Screenwriters have been on strike for greater than 100 days. In a rustic the place nearly all of folks dwell paycheck to paycheck, voluntarily going so lengthy with no regular revenue requires conviction — and planning.

Just like a layoff, a employee on strike has to grapple with a lack of revenue and advantages for an indefinite interval. In contrast to a layoff, most putting employees cannot accumulate unemployment. The chance of strikers depleting their financial savings or getting behind on payments has made lengthy strikes, such because the one by the Writers Guild of America, uncommon.

However strikes have an extended historical past of securing greater wages and higher circumstances for employees due to their monetary influence on the employer. That makes putting a invaluable software for at this time’s workforce, which faces excessive inflation and issues over new know-how resembling synthetic intelligence (AI).

If it is potential you would be a part of a strike, begin treating it as inevitable. The extra financial savings you may put aside, the higher you will really feel about supporting the trigger when the time comes.

Leverage your union’s strike fund

When you’re on strike, your pay will cease. Unions sometimes arrange a strike fund to assist members deal with the lack of revenue throughout a strike. Union member dues help the strike fund, and every union has guidelines about how a lot members can draw from it.

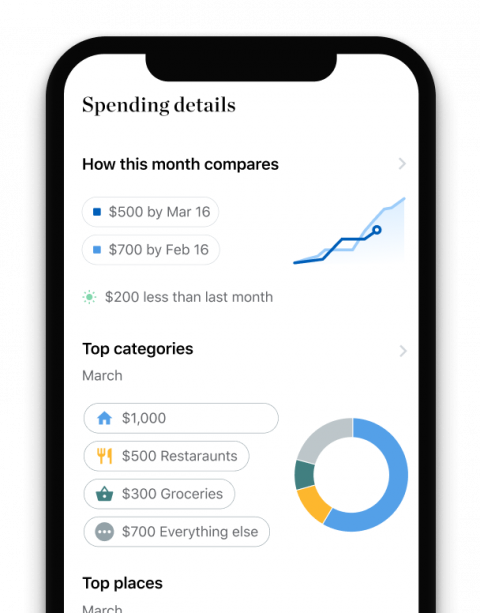

Monitor all the cash you make

See the ins and outs of your money, playing cards, and financial institution accounts at a look.

For instance, if United Auto Staff (UAW), representing 150,000 employees at GM, Ford and Stellantis, goes on strike this fall when its new contract expires, eligible union members would obtain $100 per weekday from the strike fund, in line with the UAW web site. UAW strike pay kicks in after the eighth strike day.

Your union might also be outfitted that will help you preserve your medical health insurance protection in case your employer stops paying its share of premiums. Hanging employees can elect to proceed their well being protection on their very own dime underneath COBRA, a federal regulation that briefly requires employers to increase protection after employment ends. Some unions assist members cowl these added prices.

Different medical health insurance choices could also be obtainable, as properly. For instance, the United Steelworkers encourages members who want protection for severe medical circumstances or ongoing care to make use of COBRA, in line with the union’s web site. Then it enrolls everybody else, together with members and their dependents, within the USW Emergency Medical Program, which gives restricted insurance coverage protection.

No union to assist? Plan forward

For those who’re not a part of a proper union, or your union strike fund will not totally substitute your revenue, you will doubtless depend on financial savings to get you thru the strike. So now’s the time to organize and be prepared.

🤓Nerdy Tip

Most U.S. personal sector employees have the suitable to strike no matter whether or not they’re a part of a union. Nonunionized employees strike for a similar causes unionized employees do. Here is a contemporary instance: Combat for $15, a nationwide marketing campaign began by fast-food employees with no union, organizes strikes to demand the next minimal wage.

An emergency fund may enable you sustain on important payments whilst you’re out of a paycheck. That features your hire or mortgage, meals and utilities. You might also have to sustain with transportation prices, baby care and cellular phone service so that you could be concerned in strike actions. Your emergency fund would ideally comprise sufficient money to cowl primary bills for 3 to 6 months. That may really feel like so much. However beginning with a small financial savings purpose is OK as a result of most strikes are brief.

Actually, nearly all of work stoppages lasted lower than 5 days in 2022, in line with the Labor Motion Tracker. This annual report, from the Cornell College Faculty of Industrial and Labor Relations, paperwork strikes and labor protest exercise throughout the USA.

As you put together, analysis your native legal guidelines governing who’s eligible for unemployment advantages. Whereas uncommon, some states permit putting employees to gather unemployment, relying on the circumstances.

In New York, for instance, putting employees can start amassing unemployment if the strike lasts longer than 14 days, in line with the New York Division of Labor. Different states have exceptions for employees if the employer has violated a collective bargaining settlement or initiated a lockout (when an employer bars staff from the job website till they comply with sure phrases).

For those who lose well being care insurance coverage and haven’t got choices via a union, you may elect to increase your protection underneath COBRA or store for a well being care plan utilizing an internet market.

Get management of your private funds

No matter whether or not you are tapping emergency financial savings or dwelling off of strike pay, a strike may require you to rethink your monetary priorities, resembling:

-

Chopping again on discretionary spending. Discover slicing streaming providers, subscriptions, memberships and different bills you may dwell with out. It is comprehensible if you wish to preserve one or two little indulgences. However be certain that it is one thing you actually use.

-

Discovering new methods to receives a commission. Promote stuff you do not want. Decide up a seasonal job or discover an app-based gig. Your days could possibly be crammed with picketing, however working just a few hours on the facet could possibly be sufficient to pay some payments.

-

Searching for group help. Spend a while researching group sources that would enable you keep afloat. Some group organizations might help with payments, or accessing meals and psychological well being providers. For those who want a spot to begin, go to 211.org.

-

Paying the minimal. With rates of interest as excessive as they’re, it isn’t a great time to enter bank card debt. However when your money stream is severely restricted, utilizing a bank card to purchase requirements could also be your only option. On the very least, make minimal funds, since not making any may harm your credit score rating.

-

Juggling payments as a final resort. If you’re struggling to pay utility payments, name your supplier’s customer support line. You could possibly begin a fee plan or in any other case alter what you owe. On-line sources may also enable you decide how a lot time you’ve gotten on every invoice earlier than going through the implications of nonpayments.

Share sources with different strikers

When on strike, surrounding your self with different strikers may enable you keep motivated and lower your expenses. For example, carpooling, grocery purchasing collectively so you should buy in bulk, or exchanging baby care are all sensible strategies to chop prices. The great thing about collective motion is that you just’re not alone.

Picture by Mario Tama/ Getty Photographs