- DAI’s provide has fallen by 50% from the 2022 peak.

- MKR suffers elevated distribution inflicting its worth to plummet.

Because of the decline within the costs of its underlying belongings, the full provide of DAI, MakerDAO’s decentralized stablecoin, has since dropped by 50% from its early 2022 peak, knowledge from Delphi Digital revealed.

The full $DAI provide has dropped 50% from it is peak in early 2022. pic.twitter.com/4qTaPDvCeN

— Delphi Digital (@Delphi_Digital) March 10, 2023

This contraction in DAI provide is as a result of DeFi protocol’s Collateralized Debt Place (CDP) mannequin. MakerDAO CDP permits customers to generate the DAI stablecoin by collateralizing different cryptocurrencies, corresponding to Ethereum.

Customers deposit their crypto belongings as collateral in a sensible contract. In return, they obtain DAI, which can be utilized for transactions or saved as a hedge towards market volatility.

Learn Maker [MKR] Value Prediction 2023-24

The MakerDAO CDP mannequin maintains DAI stablecoin’s worth at $1 via rate of interest incentives. The automated system will increase or decreases rates of interest to encourage the creation or burning of DAI.

This mechanism successfully manages the lower in DAI provide because of crypto worth drops, holding it near its goal worth.

Along with a contraction within the provide of DAI, MakerDAO’s income from transaction charges has returned to its Might 2022 ranges. In accordance with knowledge from Maker Burn, the protocol’s payment earnings (annualized) stood at 47.39 million DAI at press time.

Supply: Maker Burn

Lido stays an impediment

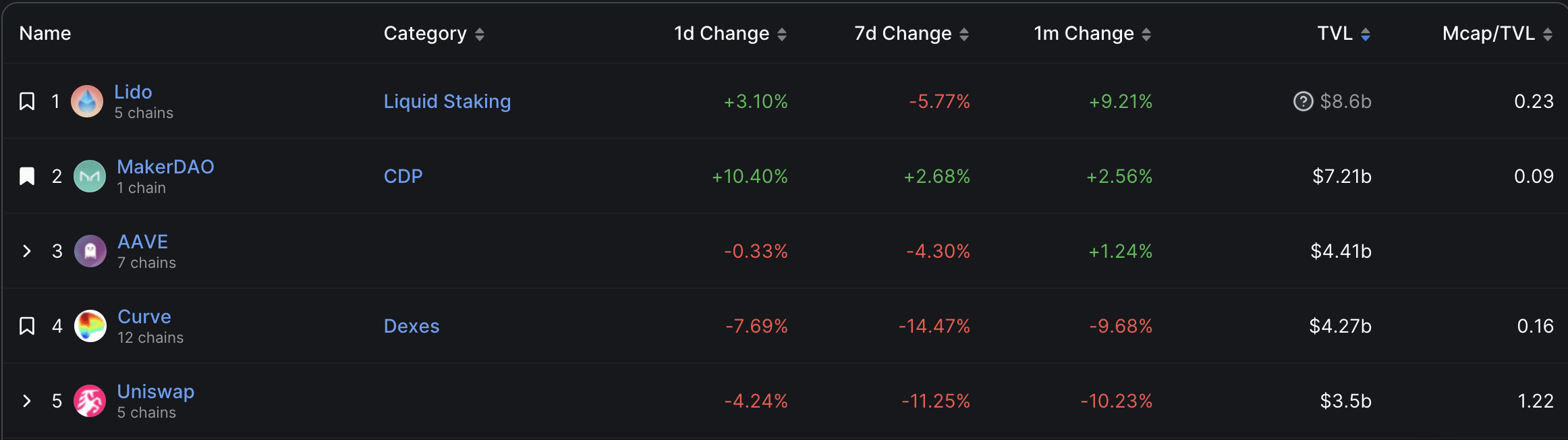

On 2 January, the full worth of belongings locked (TVL) on the main liquid ETH staking platform Lido Finance [LDO] exceeded that of MakerDAO to displace it because the DeFi protocol with probably the most TVL.

Lido’s dominance within the DeFi realm of the crypto ecosystem has grown to 19.65%, in line with knowledge from DefiLlama.

This marks a big enhance in management for the protocol over the previous three months, signaling its continued ascent on the planet of decentralized finance regardless of a constant drop within the annual share fee (APR) supplied.

Because the Shanghai Improve approaches, there was a surge in Ether (ETH) staking on Lido, leading to a rally of its TVL and additional widening the hole between Lido and MakerDAO.

As of this writing, MakerDAO’s TVL was noticed at $7.21 billion, in second place behind Lido’s $8.6 billion.

Supply: DefiLlama

Is your portfolio inexperienced? Verify the MKR Revenue Calculator

MKR within the final week

Exchanging palms at $641.47 at press time, MKR’s worth declined by virtually 30% within the final 30 days, knowledge from CoinMarketCap revealed.

On a each day chart, there was a extreme decline in token accumulation since 7 March.

This has pushed MKR’s Relative Power Index (RSI) and Cash Circulate Index (MFI) towards the oversold area. At press time, these indicators have been each noticed at 36, signaling a wane in shopping for stress and elevated token sell-offs.

Lastly, the alt’s On-balance quantity was in a downtrend at 105.275k and has fallen by 44% since 7 March.

When an asset’s OBV declines, the quantity of buying and selling exercise for that cryptocurrency decreases over time, typically precipitating a worth drawdown.

Supply: MKR/USDT on TradingView