This text/publish comprises references to services or products from a number of of our advertisers or companions. We could obtain compensation while you click on on hyperlinks to these services or products

In relation to passive investing, common choices embrace utilizing a robo-advisor or simply investing in varied ETFs and index funds.

These are tried-and-true methods to construct wealth. However they’re additionally lacking out on a method among the largest hedge funds and rich traders use to guard their portfolios: hedging.

However with Q.ai, a brand new AI-powered investing app from Forbes, on a regular basis traders can make investments equally to hedge funds beginning with simply $100. And there is a variety of portfolios to select from, so you are not caught with only a handful of funds.

Our Q.ai evaluate is masking how this new app works, the professionals and cons, and what dangers you need to take into account earlier than investing.

Options – 9

Fee & Charges – 10

Ease-Of-Use – 6

Historic Efficiency – 4

Buyer Service – 4

Portfolio Selection – 8

6.5

Whole

Q.ai is an AI-powered investing app from Forbes that allows you to spend money on a variety of portfolios. Its distinctive promoting level is that many portfolios have a hedging function to supply draw back safety. And portfolios additionally spend money on a spread of belongings like shares, ETFs, commodities, and crypto.

Execs & Cons

professionals

- A low $100 funding requirement

- Q.ai is totally free

- Broad number of portfolios to select from

- Portfolio Safety makes use of hedging to assist shield your portfolio

- New clients get a $100 bonus

- Q.ai invests in a spread of belongings like ETFs, shares, crypto, and commodities

cons

- Since Q.ai is comparatively new, its observe report is kind of restricted

- Current app retailer opinions complain about gradual and non-responsive customer support

What Is Q.ai?

Q.ai is an AI-powered investing app that is additionally a Forbes firm. The app allows you to spend money on a spread of portfolios throughout varied sectors and themes. And, it makes use of AI-powered hedging for a lot of portfolios to supply draw back safety.

This hedging technique is probably the most distinctive promoting level for Q.ai. Traditionally, investing on this hedge-fund type has solely been attainable in the event you’re an accredited investor and really rich. However by way of its AI-powered portfolios, Q.ai is striving to deliver one of these investing to on a regular basis customers.

What Makes Q.ai Nice?

There are two important promoting factors for Q.ai: its use of hedging and the sheer variety of portfolios you may spend money on. Plus, there are just a few different nice-to-haves that make this new platform fairly thrilling.

Number of Funding Kits

Equally to robo-advisors that spend money on portfolios of inventory and bond-based ETFs, Q.ai invests in “Funding Kits” which might be typically made up of 5 to twenty securities. However the distinction is that Funding Kits can include shares, ETFs, commodities, and even crypto.

Moreover, Q.ai has 4 completely different collections to select from, with every assortment having a wide range of Funding Kits that match a sure theme:

- Basis: Consists of kits for rising tech, world traits, good beta, and a worth vault.

- Restricted Version: Consists of kits for infrastructure, inflation safety, Bitcoin’s breakout, the worldwide microchip scarcity, and different area of interest themes primarily based on present occasions.

- Specialty: Consists of kits for clear tech, responsible pleasures, treasured metals, and crypto.

- Group: Invests within the Forbes Equipment, which makes use of sentiment evaluation and knowledge from Forbes to spend money on U.S. shares, worldwide shares, and ETFs.

The Restricted Version and Specialty Kits are fairly distinctive versus robo-advisors or much more actively-managed rivals like Titan. And Q.ai does all of this off the again of its AI. Plus, the Forbes Equipment is totally distinctive to Q.ai, though time will inform how profitable this investing technique is within the long-run.

AI-Powered Hedging

One other distinctive promoting level of Q.ai is its Portfolio Safety function that gives draw back safety from the market by way of hedging. This is identical technique hedge funds use to assist shield their rich shoppers, therefore the identify.

Basically, Q.ai’s AI tries to anticipate market dangers like inflation, recessions, rate of interest modifications, oil costs, and normal volatility. If its AI predicts a change in a sure danger issue, it might hedge a part of your portfolio by changing some belongings to money. It additionally invests in conventional inflation hedges like commodities.

All Basis Kits have Portfolio Safety as an possibility, and you may allow it for no additional value. Nevertheless, this will cut back your total returns versus the market since hedging typically trades some returns for additional safety. But when the chance elements Q.ai predicts come up, you would be higher off with hedging than with out.

Once more, this can be a fairly distinctive promoting level for Q.ai since this can be a technique actively-managed hedge funds typically use, not computerized investing platforms.

AI & DIY-Portfolios

There are two methods you may make investments with Q.ai when you fund your account:

- DIY: This feature allows you to spend money on a wide range of Funding Kits of your selecting. Over time, Q.ai can change the holdings in every package relying on its algorithm, nevertheless it will not change your total package allocation percentages.

- AI-Powered: With the AI-portfolio, you aren’t getting to manually modify your package asset allocation. As an alternative, Q.ai rebalances your Portfolio Kits each week to assist cut back danger and search better efficiency.

Low Minimal Funding Requirement

There is a $100 funding requirement for Q.ai, which is in the identical ballpark as robo-advisors like Betterment or Wealthfront. Nevertheless, Funding Kits have various minimal funding necessities starting from simply $10 to $250 for a lot of the completely different choices.

Simply observe that there is a $1,000 minimal if you wish to use Q.ai’s AI-powered portfolio as an alternative of the DIY route.

$100 Signal-Up Bonus

On the time of writing, Q.ai is giving new clients a $100 bonus in the event that they open an account and make the minimal $100 deposit. That is an distinctive promotion since oftentimes, robo-advisor and inventory dealer promos require depositing 1000’s of {dollars} to earn comparable quantities.

Potential to Outperform the Market

Since Q.ai makes use of hedging and likewise invests in a variety of asset lessons, it has the potential to outperform the final market. That is very true if its hedging is profitable and markets take a critical downturn.

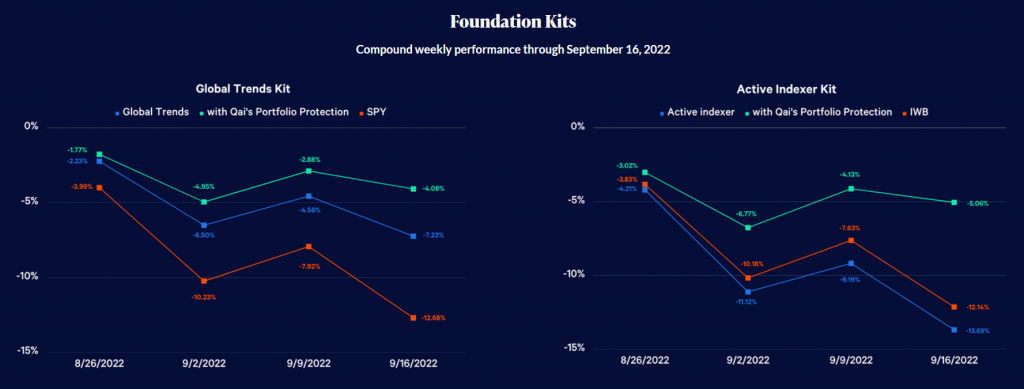

Take these two Portfolio Kits within the Foundations Kits assortment for example. As you may see, markets have been taking it on the chin on the time of writing, with each the SPY and IWB being down over 12%. Each Q.ai’s kits are down as effectively, however by considerably much less due to Portfolio Safety.

The truth is, the distinction is sort of 10% for each kits, and this can be a comparable story for a lot of funds in keeping with Q.ai’s historic efficiency knowledge.

Once more, time will inform if this development continues. However I am excited to see how these portfolios carry out when the market is trending upwards.

What Are Q.ai’s Drawbacks?

There’s a number of thrilling stuff occurring underneath the hood with Q.ai, particularly while you evaluate its hedging methods towards atypical robo-advisors. Nevertheless, there are some downsides traders ought to take into account earlier than opening an account.

Restricted Monitor Document

To its credit score, Q.ai may be very clear, itemizing its historic efficiency for every package on its web site. However year-to-date efficiency for 2022 is as a lot knowledge as we’ve got, and each package is down apart from treasured metals and the U.S. Outperformance Equipment. And a few kits, like crypto, are down over 60% on the time of writing.

This is not actually a good image since markets have been painful for many of 2022, and anybody who invested in Bitcoin or Ethereum this 12 months might be feeling the pinch. However it additionally means it is exhausting to guage if Q.ai is onto one thing or not.

Its hedging outcomes definitely appear promising because it’s no less than carried out less-poorly than the final market. However that is an early-stage funding, so proceed with warning.

Detrimental App Retailer Evaluations

The primary cause I would not personally make investments with Q.ai proper now could be due to the latest string of negative app store reviews. The app at present has a 3.8 star ranking with 127 scores in complete. However many customers complain a few clunky, complicated interface. And, even worse, some customers report poor customer support and ready for weeks to liquidate their accounts to get their a refund.

For instance, this is what one latest one star evaluate says:

“I requested for my account to be liquidated and the funds returned to my checking account 2 weeks in the past. Nothing has taken place. Wrote into customer support days in the past and haven’t acquired any response. There seems to be no telephone # to name to get assist. Trades proceed to happen with out my approval. Very involved with the shortage of motion, communication, and management on my half. Would strongly warn those that they could don’t have any management when depositing cash with this app.”

The app continues to be very new, so bumps alongside the best way are considerably anticipated. However having a number of opinions complaining about gradual liquidation or an absence of it altogether is regarding.

Lacking Some Belongings

On the time of writing, Q.ai does not spend money on most popular shares, mutual funds, or fixed-income investments like bonds. This would possibly not be a deal-breaker for everybody, nevertheless it’s price noting since many robo-advisors usually use bonds to generate extra dependable revenue.

Q.ai Historic Efficiency

As talked about, Q.ai shows all of its historical performance data on its web site, which I really like. All the knowledge is broken-down by particular person Portfolio Kits as effectively.

Just about each portfolio is down, starting from just a few factors to -20% or extra for a number of funds. General, Q.ai has been on the dropping aspect for just about each portfolio. However, as talked about, it is usually suffered lower than the S&P 500 or varied indexes that are additionally down.

I believe Portfolio Safety is extremely promising, and the info helps this because it significantly lowered the losses for the Portfolio Kits seen beneath.

Nevertheless, I believe it is too early to inform how Q.ai may carry out, so traders ought to maintain this in thoughts.

How A lot Does Q.ai Price?

In keeping with its web site, Q.ai does not cost any buying and selling or account administration charges. This implies it is utterly free to make use of at the moment.

In keeping with its website, the app will probably value $10 per 30 days in some unspecified time in the future when the limited-time free interval ends. It’d add additional perks as effectively, like choices buying and selling methods, for an additional charge as effectively.

For now, Q.ai is cheaper than many robo-advisors since you may’t beat free. But when and when it modifications to $10 per 30 days, you’d have to speculate $48,000 for the $120 annual charge to equal 0.25% in annual administration charges, which is what main robo-advisors cost. However paying barely extra in charges on a small portfolio might be price it for hedging.

Is Q.ai Secure?

Whenever you make investments with Q.ai, your account is held at Apex Clearing, which is a SEC-registered broker-dealer that additionally offers SIPC and FDIC insurance coverage in your securities and money.

This makes Q.ai secure to spend money on from an insurance coverage perspective. Nevertheless, efficiency is not assured, and previous efficiency is not an indicator of future efficiency both.

Its web site additionally says you may request a withdrawal of any quantity at any time, though latest opinions have complained this is not true.

Finest Alternate options

The primary promoting level of Q.ai proper now could be that it isn’t your on a regular basis robo-advisor. In actuality, it is an AI-powered funding platform that is a center floor between utilizing a robo-advisor and investing by way of a hedge fund.

Nevertheless, as a comparatively new platform, some traders won’t really feel comfy funding an account but. And there are different Q.ai options you need to use to nonetheless make investments on autopilot:

Robo-advisors like Betterment and Wealthfront are the principle gamers within the trade, and each spend money on portfolios of inventory and bond-based ETFs. You pay 0.25% in annual administration charges with each robos, and total, they’re extra conservative than Q.ai, which incorporates extra asset lessons and area of interest portfolios.

M1 is extra of a hybrid between a robo-advisor and an internet dealer. It additionally has a “hedge fund followers” pie, which is what it calls portfolios, you may spend money on for one thing a bit much like Q.ai. However the degree of hedging Q.ai affords with Portfolio Safety may be very distinctive for passively, AI-powered funds.

Backside Line

Personally, I believe it’s kind of too early to speculate by way of Q.ai. However I am not typically an early adopter of know-how; I like to attend for the mud to settle earlier than leaping in, particularly if it includes cash.

Should you’re like me, it is likely to be greatest to attend for Q.ai to collect extra historic efficiency knowledge. And as markets flip round, I am very eager to see how its Portfolio Kits evaluate versus the market.

Nevertheless, in the event you’re extra adventurous and need to attempt one thing very completely different from a standard robo-advisor, Q.ai might be for you. The low funding minimal and $100 bonus additionally sweeten the deal. Simply make sure you perceive the dangers, and know that latest opinions have been powerful on customer support and getting your cash out in the event you liquidate.