Generally it is advisable park money in a checking account for a time period. Maybe you might be saving for a brand new automotive or to purchase a brand new home.

Or possibly you simply wish to retailer some money in your emergency fund so that you’re ready when the surprising occurs.

In case you’re nonetheless utilizing an enormous financial institution financial savings account, likelihood is you’re dropping out on the curiosity you could possibly be incomes with a higher-paying account. Some banks and credit score unions provide financial savings account charges that dwarf brick and mortar banks.

Beneath are one of the best high-yield financial savings accounts we’ve got discovered with the very best yield at among the high on-line banks.

Word: We have now ranked these accounts by yield however in some circumstances, we issue the month-to-month charge or minimums into the equation.

The High Excessive-Yield Financial savings Accounts

Select a high-yield financial savings account that matches together with your way of life and doesn’t depart cash on the desk.

1. Axos Financial institution

Present Yield: 0.61% annual proportion yield (APY)

What we like:

- Aggressive rate of interest

- Complete steadiness earns curiosity

- No month-to-month steadiness necessities

- Free ATM card upon request

Heads up:

- Minimal opening deposit of $250

- Financial savings tier above $25,000 earns decrease rate of interest

- Paper assertion charge: $5 per assertion

- Home wire switch charge: $35

Axos Bank affords a Excessive-Yield Financial savings Account that has no month-to-month service charges or ongoing minimal steadiness necessities.

Your first $25,000 on this high-yield financial savings account earns 0.61% annual proportion yield (APY). Any extra steadiness of as much as $100,000 earns as much as 0.25% APY.

You will have to make a minimal $250 opening deposit however don’t have to take care of a minimal account steadiness.

It’s potential to request a free debit card, however the financial institution affords a number of free checking accounts for limitless withdrawals.

For instance, the Rewards Checking account can earn as much as 1.25% APY and affords limitless home ATM charge reimbursements.

Learn our full Axos Financial institution Evaluate to resolve if this is likely one of the finest high-yield financial savings accounts for you.

2. CIBC Agility

Present Yield: 3.27% APY

What we like:

- Excessive APY

- $0 Month-to-month charges

- $0.01 minimal ongoing steadiness

Heads up:

- Minimal opening deposit of $1,000

- No ATM or ATM card availability

CIBC Bank has a powerful 3.27% APY on their high-yield financial savings accounts with no month-to-month charges. Nonetheless, you will have to make a minimal $1,000 preliminary deposit.

After opening your high-yield on-line financial savings account, the continued minimal steadiness requirement is $0.01.

There aren’t any account service charges.

Along with their high-yield financial savings account, additionally they have some nice account choices, together with a well being financial savings account.

3. Ally On-line Financial savings

Present Yield: 2.75% APY

What we like:

- $0 Month-to-month upkeep charge

- $0 Minimal deposit

- Free ATMs at Allpoint®, plus stand up to $10 reimbursements per assertion for non-Allpoint® ATMs

- Cell app and deposit

I’m keen on Ally Bank as a result of I’ve a web-based financial savings account with them. Their APY is a aggressive 2.75% APY in your complete steadiness with no month-to-month charges.

The financial institution has quite a bit to supply, together with:

- Save for numerous targets with “financial savings buckets”

- 24/7 customer support

- Consumer-friendly web site and cellular app

- A number of banking and investing choices

- No minimal steadiness

- No month-to-month service charges

Make deposits by way of digital switch, cellular examine deposit, direct deposit or mail.

You may also hyperlink as much as 20 exterior accounts to your high-yield financial savings account. This financial institution has the power to investigate your checking accounts to estimate the safe-to-save steadiness you can switch to Ally Financial institution.

Ally has strong buyer critiques and has many advantages, comparable to having the ability to join Alexa to your high-yield financial savings account so you’ll be able to simply ask what your steadiness is in your financial savings and different accounts.

4. Marcus by Goldman Sachs

Present Yield: 3.00%

What we like:

- 7-day per week customer support heart

- $0 Month-to-month upkeep charge

- Complete steadiness earns highest rate of interest

Funding banking firm Goldman Sachs joins this record for a strong on-line financial savings account known as Marcus.

Your complete steadiness earns 3.00% APY and the preliminary minimal deposit is $0 to open.

There are additionally no month-to-month charges or ongoing steadiness necessities with this high-yield financial savings account.

They’ve a easy financial savings calculator on their web site that exhibits you the way a lot curiosity you’d earn with them vs an enormous financial institution.

For instance, I put $10,000 with a recurring deposit of $100 on a weekly foundation. In 5 years, I’d make $3,604 as an alternative of the nationwide common, which might yield $543. That’s a distinction of $3,061.

You may also like this platform as they provide a robo-advisor investing service that may assist you effortlessly put money into inventory index funds. The minimal preliminary funding is $5.

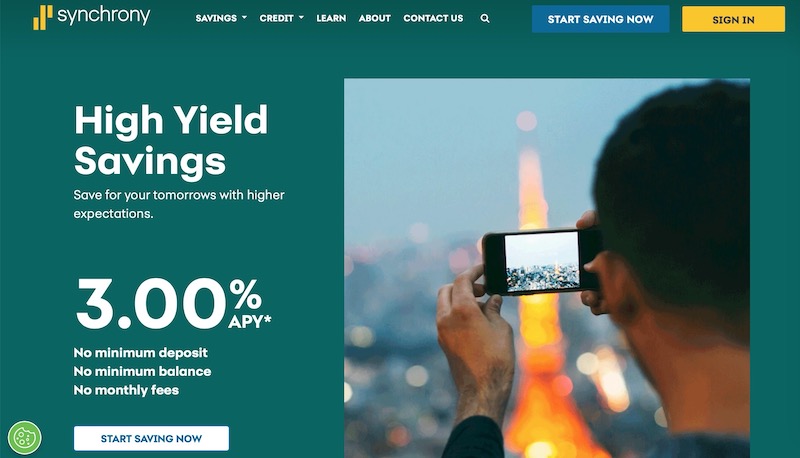

5. Synchrony Financial institution

Present Yield: 3.00% APY

What we like:

- No minimal steadiness

- $0 Month-to-month charge

- $0 Minimal deposit

- Complete steadiness earns one of the best charge

Synchrony Bank is one other financial institution to think about for its high-interest financial savings account. In actual fact, their Excessive Yield Financial savings account persistently pays one of many highest rates of interest on this record.

The account is free to open and preserve. Your complete account steadiness earns 3.00% annual proportion yield.

Not like some on-line banks, you gained’t must obtain qualifying direct deposits or preserve a minimal steadiness to get the very best charge.

Synchrony Financial institution additionally has engaging Cash Market and CD charges as nicely. See their web site by means of the above hyperlink to get extra details about their different interest-bearing accounts.

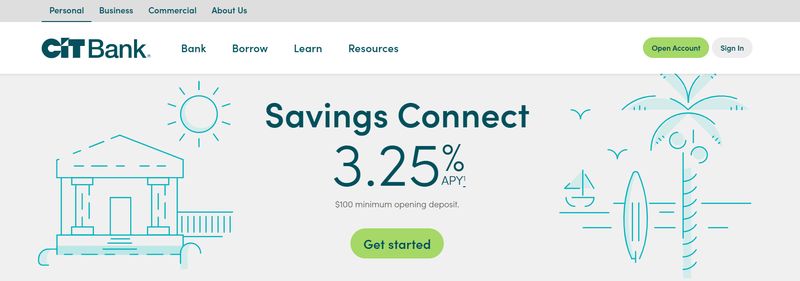

6. CIT Financial institution

Present Yield: As much as 3.25% annual proportion yield

What we like:

- Day by day compounding curiosity

- $0 Month-to-month charges

- Cell app and deposit

Heads up:

- $100 minimal to open the account

CIT Financial institution allows you to earn as much as 3.25% annual proportion yield relying on which high-yield financial savings account choice you select.

The Savings Connect account earns 3.25% and doesn’t have any minimal steadiness or direct deposit necessities.

You may also open a Savings Builder account and earn 1.00% with one in all these month-to-month actions:

- Deposit at the very least $100 in new funds every month

- Keep a minimal $25,000 account steadiness

You solely earn the bottom charge of 0.40% APY in case you don’t full one of many above duties.

There aren’t any account charges for this high-yield financial savings account, and you’ll examine balances in addition to make deposits by way of the cellular app.

You want at the very least $100 as your preliminary opening deposit to enroll.

Along with their finest financial savings accounts, CIT Financial institution affords these merchandise:

CIT Bank Money Market account additionally earns a aggressive rate of interest and should earn greater than a financial savings account. That is amongst probably the greatest cash market accounts to think about.

Moreover, they’re member-FDIC.

Learn our CIT Financial institution evaluation to check your choices.

7. Uncover Financial institution

Present Yield: 3.00% APY

What we like:

- No minimal steadiness

- $0 Month-to-month upkeep charges

- $0 Minimal deposit to open

Discover Bank affords strong financial savings accounts that simply retains up with the competitors with excessive rates of interest and non-existent charges.

Their financial savings account has a 3.00% APY that’s in step with the opposite high-yield financial savings accounts talked about right here and applies to your complete steadiness.

In addition they provide free on-line checking account that earns as much as 1% again on debit card purchases.

You would possibly think about this financial institution if you need a checking and financial savings account with many options on the similar place.

Learn our Uncover Financial institution evaluation to be taught extra about this no-fee financial institution.

8. American Specific® Private Financial savings

Present Yield: 2.75% APY

What we like:

- 24/7 customer support

- $0 Month-to-month charges

- $0 Minimal deposit

American Express® Private Financial savings Excessive Yield Financial savings Account earns 2.75% APY on your complete steadiness. Their on-line financial savings accounts additionally don’t have any month-to-month upkeep charges and no minimums.

They provide comfort and suppleness by permitting you to simply hyperlink your current checking accounts seamlessly and let you hyperlink as much as three accounts.

You may also make as much as 9 withdrawals and transfers every month. Most on-line financial savings accounts solely let you make as much as six withdrawals.

American Specific Nationwide Financial institution affords customer support 24 hours a day, 7 days per week. Plus, they’re member-FDIC.

9. Barclays On-line Financial savings Account

Present Yield: 3.00 % APY

What we like:

- No ongoing steadiness necessities

- $0 Upkeep charges

- $0 Minimal deposit to open

British-based worldwide financial institution Barclays additionally has a web-based financial savings account that has a excessive APY, no minimal balances to open and nil month-to-month upkeep charge to take care of it.

Your complete financial savings steadiness can earn 3.00 % APY.

The Barclay website has a free useful resource known as Financial savings Assistant. It helps you calculate how a lot you to avoid wasting primarily based on a specific purpose, what you’ll be able to contribute month-to-month, and the way a lot your purpose prices.

I examined it out and put in “retirement” because the purpose, with $1,000,000 as the fee and a month-to-month contribution of $2,000. After I hit “calculate,” it stated I’d want to avoid wasting for 41 years and 5 months to succeed in one million.

If you wish to belief the title of an enormous financial institution like Barclays however need a aggressive charge for financial savings, this account is a superb selection. Higher but, they’re member-FDIC.

10. Capital One®

Present Yield: 3.00% APY

What we like:

- No minimal steadiness

- $0 Upkeep charges

- $0 Minimal deposit to open

- Nice for monitoring targets (digital instruments, apps)

Heads up:

Capital One® 360 affords the 360 Efficiency Financial savings account that earns aggressive 3.00% APY rates of interest on all balances.

There aren’t any month-to-month charges or steadiness necessities to maintain the account open. The preliminary minimal deposit is $0 too.

You may speak in confidence to 25 sub-accounts to trace completely different financial savings targets.

For instance, you’ll have three savings-based targets, together with a vacation fund, trip fund and emergency fund.

Capital One® 360 additionally has areas in lots of giant cities which might be a hybrid of a financial institution, cafe and workspace. You may go there and be taught extra about their services and products, get a cup of espresso and hang around.

This financial institution may also be a very good choice if you need a free checking account with thrilling perks. As well as, they’re member-FDIC.

How Do These Excessive Yield Financial savings Accounts Evaluate?

| Financial institution Title | Minimal Opening Deposit | Upkeep Charges | Min Month-to-month Steadiness |

| Axos Financial institution | $250 | $0 | $0 |

| Barclay On-line Financial savings | $0 | $0 | $0 |

| CIBC Agility | $1,000 | $0 | $0.01 |

| Ally On-line Financial savings | $0 | $0 | $0 |

| Marcus by Goldman Sachs | $0 | $0 | $0 |

| Synchrony Financial institution | $0 | $0 | $0 |

| CIT Financial institution | $100 | $0 | $0 |

| Uncover Financial institution | $0 | $0 | $0 |

| American Specific Private Financial savings | $0 | $0 | $0 |

| Capital One | $0 | $0 | $0 |

Continuously Requested Questions?

You may have questions on high-yield financial savings accounts. And we’ve got the solutions!

What Is a Excessive-Yield Financial savings Account?

The construction of a high-yield financial savings account is similar as different financial savings accounts. Like an everyday financial savings account, you’ll be able to tuck funds into this account for later use. However the distinction is that your high-yield financial savings account can pay you a a lot increased yield than the fundamental model of a financial savings account.

For instance, most of the financial savings accounts discovered on the record above pay greater than 2.75% APY. That’s considerably increased than an everyday previous financial savings account, which could pay you an APY as little as 0.01%.

If you’re in search of a spot to stash long-term financial savings, a high-yield financial savings account is a superb choice. You’ll have fast entry to money while you want it with out giving up the possibility to place your funds to be just right for you.

Are Excessive-Yield Financial savings Accounts Protected?

Sure. Excessive-yield financial savings accounts are a protected place to retailer your money, so long as you’re employed with an FDIC-insured financial institution or NCUA-insured.

When a checking account is FDIC insured, it signifies that your funds are insured for as much as $250,000. Even when the financial institution closes down, you’ll be capable to get your funds again. With that, you’ll be capable to recuperate as much as $250,000 of your funds held in deposit accounts on the establishment. When working with a credit score union, NCUA insurance coverage affords the identical stage of safety.

So as to hold your funds protected, be sure to work with a monetary establishment that provides the suitable insurance coverage ranges to your financial savings. Don’t stash your financial savings in an account that isn’t FDIC or NCUA insured. In any other case, you could possibly be in a tricky state of affairs if the worst occurred.

How To Select the Greatest Excessive-Yield Financial savings Accounts?

When selecting one of the best excessive yield financial savings account, an apparent issue is the APY supplied. After all, the next APY signifies that your financial savings will earn probably the most financial institution to your buck.

Nonetheless, that’s not the one issue to think about. You’ll additionally wish to search for banks which have a simple platform to work with. The very best APY on this planet gained’t make up for a financial institution that makes it difficult to drag funds out while you want them.

Since many select to maintain their emergency fund locked up tight of their high-yield financial savings account, ease of entry is completely important. In spite of everything, you by no means know when an emergency goes to strike. You’ll wish to keep away from the potential for a problem while you want entry to your financial savings.

And naturally, it’s important that the financial savings account affords acceptable insurance coverage. You shouldn’t work with a high-yield financial savings account that doesn’t include FDIC or NCUA insurance coverage. In any other case, you could possibly be placing your hard-earned funds in danger.

What Ought to You Take into account When Selecting a Excessive-Yield Financial savings Account?

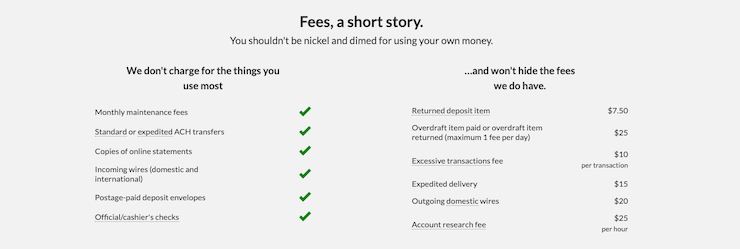

As you type by means of your whole choices, there are a lot of elements to think about. However a couple of of an important embrace the APY, any charges, and withdrawal choices.

The Annual Share Yield (APY) signifies your rate of interest for one yr. A better APY signifies that your financial savings will work more durable for you. With that, you’ll wish to search out the very best APY potential.

A excessive APY is a precedence. But it surely should steadiness nicely in opposition to the charges required to take care of your account. On the whole, it’s a good suggestion to keep away from any high-yield financial savings accounts with a month-to-month charge. You wish to develop your cash. Paying a charge for that privilege is counterintuitive. Plus, it isn’t essential as a result of many monetary establishments provide a fee-free model.

Bonuses can play a job in your determination. Many banks provide a bonus for opening your account, on high of the curiosity you’ll already be incomes. Relying on the bonus, it may sway your determination. In spite of everything, why shouldn’t you get a bonus if it’s on the desk?

Lastly, be sure you have quick access to the funds while you want them. Though you won’t plan to repeatedly faucet into your financial savings account, it’s necessary you can simply pull out your emergency financial savings when it is advisable. In any other case, it defeats the aim of an easy-access financial savings account.

The precise withdrawal strategies range primarily based in your preferences. You may want ATM entry to drag out money or a quick on-line switch choice to your linked accounts. When you’ve got a choice, be sure the high-yield financial savings account you select affords what you might be in search of.

Abstract

As you’ll be able to see from the record, most of the financial savings accounts from probably the most aggressive on-line banks are comparable in APY, don’t have any charges and even offer you calculators to find out how a lot it is advisable meet your targets.

Is a good title model necessary to you? In that case, you would possibly wish to go along with Barclays, American Specific or Uncover. However, if you need stellar customer support that’s U.S.-based, attempt Ally Financial institution.

In the end, it may be higher to make use of on-line banks and credit score unions versus brick and mortar banks to make sure you get one of the best return in your financial savings.