Small companies with a fleet of autos can profit from the financial savings and expense administration instruments constructed into fleet gasoline playing cards. You possibly can earn a base fee of anyplace from 2 to eight cents again on each gallon of gasoline, relying on the cardboard, with the potential for bigger rebates by means of companion networks.

In contrast to different enterprise bank cards that earn rewards on all of your spending, most fleet playing cards solely earn rebates on gasoline. And a few solely provide reductions at particular fuel stations. However that’s typically the draw for enterprise homeowners: You possibly can limit these playing cards to fuel-only purchases, monitor spending in actual time and set limits on particular person playing cards to finest handle your fleet.

Finest fleet gasoline playing cards

One of the best fleet gasoline playing cards mix flexibility, management and financial savings. These playing cards aren’t restricted to a particular model so that you get gasoline rebates at virtually any fuel station — and you may faucet into further financial savings on fuel and different purchases by means of their massive companion networks. Plus, you may monitor spending, handle receipts and management purchases right down to when, the place and on what for every particular person card.

AtoB

AtoB is a know-how firm that mixes gasoline playing cards with an expense administration platform and a devoted cell app to assist handle your fleet and discover financial savings on the go.

You possibly can choose from two gasoline playing cards — AtoB Limitless and AtoB Flex — which earn a rebate of two to three cents per gallon in your first three months. After that, you’ll must depend on AtoB’s app to search out reductions at taking part stations in its companion community.

These playing cards can be utilized anyplace Visa is accepted so that you’re not locked into a particular model.

-

Gas rebate: 2 to three cents per gallon for first three months; then as much as 12 cents per gallon at taking part fuel stations utilizing the AtoB app.

-

Different rewards: Money again on choose providers once you use the AtoB app.

-

Month-to-month charge: $3 per thirty days, per lively card.

-

Different charges: $25 setup charge for AtoB Limitless.

Coast

Coast gasoline and fleet playing cards earn 2 cents off on fuel and 1% again on nonfuel purchases, like on upkeep and tools or at eating places and lodges. Coast playing cards can be utilized anyplace Visa is accepted (at fuel stations, they will solely be used to buy gasoline).

Enterprise homeowners and fleet managers can use Coast’s expense administration platform to trace spending on all lively playing cards and set parameters on every particular person gasoline card, together with proscribing sure buy classes.

-

Gas rebate: 2 cents per gallon.

-

Different rewards: 1% again on nonfuel purchases. Further reductions by means of Coast companions.

-

Month-to-month charge: $2 per lively card, per thirty days.

-

Different charges: $35 for returned or late funds.

WEX

WEX affords dozens of fleet playing cards, together with branded playing cards from a number of the largest gasoline chains on the planet. However the WEX Fleet FlexCard is our favourite for small companies.

This card has no setup price or month-to-month per-card charges. Plus, you may carry a steadiness (curiosity expenses apply), an possibility not out there with Coast and AtoB. You may get a promotional rebate of three cents per gallon for the primary 180 days.

In contrast to Coast and AtoB, the WEX FlexCard can solely be used at fuel stations within the WEX community. However that community encompasses greater than 45,000 fuel stations, together with BP, Exxon and Shell, in addition to smaller chains like Casey’s, Pilot, Flying J and Wawa. And WEX gasoline playing cards include the spend administration instruments you’d count on from a fleet card.

-

Gas rebate: 3 cents per gallon for the primary 180 days.

-

Different charges: $50 returned fee charge; $75 or 6.99% of the account steadiness, whichever is larger, for late funds.

Different gasoline playing cards to contemplate

Fuelman affords a spread of fleet playing cards, together with choices for diesel-only, and it has a community of greater than 50,000 stations.

If you happen to’re in search of the largest low cost attainable, the Fuelman Combined Fleet card bests most different gasoline playing cards with a base rebate of 8 cents per gallon for the primary yr. However that comes with a number of tradeoffs. This card has a month-to-month charge of $25 to $99, relying in your plan, and a $3 charge anytime you gasoline up at a station outdoors of the discounted community. Companies is also topic to a 30 cent per gallon charge in the event that they miss a fee or their enterprise credit score rating falls under a sure threshold.

Most massive gasoline suppliers additionally provide fleet playing cards, together with BP, Exxon, Shell and Conoco. These fleet gasoline playing cards are sometimes closed-loop playing cards, that means they will solely be used for gasoline purchases with that particular model. A branded card is usually a nice possibility in case your fleet runs predictable routes and you may guarantee entry to eligible stations.

What are fleet playing cards?

Fleet playing cards, also known as gasoline playing cards, are an alternative choice to enterprise fuel bank cards for firms with a number of enterprise autos. These playing cards provide rebates on gasoline and strong expense administration platforms that help you simply monitor and handle spending throughout all lively playing cards.

Most fleet playing cards are enterprise cost playing cards, so you have to pay your steadiness in full every month. There are a handful of gasoline playing cards that allow you to carry a steadiness; the tradeoff is often a decrease gasoline rebate. And many don’t require a private assure, to allow them to be simpler to get than a standard enterprise bank card since there isn’t a private credit score examine.

How do fleet playing cards work?

Fleet playing cards provide per-gallon rebates on gasoline purchases — a base fee of anyplace from 2 to eight cents per gallon, relying on the cardboard — and so they can sometimes solely be used at fuel stations.

How your fleet card works will depend upon its issuer and companion community.

Branded gasoline playing cards: These gasoline playing cards have above-average rebates. For instance, Shell and Exxon provide as much as 6 cents per gallon — however solely at that model’s fuel stations. Plus, your precise rebate relies on how a lot gasoline you buy; you sometimes must hit 10,000 gallons per thirty days to internet the total rebate. Many of the main branded gasoline playing cards are issued by WEX Financial institution, and whereas some are accepted throughout the bigger WEX community, rebates stay tied to a particular chain.

WEX and Fuelman fleet playing cards: These fleet playing cards negotiate discounted pricing with fuel stations, then they go that financial savings onto cardholders by means of rebates. WEX and Fuelman have massive networks — 45,000 and 50,000 stations, respectively — however their playing cards are hardly ever accepted outdoors of fuel stations and maintenance-specific retailers, like tire outlets. These playing cards could provide a set rebate of anyplace from 3 cents to eight cents per gallon for the primary yr. After that, rebates are primarily based on month-to-month gasoline purchases.

Fleet playing cards that run on a significant bank card issuers community: These playing cards can be utilized anyplace their companion community is accepted. Coast and AtoB run on Visa’s community, as an example. You earn a base rebate of two to three cents per gallon, relying on the cardboard, with the potential to earn bigger rebates by means of companion networks. This could require some maneuvering, although, as you have to monitor down affords by means of the cardboard’s app or on-line platform.

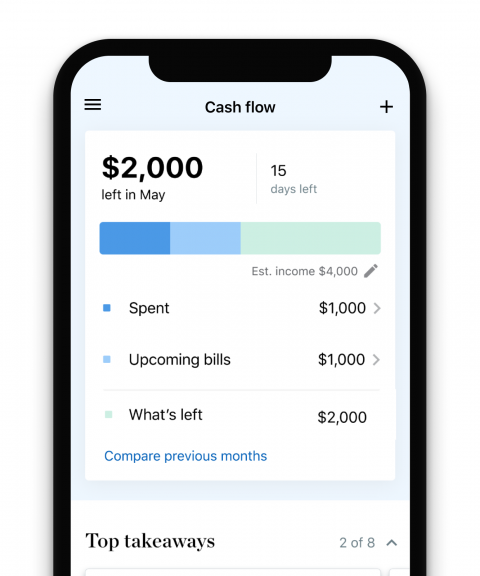

Fleet expense administration instruments

Fleet playing cards sometimes additionally provide strong expense monitoring and administration that permits enterprise homeowners and fleet managers to see real-time spending, set limits by particular person card and generate accounting and expense studies. Some fleet gasoline playing cards additionally provide telemetrics instruments that allow you to see the situation, and even the gasoline degree, of every car in your fleet in actual time.

Fleet gasoline playing cards: advantages and downsides

The principle draw of gasoline playing cards is the management over spending — particularly for enterprise homeowners with massive fleets. You may get fuel financial savings with a cash-back enterprise card, typically exceeding what is obtainable by fleet playing cards. However conventional enterprise playing cards hardly ever present the extent of monitoring and controls supplied by gasoline playing cards.

Different advantages and downsides to contemplate embrace:

Advantages

-

Expense monitoring and administration instruments.

-

Simply situation, deactivate or reassign worker playing cards.

-

Many can be found with no private assure or credit score examine.

Drawbacks

-

Reductions are sometimes restricted to sure chains and even sure states or areas.

-

Cost playing cards require fee in full every billing interval.

-

Purchases and reductions are sometimes restricted to gasoline purchases.

-

Typically will not be out there to sole proprietors or different unincorporated companies.

Gas card vs. enterprise fuel bank card

Gas playing cards are a fantastic possibility for enterprise homeowners managing a fleet of 5 or extra playing cards, particularly in case your precedence is managing bills fairly than getting the most important attainable financial savings.

Fleet playing cards are often cost playing cards, in order that they have to be paid in full month-to-month (or typically weekly), and plenty of fleet playing cards are solely out there to included companies. You might be able to apply with simply your employer identification quantity, and there’s typically no private assure.

Enterprise fuel bank cards can provide a better reward fee — as much as 3% again in your complete buy — however they lack the power to trace and management spending throughout a number of worker playing cards. They might place a spending cap on that rewards fee, too.

Most enterprise bank cards allow you to carry a steadiness from month to month (with curiosity) and can be found to sole proprietors and unincorporated companies — one thing that may’t be stated of most fleet playing cards. However they do require a private credit score examine and assure.

Does your enterprise want a fleet gasoline card?

If your enterprise operates 5 or extra autos: A fleet card is usually a useful gizmo to save cash and handle bills. Whereas branded gasoline playing cards boast a excessive per-gallon rebate, in addition they are inclined to produce other charges, restrictions or necessities. If you already know your spending gained’t be restricted to a single chain, an open-network card like Coast and AtoB can provide a fantastic steadiness of financial savings and adaptability.

If your enterprise operates only one or two autos: You might be able to internet bigger rewards from a enterprise fuel bank card. Our high picks provide as much as 3% again on fuel, plus as much as 5% again on different purchases. However even a common cash-back enterprise card like The American Specific Blue Enterprise Money™ Card, which earns 2% again on the primary $50,000 spent annually, would yield double the financial savings of many fleet playing cards. Phrases apply.