EOG Assets (NYSE: EOG) is a Houston-based oil and gasoline producer with a fortunate previous.

The corporate had lucky timing, because it was spun out of the notoriously fraudulent Enron in 1999, which imploded simply two years later.

Buyers additionally had good timing, as they noticed the share worth greater than triple previously three years. In that point, the corporate began paying particular dividends that provided shareholders huge payouts.

Let’s take a look at how secure the dividend is.

In 2021, EOG Assets paid two particular dividends – of $1.00 per share and $2.00 per share. Final yr, it paid 4 particular dividends of $1.00, $1.80, $1.50 and $1.50 per share. To date in 2023, there was one particular dividend of $1.00 per share, paid in March.

Particular dividends ought to by no means be counted on. They’re irregular dividends that an organization pays when it has extra money or money circulate. It’s like when your partner will get you that basically good bottle of whiskey in your birthday that you’d by no means purchase for your self. It’s good to obtain, however you don’t count on it yearly.

As a substitute, we’ll check out the common dividend as a result of that has been extra constant and is what traders have come to count on.

EOG Assets at present pays a $0.825 per share quarterly dividend, or $3.30 yearly, which comes out to a 2.5% yield.

The dividend has been raised yearly since 2018 at a robust clip. Over the previous six years, the common dividend has grown at an astounding 30% compound annual development charge, together with a ten% enhance this yr.

Final yr, the corporate paid $5.2 billion in dividends. However while you think about solely the common dividends, it comes out to about $1.8 billion. Free money circulate totaled $6.1 billion, so the payout ratio is simply 30% of free money circulate.

This yr, the corporate is forecast to pay out $2.9 billion in dividends, however once more, if we glance solely on the common dividend and don’t embrace particular dividends, the overall quantity must be round $1.9 billion.

Free money circulate is projected to say no to $4.5 billion this yr, which nonetheless simply covers the dividend (although it will not have coated all of the particular dividends final yr, which is why administration has possible pumped the brakes on them).

Falling free money circulate isn’t nice, however it’s nonetheless nicely above the common dividend. So except free money circulate continues to drop, the common dividend is pretty secure.

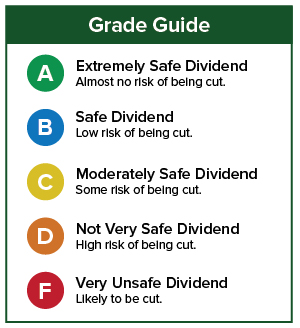

Dividend Security Ranking: B

When you’ve got a inventory whose dividend security you’d like me to investigate, go away the ticker within the feedback part.

And make sure to examine to see if I’ve written about your favourite inventory just lately. Simply click on on the phrase “Search” on the higher proper a part of the Rich Retirement homepage, kind within the title of the corporate and hit “Enter.”