The return of federal pupil mortgage funds in October has the potential to derail your funds, particularly for those who’re already fighting bank card funds.

One in 5 pupil mortgage debtors have threat elements that recommend they may battle with pupil mortgage funds once they resume, in line with a June weblog submit on the Shopper Monetary Safety Bureau.

The influence received’t be as important through the preliminary 12-month pupil mortgage on-ramp interval from Oct. 1 to Sept 30, 2024. You received’t default on pupil loans or see credit score scores plummet after lacking funds throughout that point. However curiosity will proceed to accrue, making the rising debt tougher to handle. Use the following 12 months to make progress with constant funds. You’ll save extra money over time and pay down debt sooner.

Listed here are some methods to contemplate as you’re getting began.

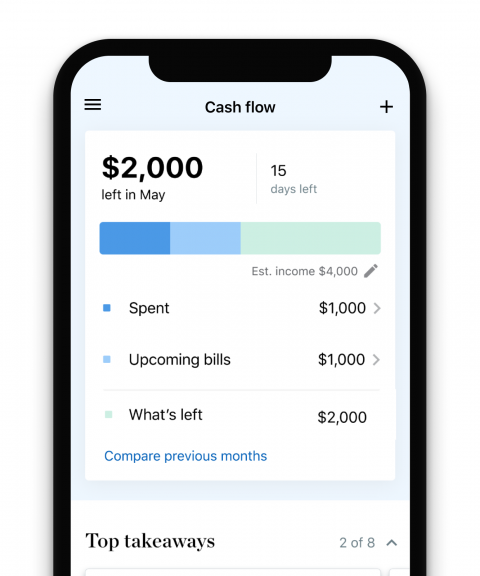

1. Revamp your funds

An up to date funds clarifies how a lot cash is offered to pay down money owed. Overview your debit and bank card statements for alternatives to chop again or discover cheaper options.

Begin by writing down the place your cash goes, says Kristen Holt, CEO at GreenPath, a nonprofit credit score counseling company.

Prioritize necessities like lease, utilities, transportation and others, she says. And, if attainable, work towards constructing an emergency fund of at the least $500 to stop extra debt.

“Something is healthier than nothing,” Holt says. “Even for those who’re placing $10 a paycheck right into a financial savings account, it takes some time, nevertheless it’s nonetheless going to be higher than zero.”

Subsequent, decide whether or not you’ll be laser centered on pupil mortgage or bank card debt. Sustain with all funds, however put extra money towards the excessive curiosity debt to make extra progress. Bank cards sometimes have greater rates of interest until new phrases are utilized by way of an settlement or promotional provide.

2. Search decrease bank card rates of interest

A superb credit score rating of 690 or greater can qualify you for low-interest presents. A stability switch bank card, as an illustration, allows you to transfer debt from a distinct account onto the cardboard to get a decrease rate of interest. The best stability switch card has no annual payment, a 0% introductory rate of interest and an affordable stability switch payment of three% or decrease. If that payment is decrease than your present projected curiosity funds, the financial savings will add up and you’ll apply them to pupil mortgage funds.

For a number of bank card balances, contemplate a private mortgage that consolidates money owed right into a single low-interest mounted fee.

If circumstances past your management, like an emergency or a layoff, are impacting your capacity to maintain up with funds, ask the bank card issuer if it has a hardship plan. It could briefly decrease curiosity and waive charges for a particular time period, relying on the issuer’s phrases.

3. Take into account an income-driven compensation plan

With an income-driven compensation plan, your month-to-month funds on federal pupil loans are primarily based in your revenue and household dimension. The money owed are additionally forgiven after 20 or 25 years of funds. There are at present four income-driven repayment plans to contemplate primarily based in your targets and mortgage kind.

In the case of pupil loans, you both wish to pay them off rapidly to avoid wasting on curiosity or pay as little as attainable to benefit from any of the forgiveness plans which might be accessible, says Renée Earwood, an accredited monetary counselor and pupil mortgage coach.

“It’s a case-by-case foundation relying on how a lot pupil mortgage debt they’ve, what their private targets are and what their revenue stage is,” Earwood says.

For those who’re already on an income-driven compensation plan, Earwood suggests evaluating choices in case a distinct one is sensible on your targets. As an illustration, those that have undergraduate loans could wish to change to the brand new SAVE plan as a result of it might minimize their funds in half beginning in July 2024, and forgive remaining debt extra rapidly if they’ve a smaller principal stability.

4. Take part in credit score counseling if wanted

When you may’t envision making progress on debt, a nonprofit credit score counseling company could assist. A credit score counselor can evaluate your funds, create a funds and decide eligibility for a debt administration plan. This selection consolidates bank card balances right into a single fee with a decrease rate of interest, for a payment. If the credit score counselor can be a licensed pupil mortgage knowledgeable, they may help slender down the perfect pupil mortgage compensation plan.

“We’re going to have a look at the individual’s complete scenario,” Holt says. “We do a tender pull of their credit score report — it doesn’t have an effect on their credit score rating in any method — however we get that image of the whole lot.”

5. Take a break from bank card spending

After reducing the prices of your money owed, keep away from including new purchases in your bank cards. A brief change to a debit card or money can hold monetary targets on monitor.

Your bank card received’t be closed by the issuer because of inactivity, since there’s a stability on it and also you’re making funds. As soon as the stability is paid off, hold the cardboard open and energetic with small recurring purchases.

This text was written by FinanceGrabber and was initially printed by The Related Press.