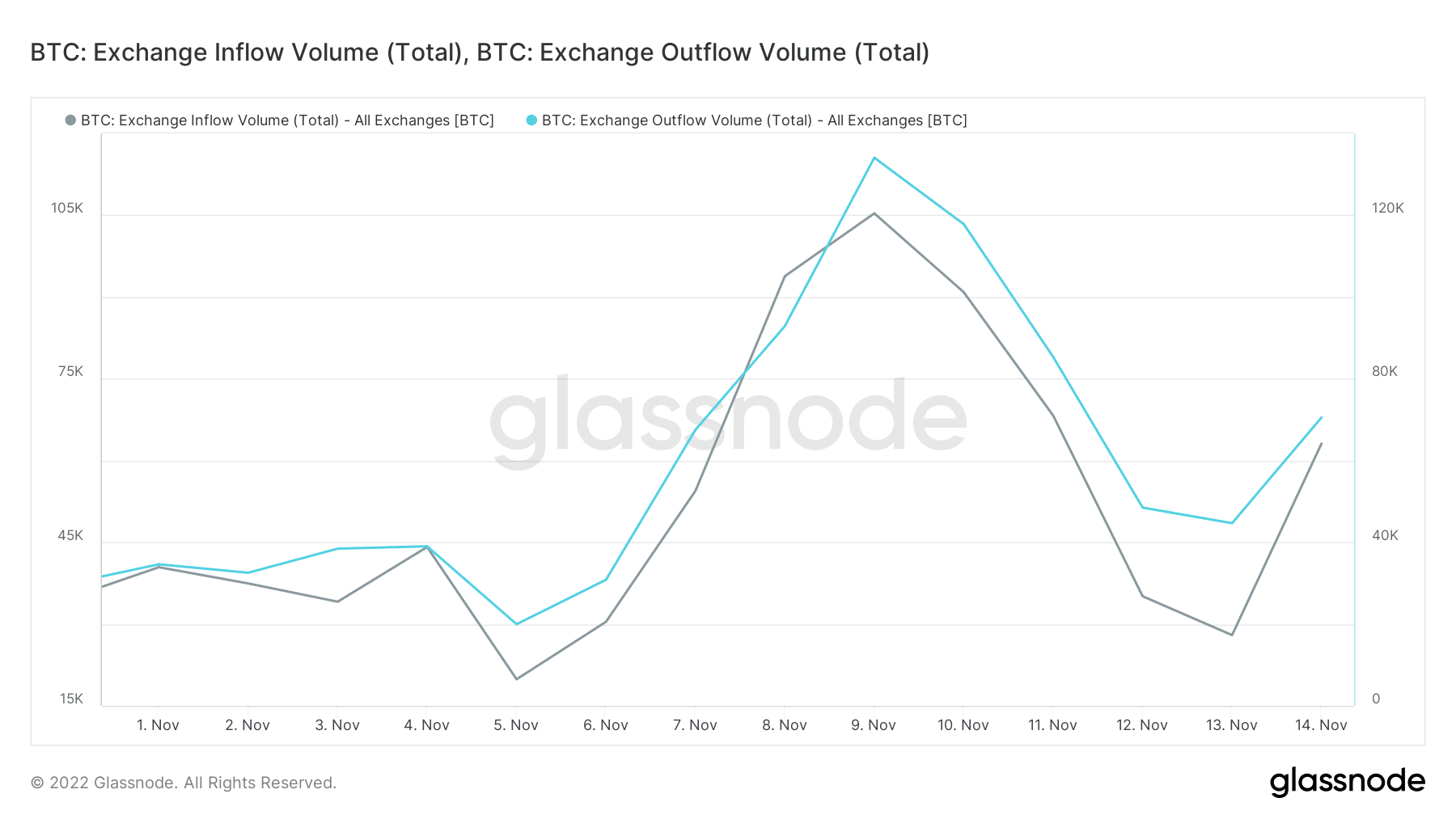

Based on the newest Glassnode evaluation, massive quantities of Bitcoin have been flowing out of exchanges in the previous couple of days. Such observations normally underscore sturdy accumulation and are thought-about a constructive end result particularly so far as demand is worried.

#Bitcoin is leaving exchanges EN MASSE!! pic.twitter.com/z8r7psjXO9

— Altcoin Each day (@AltcoinDailyio) November 15, 2022

Traders are panic transferring their Bitcoin into non-public wallets

This time the large Bitcoin alternate outflows could not essentially be tied to heavy accumulation. Final week’s market crash highlighted the dangers of getting cryptocurrencies on exchanges. Consequently, many merchants opted to maneuver their Bitcoin from exchanges to non-public wallets.

Though the above statement didn’t essentially mirror demand, the market confirmed some vital bullish indicators. The quantity of stablecoins on exchanges elevated considerably within the final couple of months. This highlighted the sturdy buying energy ready for market circumstances to recuperate.

Stablecoins on exchanges at all-time excessive!! #crypto pic.twitter.com/ScoeubHKF8

— Altcoin Each day (@AltcoinDailyio) November 15, 2022

Bitcoin demand sees some restoration

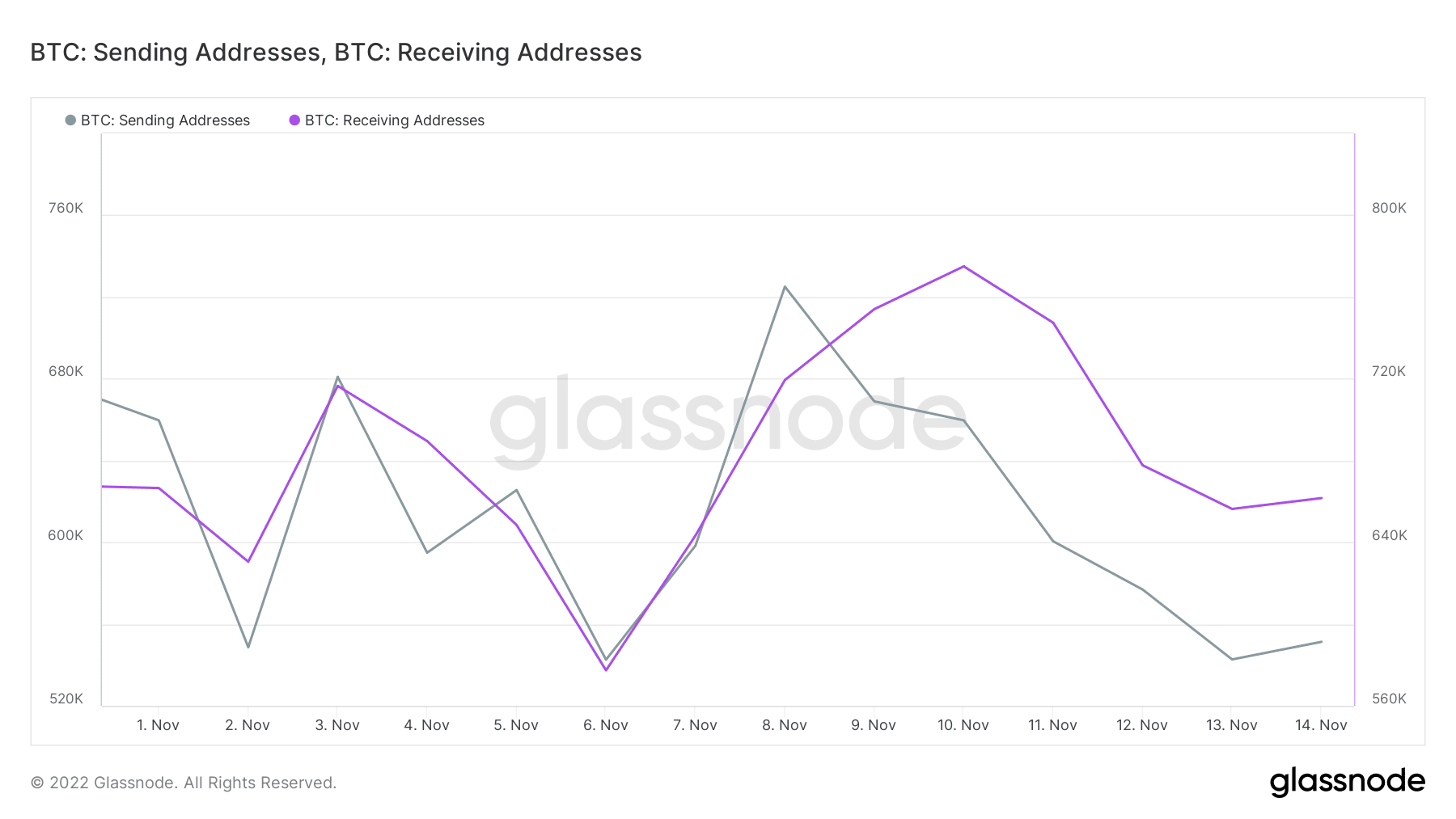

Bitcoin transactions have been sure to see a rise particularly contemplating buyers transferring their funds. This was noticed within the variety of lively addresses which registered a spike within the final two days.

Supply: Glassnode

However did this essentially mirror greater demand for BTC? A take a look at alternate flows could assist present a clearer image. Bitcoin alternate outflows, at press time, outweighed alternate outflows. This was affirmation. Nevertheless, it did point out that there was nonetheless a big quantity of alternate inflows that indicated incoming promote stress.

Supply: Glassnode

Bitcoin receiving addresses additionally outweighed the variety of sending addresses. This confirmed that demand witnessed a big improve particularly within the final two days and stood in favor of the bulls.

Supply: Glassnode

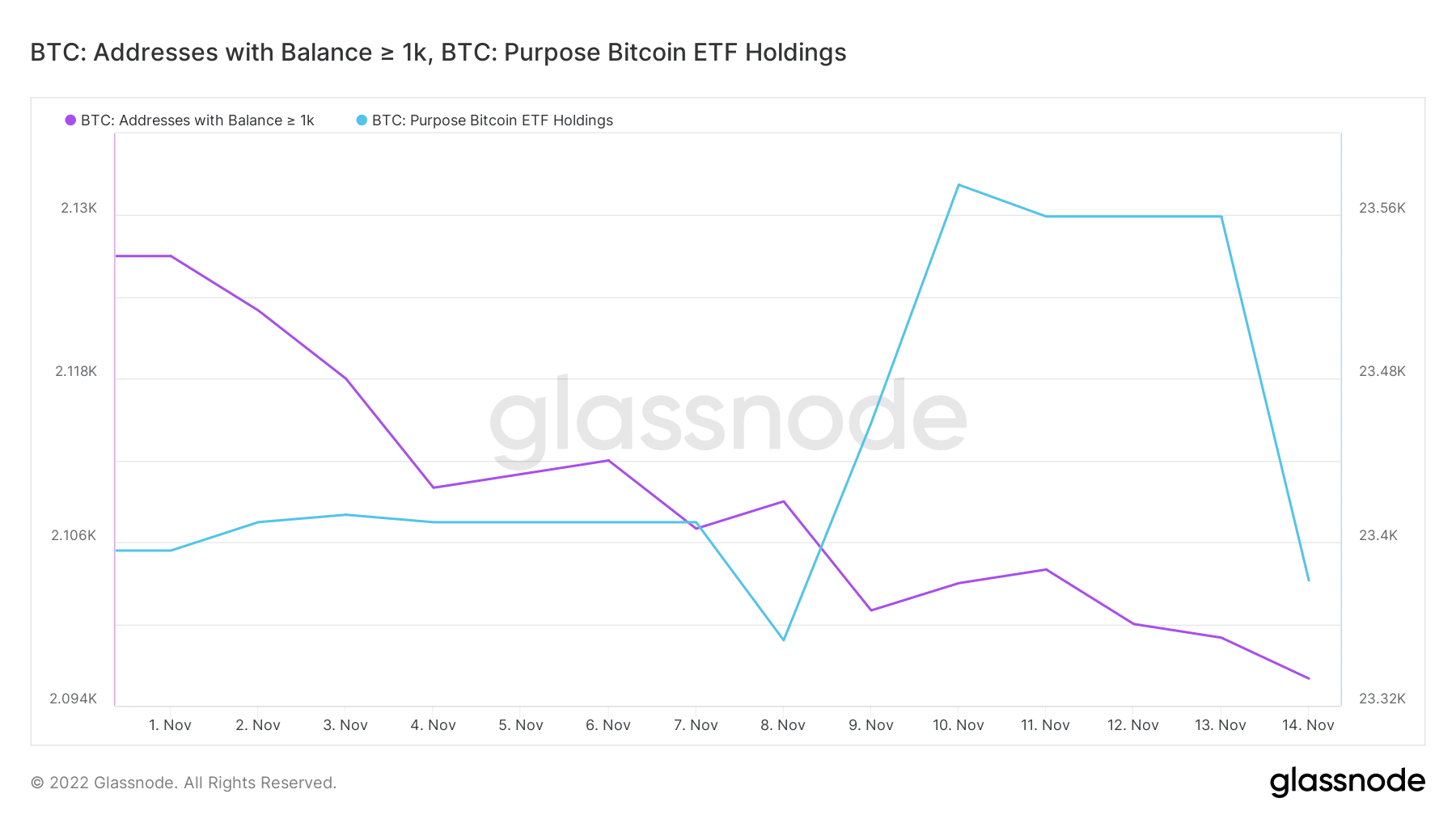

Whereas these observations could point out a requirement restoration, it was value noting that the demand was comparatively low. This was as a result of it was largely related to retail demand which frequently fails to have sufficient muscle to affect a considerable market transfer. It additionally prompt that whales have been comparatively absent. The addresses holding greater than 1,000 BTC confirmed this expectation.

Supply: Glassnode

Summing up the BTC state of affairs…

One would count on that whales and establishments could be shopping for particularly after the newest discounted costs. Nevertheless, the above chart revealed that the market-moving monetary muscle did not contribute to the present demand.

Thus, all in all a significant market transfer with out shopping for stress from Bitcoin whales and establishments couldn’t be anticipated. Nonetheless, the retail market was taking benefit of the present low cost to build up. Whales and establishments may do the identical when the FUD cools down.