Welcome to the new travel reality, one in which the idea of “making firm plans” seems laughably quaint. The focus these days is not so much on nailing down an itinerary, but building one that can be painlessly un-nailed when circumstances and rules change.

Americans are ready to travel. A 2021 poll from the Out of Home Advertising Association of America showed that 72% of respondents plan to travel in the first half of 2022, regardless of the state of the pandemic.

Yet all the good intentions in the world won’t matter if your flight is canceled, you get sick or your destination closes its borders to foreigners. So it’s not just about avoiding travel disruption in 2022 — it’s about avoiding the headaches that come with uncertainty.

1. Forget about basic economy

Basic economy fares have moved to even less flexibility. On most airlines, you can’t change them at all, and on some, you must pay a fee. This is in contrast to regular economy (or “main cabin”) fares, many of which now allow changes and cancellations with no fees at all.

To be clear, this change is not a temporary pandemic policy, but a permanent shift in how many airlines handle changes and cancellations. It means that, unless you’re equipped with a crystal ball to see into the future, you should forget about booking basic economy tickets altogether.

The flexibility of main cabin fares makes them more appealing in nearly every situation, regardless of the extra cost.

2. Do your research with travel insurance

In a 2022 survey conducted by insurance provider VisitorsCoverage, 64% of respondents say that getting a travel insurance policy that covers emergencies will make them more likely to travel.

But travel insurance isn’t as straightforward as it seems.

Will a policy cover changes to your trip if a country closes its borders? What about if you get sick with COVID-19 and are unable to travel?

The answer is a resounding “It depends.” Some travel insurance policies — such as “cancel for any reason” insurance — will cover these events, but will also cost much more. Most travel medical plans will cover hospital costs (that your health insurance might not) while abroad, but won’t cover cancellations or rebookings for the rest of the trip.

Basically, travel insurance is an umbrella term that can refer to a range of coverage options. Don’t assume the first policy you find will cover what you need. Do your research and get a plan that covers COVID-related disruptions, or make sure your travel plans are flexible enough to withstand them.

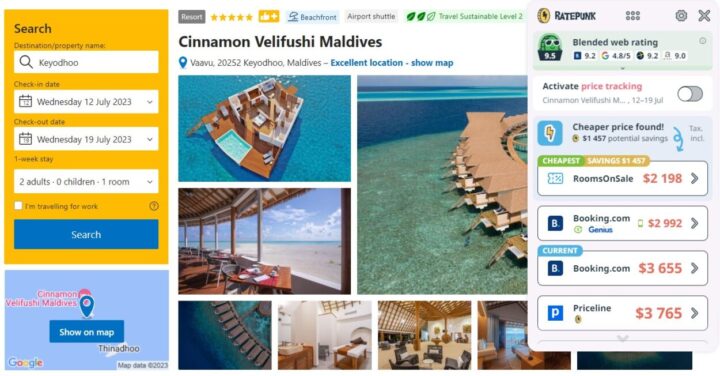

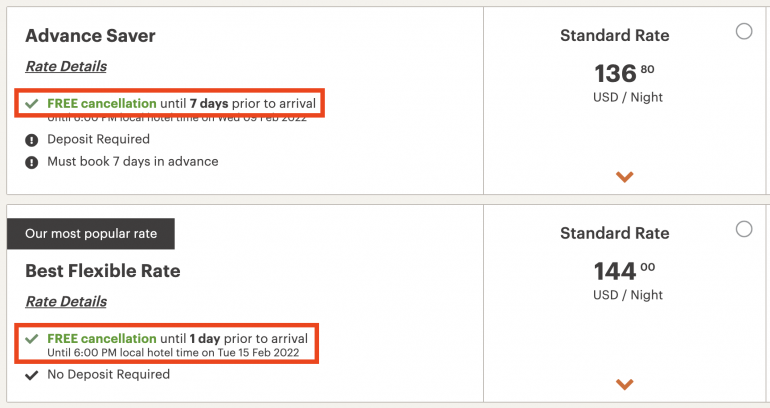

3. Never prepay for cars and hotels

You’ve found a hotel room and are ready to book it when you notice that it’s a “prepay” (or similar) rate. Under most circumstances, you might not care much. But in the new COVID reality, you should care a great deal.

Most hotels, most of the time, should offer a flexible rate that can be canceled 24 hours prior to check-in for no fee. This is what you want in our current reality, regardless of how confident you think you are in your plans.

Hotels are getting a little trickier at hiding these refundable rates, or making less flexible options the default during checkout. That’s because they want to lock you into paying now that so many travelers are canceling and rebooking at the last minute. The same applies to rental car companies, which have enjoyed greater leverage over customers due to an ongoing car shortage.

Don’t fall for it. Pay the few extra bucks to keep your itinerary flexible.

4. Make a backup plan

It’s a great idea to plan a family trip to Southeast Asia for the autumn. It’s also a great idea to pencil in a backup plan in case that falls through. “If we can’t go to Thailand, we’ll rebook for Hawaii instead.”

The reason for having a backup is less practical and more psychological. It’s disheartening to have plans fall through, especially this far into the pandemic. So it’s smart to build in a backup plan that you can switch to without losing your steam.

To be clear: You shouldn’t book any travel for your backup plan. Just have it ready to go if and when borders close or virus variants emerge.

5. Don’t overbook

With airline fares so much more flexible than they used to be, you might be tempted to book three or four trips and cancel whichever ones don’t work out. But watch out: “Free cancellations” doesn’t necessarily mean you’ll get your money back.

For example, the value of canceled main cabin fares on Delta Air Lines is returned as a credit that can be used for future flights. So if you cancel three $800 flights, you could end up with $2,400 in credits that can be used only on Delta. This outcome might seriously restrict your options when rebooking.

Take advantage of airlines’ cancellation policies to avoid getting stuck with a ticket you can’t use, but don’t abuse them or you might get saddled with an even bigger hassle.

The bottom line

It’s easy to get frustrated in the new travel reality. Understanding travel rules and restrictions can feel like a full-time job, never mind predicting what will happen next with the pandemic — or is it endemic?

To minimize these travel disruptions and headaches, keep it simple. Keep your bookings flexible by avoiding prepaid rates and basic economy fares. Make sure your travel insurance covers what you think it does. And have a backup plan ready when everything changes again.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2022, including those best for: