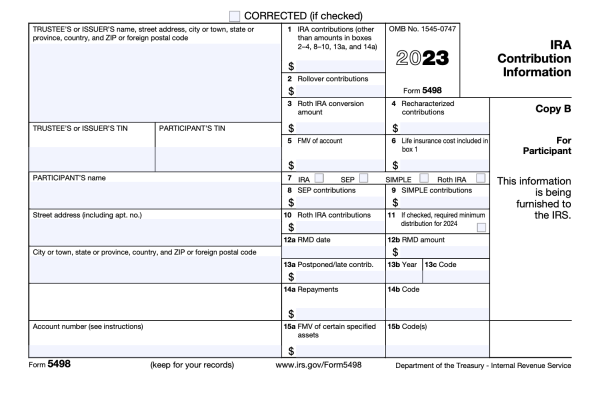

If you happen to contribute to an particular person retirement account (IRA), there’s a tax kind it is best to get accustomed to: Type 5498. In easy phrases, it’s a file of your IRA actions over the past yr. Type 5498 is usually issued to anybody who has contributed to an IRA, however you typically received’t should do something with this kind.

What’s Type 5498? What does it present?

You, as an IRA holder, usually are not required to file a Type 5498 to the IRS — your IRA custodian (e.g. Vanguard or Constancy) is, and also you merely obtain a replica on your personal information.

Monitor your funds

A FinanceGrabber account is the neatest approach to monitor your financial savings, bank cards, and investments collectively in a single place.

Who will get Type 5498, and when?

Anybody who owns an IRA ought to get a Type 5498 annually, for every IRA they personal.

IRA custodians are required to file Kinds 5498 for tax yr 2023 by Might 31, 2024, so it might arrive in your mailbox anytime between January and mid-June.

What do you do with Type 5498?

You don’t have to fill something out on a Type 5498, nor do you’ll want to ship it to the IRS — your IRA custodian has already performed that for you. Type 5498 is offered to you purely on a “on your info” foundation.

That mentioned, like all tax kind, it’s price conserving any Type 5498s you obtain in a protected place, for a number of causes:

-

It’s good to maintain tax varieties in case of an audit. Specifically, preserve a paper path for giant deductions like conventional IRA contributions. If, for no matter motive, the IRS questions conventional IRA contributions you deducted in years previous, Type 5498 can function third-party documentation of these contributions.

-

Type 5498 could also be useful for correctly reporting your IRA contributions in your Type 1040 (particular person earnings tax return). Conventional IRA contributions are an necessary deduction for a lot of taxpayers, and Type 5498 reveals you the quantity of conventional contributions that the IRS is anticipating you to report for a particular account and tax yr. Utilizing it might probably assist you keep away from errors when including up the full quantity of IRA contributions you may deduct.

-

Field 3 of Type 5498 can assist you keep on prime of tax legal responsibility from a Roth IRA conversion. If you happen to beforehand contributed cash to a conventional IRA, deducted these contributions, after which transformed that conventional IRA to a Roth IRA, you now owe taxes on that cash. The “Roth IRA Conversion Quantity” field of Type 5498 can assist you fill out Type 8606 (Nondeductible IRAs), which tells you ways a lot taxable earnings your Roth IRA conversion generated.