- LINK’s worth elevated by 2% within the final 24 hours

- Alternate reserve and MVRV Ratio stood in an optimistic place

Chainlink’s [LINK] Twitter account just lately posted just a few optimistic updates relating to its ecosystem, predicting that it had the potential to gasoline a worth pump within the days to come back.

To emphasise its level, the tweet talked about that the blockchain powered over 1,000 Chainlink decentralized oracle networks to energy Web3. Thus, growing the transaction quantity to over 6 trillion. Furthermore, it was additionally revealed that Chainlink has been delivering greater than 5 billion information factors on-chain.

1/ Over 1,000 #Chainlink decentralized oracle networks have launched to energy #Web3.

Enabling 6T+ in transaction quantity.

Delivering 5B+ information factors on-chain.

Supporting 14+ blockchains and L2s. pic.twitter.com/vISZPPiJm7

— Chainlink (@chainlink) November 19, 2022

Learn Chainlink’s [LINK] Worth Prediction 2023-2024

Curiously, a latest testing by RoboVault revealed that Chainlink Automation was considerably extra dependable than its options.

Latest testing by @robo_vault revealed #Chainlink Automation to be considerably extra dependable than options.

That is certainly one of many causes Chainlink Automation has turn out to be the business customary for builders constructing superior #DeFi protocols. https://t.co/fLuFP2t0sl pic.twitter.com/W0l1bIICD4

— Chainlink (@chainlink) November 19, 2022

All these developments seemed fairly constructive for the blockchain. These developments additionally mirrored on LINK’s chart, because it registered over 2% each day features. On the time of writing, LINK was trading at $6.21, with a market capitalization of over $3 billion.

The 12 months to finish properly for LINK?

LINK painted a bullish image for the token, as most metrics had been in favor of a continued worth hike over the times to come back. As an example, LINK’s Market Worth to Realized Worth (MVRV) Ratio registered an uptick. This was a sign that aligned with traders’ curiosity.

LINK additionally remained widespread within the crypto business, as its social quantity spiked within the final week. Not solely that, however LINK was additionally on the record of cryptoscurrencies that had been trending on CoinGecko on 19 November.

Supply: Santiment

Moreover, as per information from CryptoQuant, LINK’s trade reserve was declining. This might be taken as a constructive sign because it indicated a decrease promoting stress. LINK’s stochastic was additionally in an oversold place, additional growing the possibilities of a northward worth motion.

LINK is having its means…

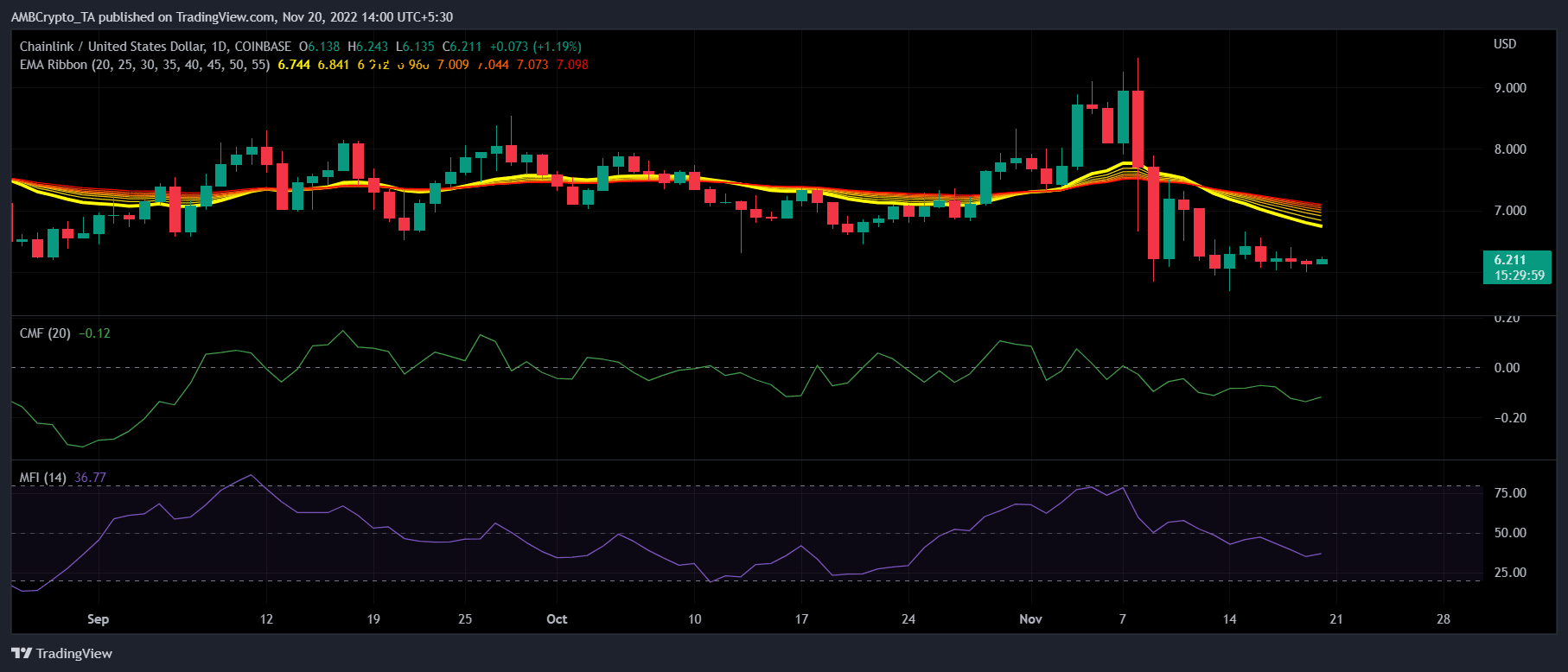

Contemplating LINK’s worth chart given under, Chainlink’s Cash Move Index (MFI) registered a slight uptick, regardless that it was resting under the impartial mark. The Chaikin Cash Move (CMF) additionally adopted an identical sample and displayed an upward motion.

Nevertheless, nothing may be mentioned with utmost certainty because the Exponential Transferring Common (EMA) Ribbon revealed that the bear nonetheless had a bonus because the 20-day MA was means under the 55-day EMA.

Supply: TradingView