- Dogecoin whales have been concerned in about $3.5 million transactions regardless of the Elon Musk tradition change at his new firm

- The meme may must endure its keep on the bearish zone contemplating revelations per value motion

Since Elon Musk took over Twitter, the Dogecoin [DOGE] group has remained hopeful of extra substantial recognition. This similar acquisition was very important to the rally the meme loved within the first few days after Musk bought the social media platform.

Nevertheless, the celebration was to not final without end as DOGE slumped 8% within the final seven days. Moreover as of 19 November, CoinMarketCap confirmed that the cryptocurrency exchanged arms at $0.084.

Learn Dogecoin’s [DOGE] value prediction 2023-2024

Regardless of the decline, Dogecoin’s whales had not held again in performing transactions by way of the chain. On the time of writnig, Dogecoin Whale Alert reported that there had been giant transactions across the worth of $3.5 million between 18 and 19 November. Curiously, most of those transactions emerged from the coin’s high twenty wallets.

🐕🪙🐋🚨

5,000,000 $DOGE ($421,995 USD) was transferred from a #Top20 pockets to a #Top20 pockets.

Payment: 0.072 ($0.006 USD)

Tx: https://t.co/QoMtz1DCZJ#DogecoinWhaleAlert #WhaleAlert #Dogecoin #CryptoNews

— Ðogecoin Whale Alert (@DogeWhaleAlert) November 18, 2022

DOGE and the Musk bond

As well as, DOGE’s lack of ability to recuperate the Twitter purchase-week ranges is likely to be related with the current motion of Mr. Musk. Of late, the “Dogecoin promoter” had been concerned in public altercations with staff. Equally, he introduced again controversial figures to the social media platform. In flip, DOGE’s current efficiency won’t be shocking, contemplating the negativity surrounding him.

Following the bond between each events, DOGE appeared locked in a tussle for a bullish or bearish route. This place was revealed by the Directional Motion Index (DMI). In accordance with indications from the DMI, the shopping for energy (inexperienced) maintained a slight place over the bearish route chance (pink).

Nevertheless, the Common Directional Index (ADX), at 24.76, indicated that bullish energy wanted extra effort to neutralize the choice of DOGE selecting the bearish state.

Supply: TradingView

On high of that, the Transferring Common Convergence Divergence (MACD) appeared to have secured the bearish prospect. In evaluating the MACD, DOGE sellers (orange) managed the coin momentum. Whereas the patrons (blue) weren’t far off, the place indicated a bearish momentum. Therefore, it was nearly sure that Dogecoin would fail within the bid to revert to an uptick within the brief time period.

Right here’s the visuals on-chain

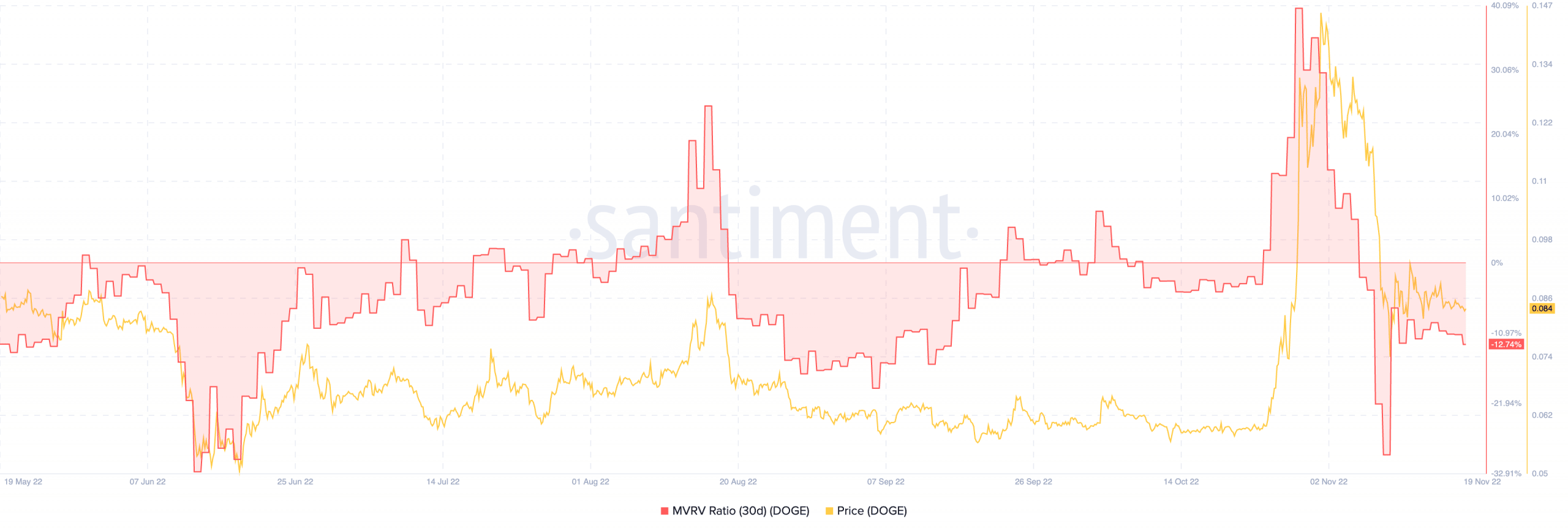

Per its thirty-day Market Worth to Realized Worth (MVRV) ratio, DOGE’s buyers felt the impact of the worth decline. In accordance with Santiment, the MVRV ratio, as of 19 November, was -12.74%.

Whereas this signaled a restoration from its state on 9 November, it didn’t appear sufficient to assist recoup income initially gained round 30 October. Subsequently, the MVRV ratio place implied that DOGE buyers had fallen to losses.

On the similar time, hitting important income for many who lately gathered the altcoin is likely to be difficult.

Supply: Santiment