- ETH’s short-term restoration may rely on the USD and rates of interest development.

- Technical indicators counsel short-term consolidation.

The primary few days of March have failed to offer Ethereum [ETH] holders a much-desired breather. Regardless of the truth of despair, any hope for respite may rely on one situation, in response to Chris Burniske.

The ex-crypto funding head at ARKInvest opined that ETH, alongside Bitcoin [BTC], would solely recuperate if the greenback and rates of interest drop.

For a lot of February the greenback and charges went larger, whereas crypto hung in there. If the previous two begin to drift decrease, $BTC may push by $25K, and if $ETHBTC pushes alongside that we may get one other spherical of fireworks.

— Chris Burniske (@cburniske) March 5, 2023

Sensible or not, right here’s ETH’s market cap in BTC’s phrases

Striving for stronghold

Recall that the primary two months of the yr introduced obvious greens to the market, with the highest two cryptocurrencies incomes beneficial properties for his or her holders.

As well as, the Fed charges enhance in February had initially triggered reds available in the market. However ETH, led by BTC ensured that the drawdown solely lasted a number of hours. So, does the ETH technical outlook seem encouraging but?

Nicely, the ETH/USD each day chart confirmed that the asset volatility was exiting its long-standing contraction standing at press time.

In the meantime, the decrease a part of the Bollinger Bands (BB) which measures an asset’s risky situation was at par with the ETH value. For the reason that bands didn’t squeeze, this standing signifies that ETH was oversold and had fewer probabilities of a big breakout.

Supply: TradingView

Nonetheless, the Directional Motion Index (DMI) recommended that the altcoin won’t be prepared for a rally, and the situation talked about above could possibly be instrumental.

This was as a result of the -DMI (crimson) positioned larger than the +DMI (inexperienced) at 20.71 to 18.60. Moreso, the chart above revealed that the Common Directional Index (ADX) had no robust assist for both a breath or bullish transfer.

The ADX (yellow) at 25, indicated a powerful directional motion whereas a worth under it exhibits a weak one. On the time of writing, the ADX was 14.90.

Portfolios dangle within the stability

Other than the draw back projection of the technical indicators, the liquidations over the previous few days have light indicators of a bullish crossover. However some ETH holders are optimistic that the Shanghai improve may provide a slide methods from the bears.

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

There have, nonetheless, been shifts within the remaining mainnet occasion after it was initially slated for March. However Ethereum builders appeared to have made progress with the Sepolia Testnet success, and Georli in view. So, how has the ETH decline to $1,561 affected its holders?

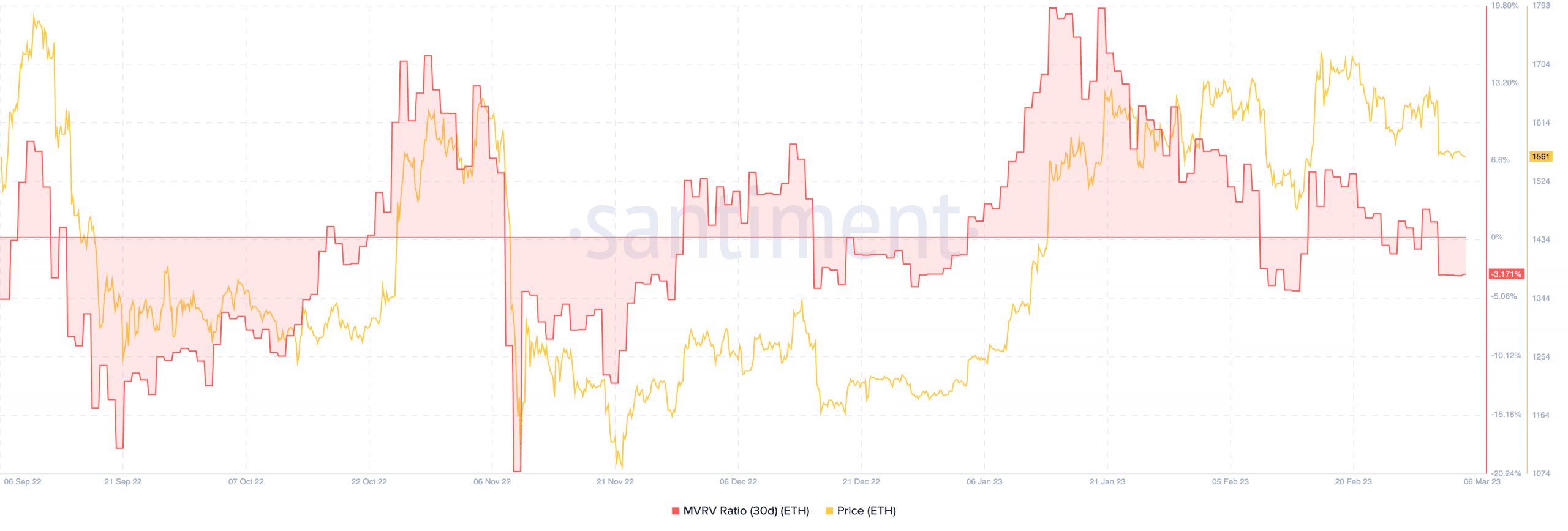

In accordance with Santiment, the 30-day Market Worth to Realized Worth (MVRV) ratio was -3.171%. The metric exhibits the ratio between the present value and the common value acquired in relation to market profitability.

Therefore, the MVRV ratio drawdown implied that the majority of those that acquired ETH a number of weeks again remained underwater.

Supply: Santiment

![Ethereum [ETH] could be set for another round of explosion, only if…](https://nourishmoney.com/wp-content/uploads/2023/03/po-2023-03-06T093459.000-1000x600-750x375.png)