- CHZ took on losses regardless of Chiliz not being immediately uncovered to occasions that triggered losses.

- CHZ bulls wish to take over however the coast is probably not clear but.

Chiliz not too long ago joined the listing of crypto initiatives which have launched statements relating to the state of publicity to latest market woes. An try at boosting investor confidence in a month that has up to now seen an inflow of FUD.

Reasonable or not, right here’s Chiliz market cap in BTC’s phrases

Chiliz CEO Alexander Dreyfus not too long ago famous that the community was not uncovered to Silvergate, FTX, Celsius, SBV, or Signature.

His assertion is on account of elevated investor issues relating to the state of most networks. A situation that has led to liquidity outflows no less than till issues settle down. Dreyfus additionally added that Chiliz has as an alternative targeted on improvement.

For what it is value, @socios did not have any publicity on FTX, Celsius, 3AC, Silvergate, Signature, SVB, or any of the dramas of the final 12 months. We’re a really conservative group of individuals, specializing in constructing @chiliz as an ecosystem. We’re spectators of this clean-up.

— Alexandre Dreyfus 🇹🇷 (@alex_dreyfus) March 10, 2023

Sadly, Chiliz’s native crypto CHZ nonetheless skilled the impression of the market turmoil attributable to these black swan occasions within the final 12 months. Because of this, CHZ was unable to carry on to its January beneficial properties. As a substitute, it pulled again within the final three weeks, wiping out earlier beneficial properties.

CHZ worth recap

CHZ exchanged palms at $0.106 at press time after a 40% dip from its February highs. It additionally fell virtually to its January low, adopted by a slight bounce again simply earlier than it dipped into the RSI’s oversold zone.

Supply: TradingView

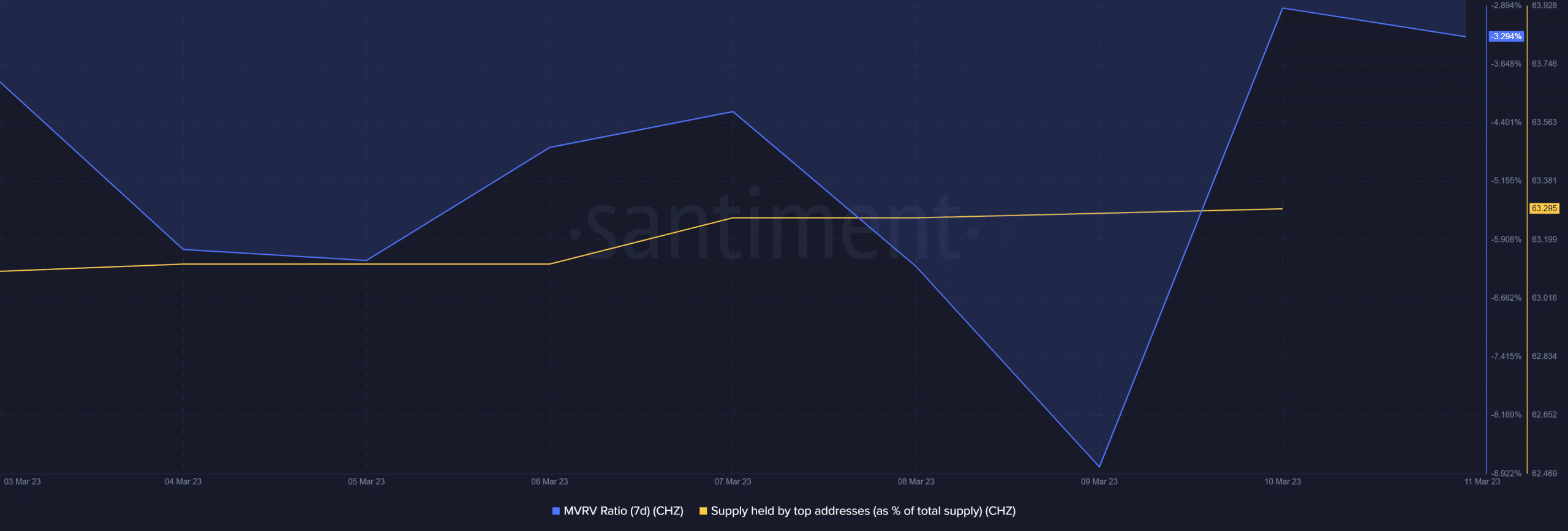

Can CHZ bounce again sturdy? Nicely, the MFI signifies that noteworthy accumulation has been going down. One key indicator that helps that is the 7-day MVRV which bounced again on 9 March after falling to a weekly low.

Supply: Santiment

The bounce again confirms a surge in CHZ accumulation within the final two days. It thus signifies that those that purchased close to the latest lows are actually in revenue after the slight worth uptick that occurred on Friday.

Extra importantly, whales have been accumulating. The provision held by high addresses metric registered a marginal upside inside the final seven days.

Is your portfolio inexperienced? Try the Chiliz Revenue Calculator

Whale accumulation is a crucial half due to the impression they’ve on worth actions.

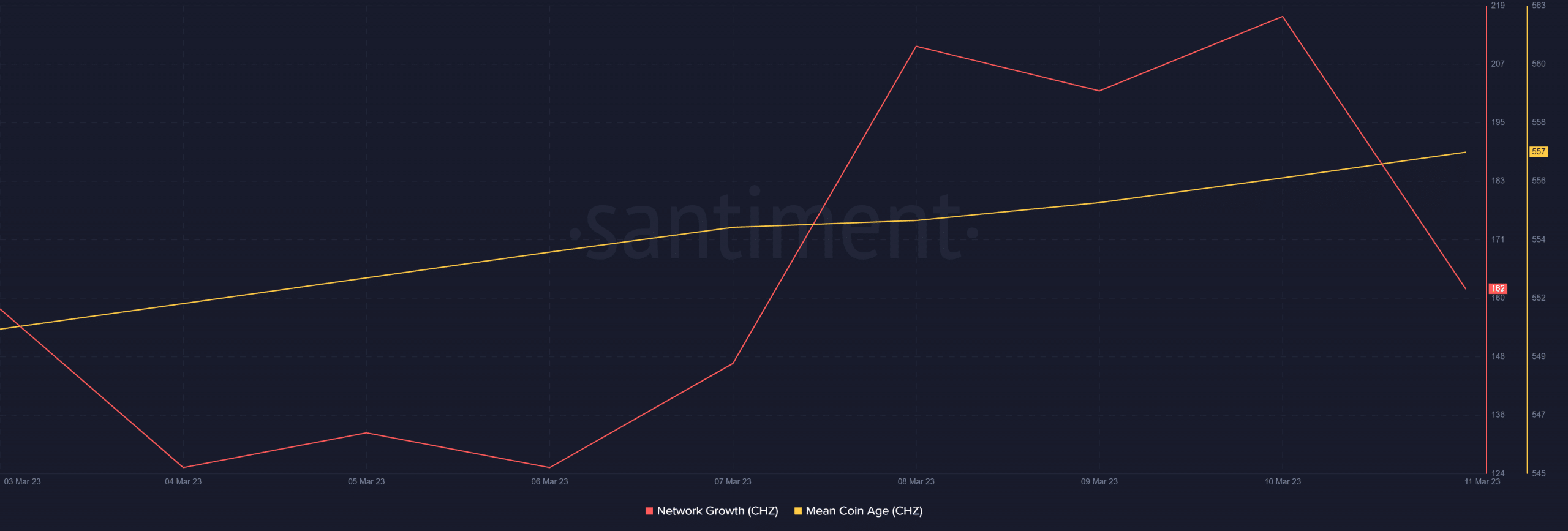

In the meantime, the imply coin age achieved a gentle incline within the final 7 days regardless of the worth crash. A mirrored image of the aforementioned whale accumulation.

Supply: Santiment

Community development additionally improved throughout the identical weekly interval. Nonetheless, it pivoted on Friday, however this pivot may simply be an indicator that the promoting stress was dying down.

The noticed whale accumulation could supply some reduction in opposition to the draw back. However, it doesn’t act as affirmation that costs won’t proceed falling.