Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- MKR’s retracement is approaching a vital demand zone

- A retest of the demand zone may supply new shopping for alternatives

Maker [MKR], at press time, was one of many market’s largest weekly gainers, regardless of the general bearish sentiment within the crypto-market. The truth is, it recorded good points of 10% in comparison with Bitcoin’s [BTC] 4.6% depreciation over the past 7 days.

One of many important causes for the rally may very well be MKR’s aggressive charge discount and readjustment, each of which have been announced in the direction of the start of March.

Learn Maker [MKR] Value Prediction 2023-24

MKR sliding into the demand zone – Can bulls prevail?

Supply: MKR/USDT on TradingView

After an prolonged value consolidation within the $683 – $791 vary in February, MKR broke above it and inflicted over 20% good points in early March. Nevertheless, the $964-level has change into a key promote stress (provide zone), stopping additional northbound motion. Every value rejection on the provide zone has led to a retest of the demand zone.

If the development repeats itself, a retest of the demand zone may supply new shopping for alternatives within the subsequent few hours/days. Lengthy-term bulls may search entry and goal the promote stress degree of $964 – A possible 10% rally with a wonderful risk-to-reward ratio (4.3).

An in depth beneath $833 will invalidate the bullish thesis. Such a downswing may tip bears to hunt short-selling alternatives at $791 or the earlier parallel channel’s (orange) mid-level of $740.

The Relative Power Index (RSI) was beneath 50, which tip bears to sink MKR to the demand zone. Furthermore, the OBV (On Stability Quantity) registered a slight decline which may undermine robust shopping for stress within the quick time period and supply bears extra affect.

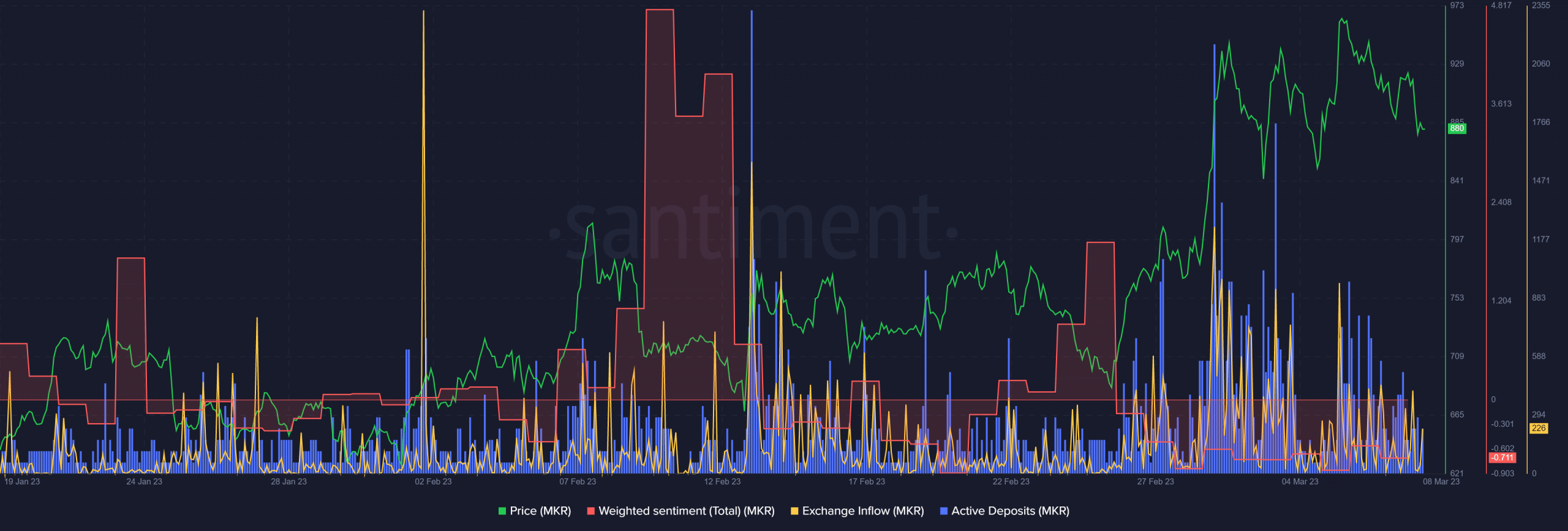

MKR recorded spikes in energetic deposits and trade inflows

Supply: Santiment

In accordance with Santiment, MKR recorded spikes in trade inflows – An indication that extra tokens have been moved into central exchanges for offloading. It revealed elevated short-term promote stress, which may pull MKR to the demand zone. Equally, the spike in energetic deposits additional strengthened the short-term promote stress MKR recorded on the time of writing.

Is your portfolio inexperienced? Verify the MKR Revenue Calculator

Furthermore, the detrimental weighted sentiment may play within the bears’ favor and push MKR to retest the demand zone ($833 – $860). Bulls may get new shopping for alternatives at discounted costs if the zone holds.

Nevertheless, bulls’ efforts may very well be undermined if BTC drops beneath $22K. Ergo, buyers ought to observe the king coin’s value motion on the charts.

![Maker [MKR] heading towards key demand zone – Is a reversal likely?](https://nourishmoney.com/wp-content/uploads/2023/03/david-barajas-q_klhRcIdbY-unsplash-1000x600-750x375.jpg)