Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- APT toiled beneath a descending line.

- APT registered an OI (open curiosity)/worth divergence.

Aptos [APT] market construction declined additional and breached key assist. It’s value noting that APT posted a couple of 500% hike within the January rally, rising from $3.4 to $20.4.

However the prolonged correction after worth rejection at $20.4 has seen the token clear over 44% of the beneficial properties. APT traded at $11 on the time of writing, means beneath a key assist degree.

Is your portfolio inexperienced? Take a look at the APT Revenue Calculator

The bulls didn’t defend the $12 assist

Supply: APT/USDT on TradingView

APT has been struggling beneath descending line (white line), delaying any robust restoration that might flip the market right into a bullish construction.

Bitcoin’s [BTC] sharp drop on Thursday (2 March) noticed APT break beneath the 38.2% Fib assist degree ($12.1310). The assist degree prevented steep declines beforehand. However the bulls didn’t defend it on the time of writing, which might tip the dimensions in favor of bears.

Bears might sink APT to the 23.6% Fib degree ($10.1773), particularly if BTC retests or breaks beneath $21.60K. Lengthy-term bears might place cease losses above the 38.2% Fib degree ($12.1310) and goal the $10.1773 worth degree.

Alternatively, bulls might search entry into the market if APT closes above the 38.2% Fib degree ($12.1310). The fast goal can be the EMA ribbon degree of $12.6717 or the descending line.

An in depth above the descending line and 50% Fib degree would give bulls extra leverage to focus on the 78.6% Fib degree ($17.5372). The upswing could possibly be accelerated if BTC reclaims the $23K degree.

The RSI (Relative Energy Index) was within the decrease vary as OBV (On Steadiness Quantity) declined, exhibiting shopping for strain lowered considerably. Furthermore, the CMF (Chaikin Cash Stream) moved southwards beneath the zero mark, indicating bears’ leverage.

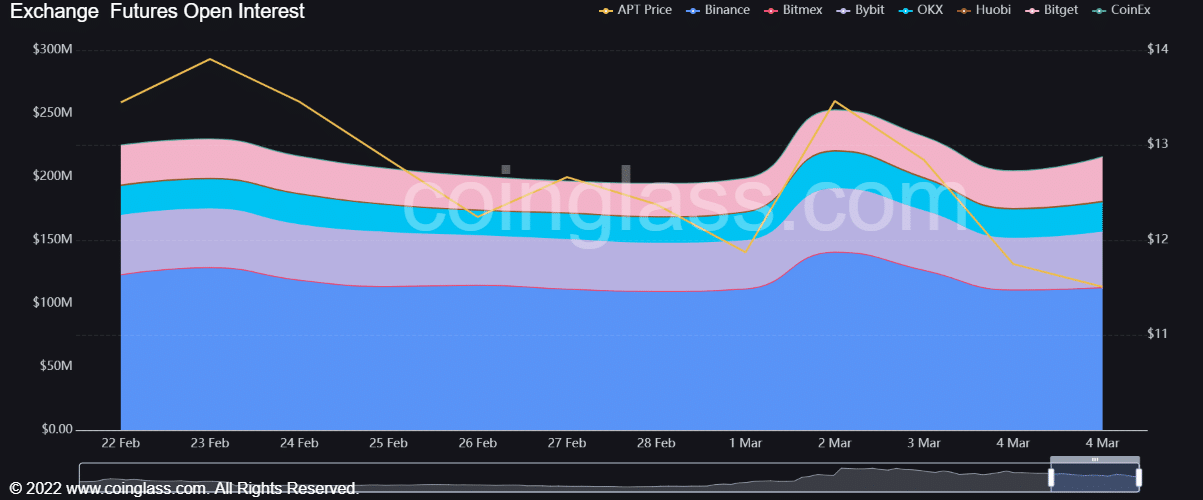

APT recorded an OI/worth divergence

Supply: Coinglass

As per Coinglass, APT’s open curiosity (OI) peaked on 2 March and declined afterward. Nonetheless, the OI elevated on the time of writing regardless of the value decline, forming a divergence. It suggests {that a} worth reversal could possibly be imminent if demand for APT will increase within the futures market.

Learn Aptos [APT] Value Prediction 2023-24

Nonetheless, extra lengthy positions have been liquidated up to now 24 hours than short-positons, as per Coinalyze. It exhibits lengthy positions have been paying quick positions, reiterating the bearish sentiment. Due to this fact, traders ought to train warning and take cues from BTC’s worth motion.

![Aptos [APT] market weakened further- Will bears enjoy more benefits?](https://nourishmoney.com/wp-content/uploads/2023/03/kamil-pietrzak-G0FsO2Ca8nQ-unsplash-1000x600-750x375.jpg)